CAL-MAINE FOODS INC (NASDAQ:CALM) stands out as a potentially undervalued stock with solid financial health and profitability. The company, a leading producer and distributor of shell eggs, has been identified by our Decent Value screener due to its attractive valuation and strong fundamentals.

Key Strengths

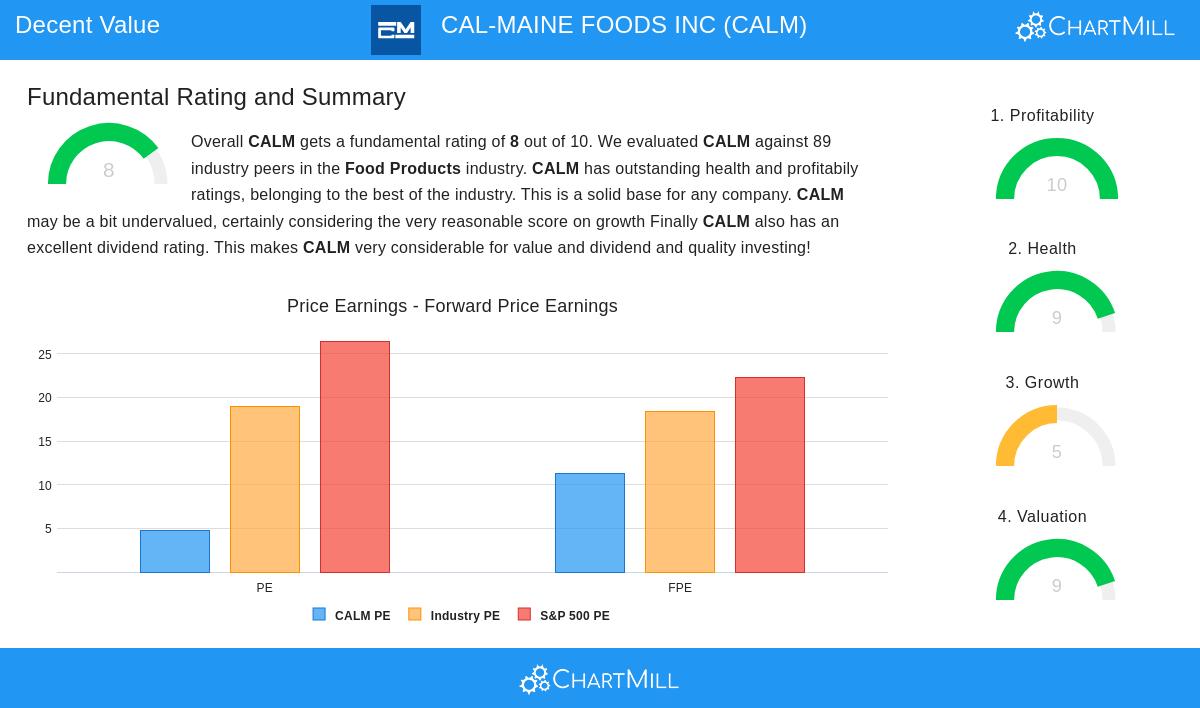

Valuation (Rating: 9/10)

- Low P/E Ratio: CALM trades at a P/E ratio of 4.80, significantly below the industry average of 19.00 and the S&P 500 average of 26.46.

- Attractive Forward P/E: At 11.27, the forward P/E suggests reasonable future earnings expectations.

- Strong Free Cash Flow: The company’s Price/Free Cash Flow ratio is better than 96.6% of its peers, indicating efficient cash generation.

Profitability (Rating: 10/10)

- High Margins: CALM boasts a profit margin of 26.08% and an operating margin of 32.33%, outperforming most competitors.

- Exceptional ROIC: With a Return on Invested Capital (ROIC) of 36.48%, the company generates strong returns relative to its capital investments.

- Consistent Earnings Growth: Over the past five years, CALM has maintained profitability with an impressive 34.3% average annual EPS growth.

Financial Health (Rating: 9/10)

- No Debt: CALM has zero debt, reducing financial risk and enhancing stability.

- Strong Liquidity: A current ratio of 3.86 and a quick ratio of 3.26 indicate ample capacity to meet short-term obligations.

- High Altman-Z Score: A score of 8.22 suggests low bankruptcy risk.

Growth (Rating: 5/10)

- Past Growth: Revenue grew 60% YoY, while EPS surged 303.8% in the last year.

- Future Concerns: Analysts project a decline in earnings (-14.6%) and revenue (-0.8%) in the coming years, which may weigh on growth prospects.

Dividend (Rating: 7/10)

- High Yield: CALM offers a substantial 14.86% dividend yield, well above the industry average.

- Sustainable Payout: Only 21.2% of earnings are allocated to dividends, ensuring sustainability.

Why CALM Could Be a Value Opportunity

Despite near-term earnings concerns, CALM’s strong profitability, debt-free balance sheet, and high dividend yield make it an appealing candidate for value investors. The stock’s low valuation multiples suggest potential upside if market sentiment improves.

For a deeper analysis, review the full fundamental report for CALM.

Our Decent Value screener lists more stocks with strong valuations and fundamentals.

Disclaimer

This is not investment advice. The observations are based on data at the time of writing, and investors should conduct their own research before making decisions.