Market Monitor News June 23 BMO (GMS, Kroger, Under Armor UP - Smith & Wesson, Accenture DOWN)

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Jun 23, 2025

Tension You Can Feel Through the Ticker

When the market twitches on a Friday, you know something's brewing. This past session was a perfect storm of geopolitics, macro pressure, and tech sector turbulence.

We saw a defensive tone across the board in U.S. markets. The Dow Jones managed a limp +0.1%, but the S&P 500 slid -0.2% and the Nasdaq fell -0.4%. It marked the third straight down day for the broader S&P 500.

That alone is enough to raise an eyebrow, but the backdrop makes it even more telling.

Options Expiry Meets the Middle East

Friday's market wasn’t just reacting to headlines, it was bracing for them. The massive $6.5 trillion options and futures expiry added a layer of volatility, but the real drag came from rising fears over the situation in Iran.

The U.S. appears to be toggling between diplomacy and airstrikes, and that kind of ambiguity is poison for investor confidence.

“Operation Midnight Hammer”: War Gets Real

It escalated fast. On Saturday, the U.S. launched coordinated strikes on Iran's nuclear infrastructure.

President Trump called it a “spectacular military success”, claiming complete destruction of sites in Fordow, Natanz, and Isfahan. There’s no sugarcoating this: it’s a massive geopolitical shift.

And with Iran now reportedly considering shutting down the Strait of Hormuz, through which 20% of the world’s oil and gas flows, the stakes are dangerously high. Oil traders are already eyeing Sunday evening with clenched jaws.

Even if Iran blinks, the potential disruption to global energy and shipping routes is now firmly on the radar.

Chips, China, and the Next Trade Salvo

While bombs were dropping in the Middle East, the U.S. was quietly loading up another trade weapon, this time aimed squarely at chipmakers.

Word got out that Washington might revoke key export exemptions for Samsung and TSMC, currently allowed to send American chip tech to their Chinese plants without special licenses.

This is no minor tweak. If the policy shift sticks, it's a fresh front in the U.S.-China tech war.

Investors reacted accordingly: Nvidia (NVDA | -1.9%), Intel (INTC | -1.91%), and Broadcom (AVGO | -0.51%) all slid as the chip sector got caught in the crossfire. And with Japan pulling out of a scheduled trade meeting with the U.S., it’s safe to say that calm is not the prevailing mood.

Defensive Plays Shine While Some Stocks Bleed

There were bright spots, mostly where you'd expect.

Kroger (KR | +9.84%) rallied after delivering solid Q1 results and raising its full-year sales outlook. With 2,700 stores and a captive consumer base, Kroger proved once again that people don’t skimp on groceries, even when everything else is up in the air.

CarMax (KMX | +6.59%) also beat expectations, while GMS Inc. (GMS | +23.77%) spiked after Home Depot (HD | +0.75%) reportedly made a takeover offer.

Coinbase (COIN | +4.43%) continued its rollercoaster run after new legislation for stablecoins cleared the Senate, giving the crypto industry something rare these days, regulatory clarity.

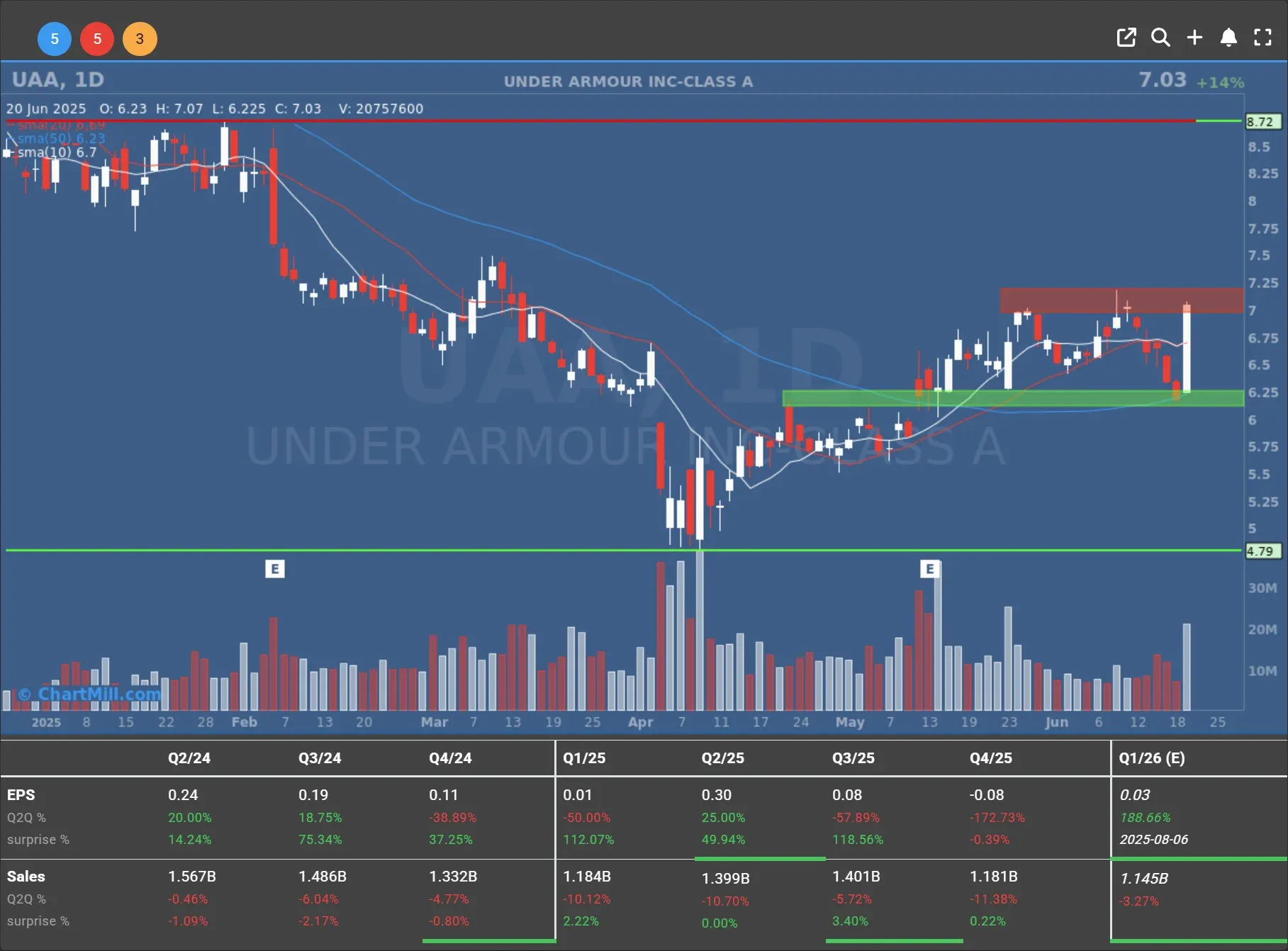

Under Armour (UAA | +13.94%) Jumps 13.9% After a $400-Million Debt Offer.

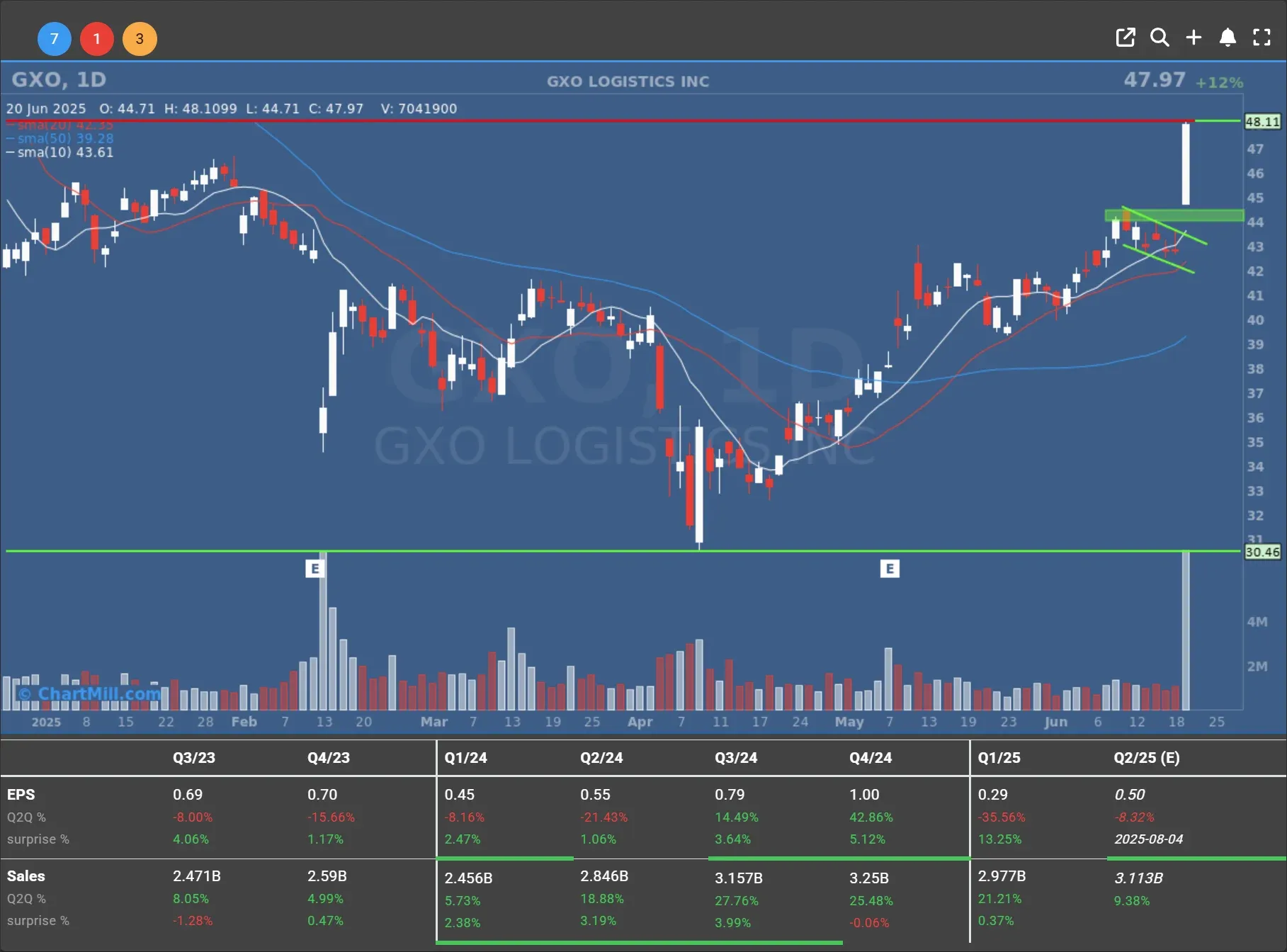

GXO Logistics (GXO | +12.13%) gets 12% boost on new CEO, Patrick Kelleher, welcome.

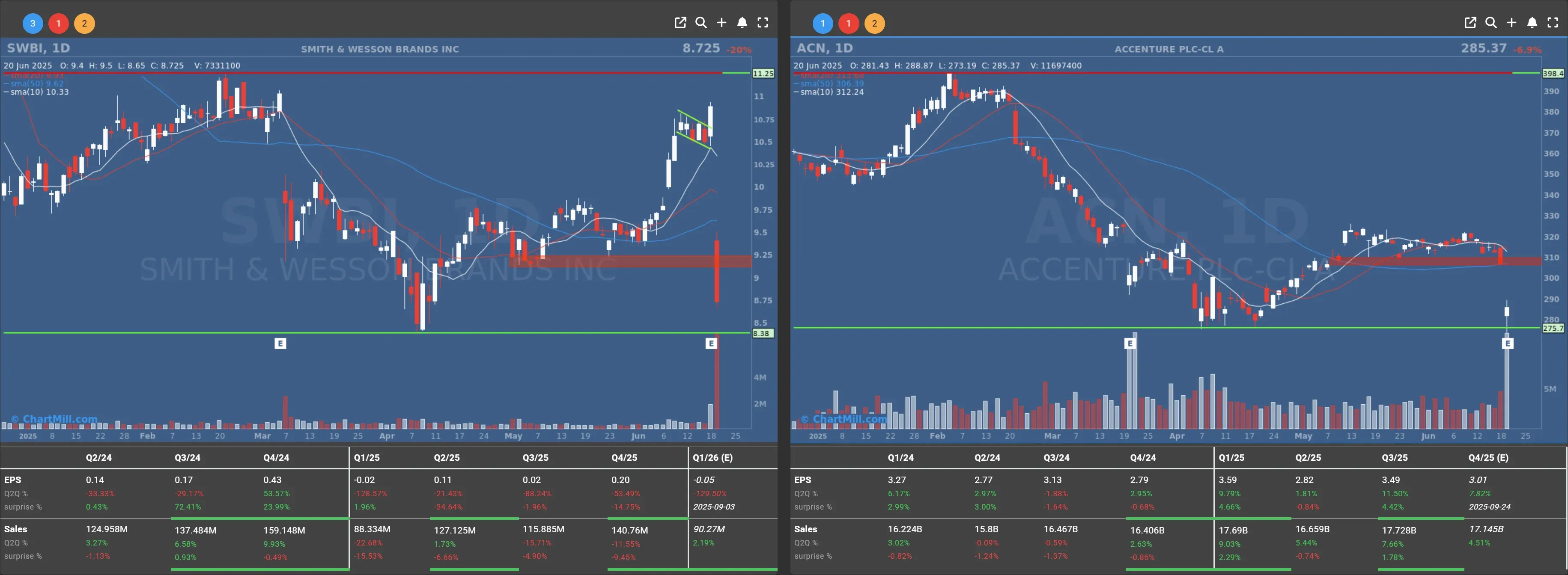

On the other side of the ledger: Accenture (ACN | -6.86%) posted decent earnings but slumped after weak bookings and management shakeups.

Smith & Wesson (SWBI | -19.81%) tanked on a dismal quarter.

Macro Clouds Don’t Budge

The economic data didn’t help either. Philly Fed manufacturing stayed in contraction at -4.0, and the Conference Board’s Leading Economic Index dropped again in May, down 0.1%.

Weak orders and gloomy consumers formed the perfect cocktail of caution.

Yet there was one sliver of hope: Fed Governor Christopher Waller suggested a July rate cut is still possible, despite potential inflation from new tariffs. It’s a hint, but not enough to calm markets already jittery from bigger risks.

Looking Ahead: Oil, PMIs, and Hormuz

Monday will bring new U.S. data on housing and PMI activity, but let’s be real, the real market mover is the Middle East. If Iran retaliates or the Strait of Hormuz gets blocked, brace for impact. If they don’t, expect oil to spike at the open and then simmer down, at least temporarily.

But make no mistake: the illusion of geopolitical control has been shattered. What used to be distant proxy wars are now direct U.S. actions with global consequences.

Markets hate uncertainty. Right now, they’re drowning in it.

Stay sharp.

Kristoff - Co-Founder ChartMill

Next to read: Market Monitor Trends & Breadth Analysis, June 23

6.52

-0.07 (-1.06%)

21.08

-0.25 (-1.17%)

67.17

-1.4 (-2.04%)

74

+2.03 (+2.82%)

356.96

+7.34 (+2.1%)

295

+9.63 (+3.37%)

21.19

+0.11 (+0.52%)

54.67

+0.17 (+0.31%)

144.17

+0.32 (+0.22%)

100.41

+0.14 (+0.14%)

307.59

-0.79 (-0.26%)

49.1

+1.13 (+2.36%)

Find more stocks in the Stock Screener

UA Latest News and Analysis

a day ago - ChartmillMarket Monitor News June 23 BMO (GMS, Kroger, Under Armor UP - Smith & Wesson, Accenture DOWN)

a day ago - ChartmillMarket Monitor News June 23 BMO (GMS, Kroger, Under Armor UP - Smith & Wesson, Accenture DOWN)U.S. Strike on Iran Shakes Markets as War Fears, Chip Tensions, and Weak Data Collide