Markets Lose Ground as China Trade Deal Wavers and Earnings Paint Mixed Picture

U.S. stocks closed lower on Wednesday, as initial optimism surrounding a renewed trade deal with China faded throughout the trading session.

The S&P 500 fell by 0.3%, the Dow Jones Industrial Average ended flat and the Nasdaq Composite declined 0.5%.

Markets initially reacted positively to news that the U.S. and China had reached a framework agreement during talks in London. The deal largely reinstated terms from an earlier pact where both sides had agreed to reduce tariffs.

However, investor sentiment soured as details emerged, particularly China's decision to impose a six-month limit on easing export permits for rare earth materials, signaling that Beijing seeks to retain leverage in future negotiations.

President Donald Trump announced on Truth Social that the deal was “done” but still pending approval by himself and President Xi.

According to Trump, China agreed to increase shipments of rare earths and magnets, while the U.S. would uphold previously agreed-upon concessions, including allowing Chinese students to study in the U.S.

“We get 55% of the tariffs, China 10%,” Trump added, describing the bilateral relationship as “excellent.”

We get 55% of the tariffs, China 10% - President Trump

Yet analysts were skeptical. Henrietta Treyz of Veda Partners remarked that negotiations seemed to be “treading water” rather than progressing. Sector-specific tariffs - on steel, aluminum, vehicles, and parts - remain in effect, with more expected.

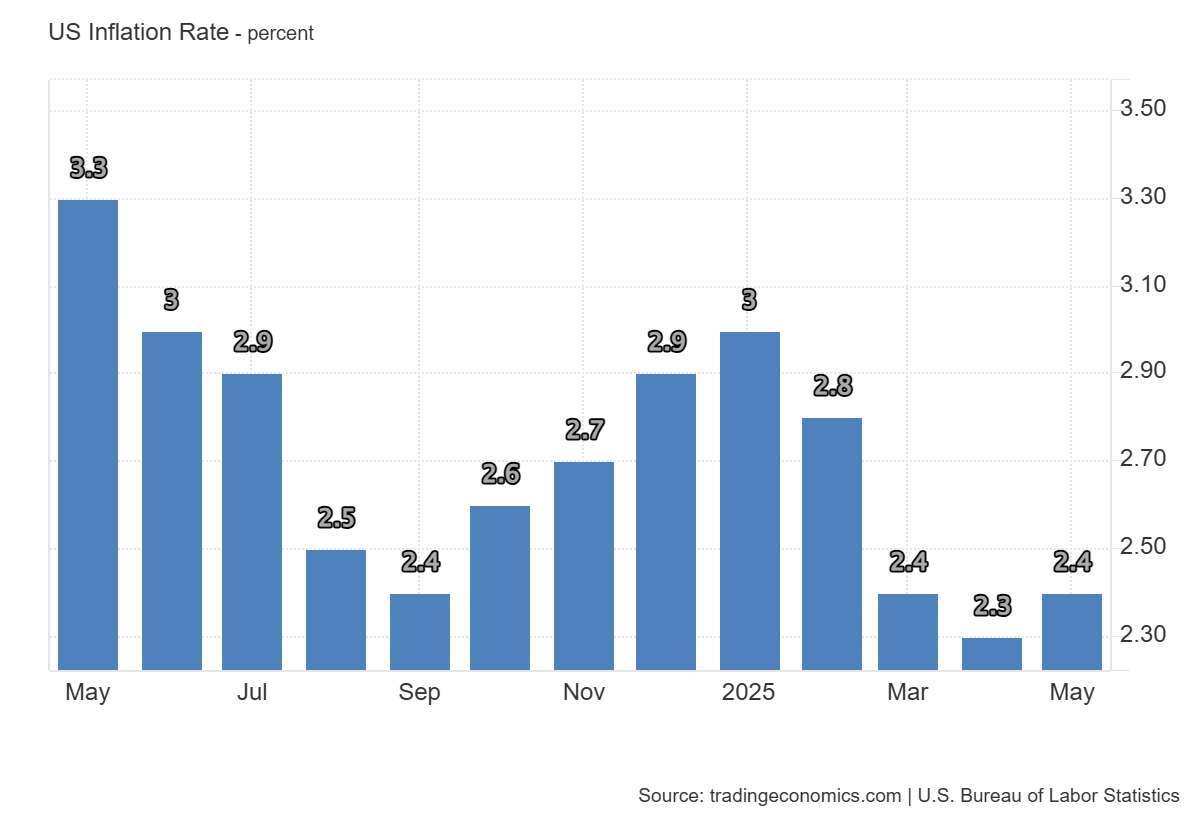

Inflation Data and Fed Pressure

May’s consumer price data came in broadly in line with expectations. Year-over-year, U.S. inflation rose 2.4%, up slightly from 2.3% in April, while core inflation held steady at 2.8%, missing projections of 2.9%. Month-over-month, both headline and core inflation increased by 0.1%.

Trump hailed the numbers as “great” and renewed his call for the Federal Reserve to slash interest rates by a full percentage point, arguing this would significantly reduce borrowing costs.

Bond yields dipped in response to the inflation data. The 10-year Treasury yield dropped 6 basis points to 4.409%, while the 2-year yield slipped to 3.943%.

Energy and Currency Movements

-

Oil prices surged after a larger-than-expected draw in U.S. crude inventories. WTI crude for July delivery gained $3.17, or 4.9%, to settle at $68.15 per barrel.

-

Meanwhile, the euro strengthened against the dollar, with the EUR/USD trading at 1.1484, up from 1.1425 the previous day.

Company Highlights

Tesla (TSLA | +0.1%) inched higher, extending Tuesday’s 5.7% rally following footage of a self-driving Tesla in Austin. CEO Elon Musk said the company plans to launch its robotaxi service on June 22, though the date could shift due to safety concerns. Musk also expressed regret over recent posts about Donald Trump.

Chewy (CHWY | -10.98%) plunged despite beating Wall Street’s earnings forecasts. Investors were unimpressed, likely due to concerns over slowing revenue growth.

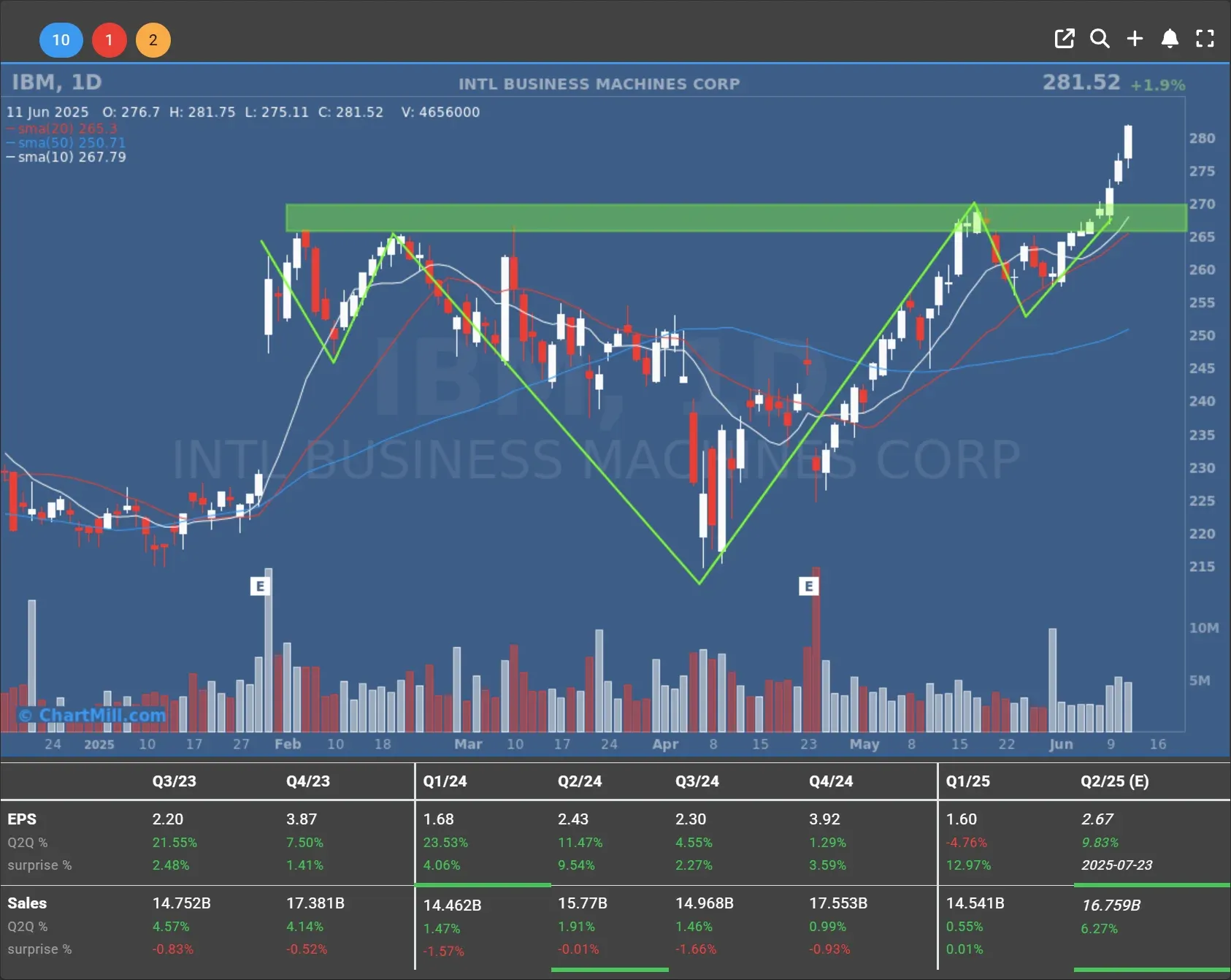

IBM (IBM | +1.9%) continued its upward trend, closing at a record high after unveiling what it claims is the world’s first large-scale, fault-tolerant quantum supercomputer.

GitLab (GTLB | -10.6%) fell sharply, as its strong earnings report was overshadowed by a disappointing forecast.

GameStop (GME | -5.3%) returned to profitability in Q1, thanks to merchandise sales, despite a revenue drop. The market reaction remained negative.

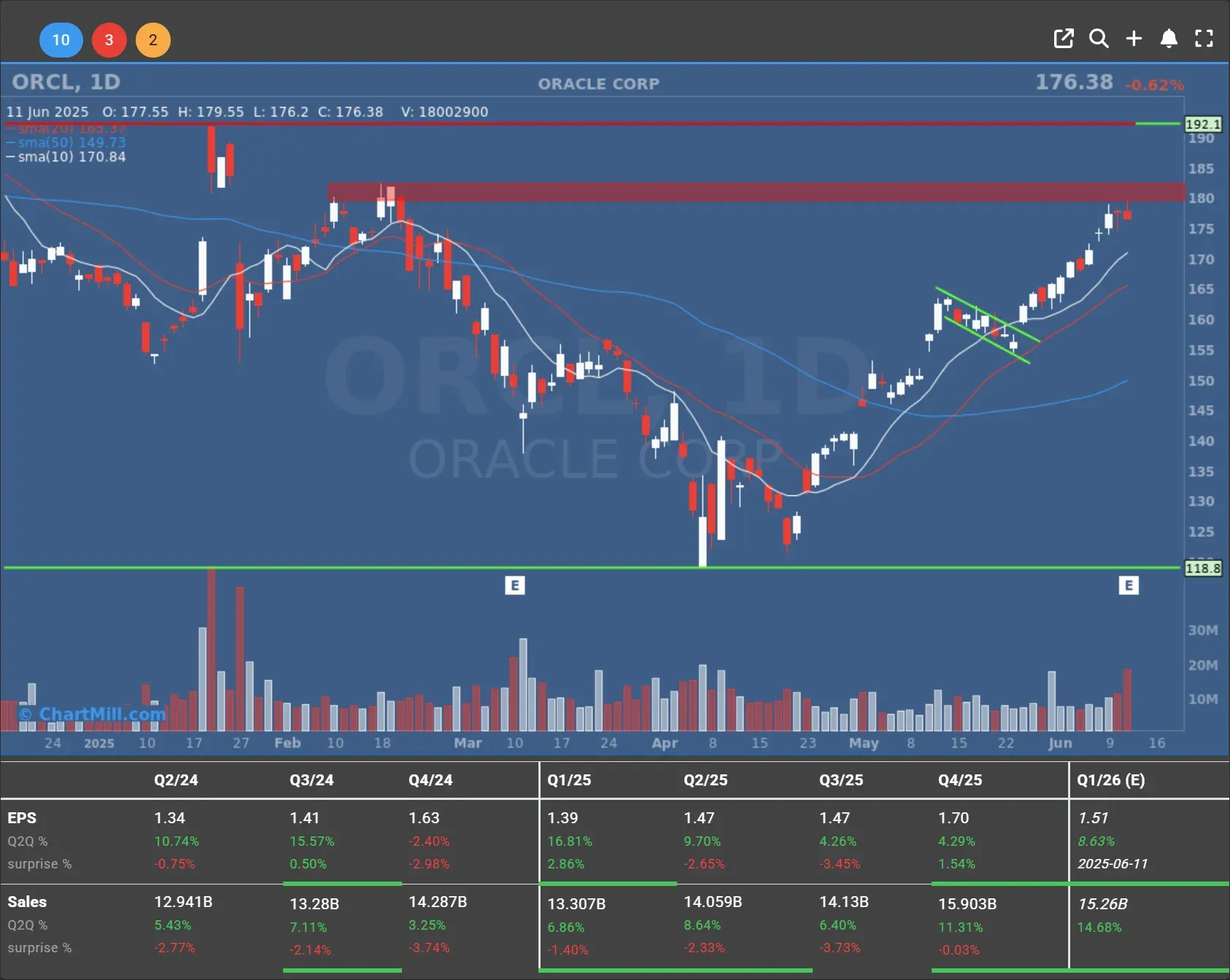

Oracle (ORCL | +7.7% after-hours) reported strong fiscal Q4 results, with revenue climbing to $15.9 billion and net income at $3.4 billion. Adjusted EPS of $1.70 topped expectations.

CEO Safra Catz said the company expects significant acceleration in cloud growth in FY2026, forecasting infrastructure growth of over 70%. Oracle also declared a $0.50 per share quarterly dividend.

Nuclear enery start-up OKLO (OKLO | +29.48%) shares surged almost 30%, following the announcement of a new contract with a branch of the U.S. military.

Outlook

On Thursday, markets await fresh data on producer prices and weekly jobless claims, which could provide further clarity on inflation and labor trends.

Meanwhile, geopolitical uncertainty remains high as Trump indicated that letters outlining new unilateral trade terms will be sent to global partners within the next two weeks. “They can take the deal or not,” he stated plainly.

Next to read: Market Monitor Trends & Breadth Analysis, June 12