The Bullish Harami Pattern | Definition, Interpretation and Trading Strategy

A Bullish Harami: How does it look?

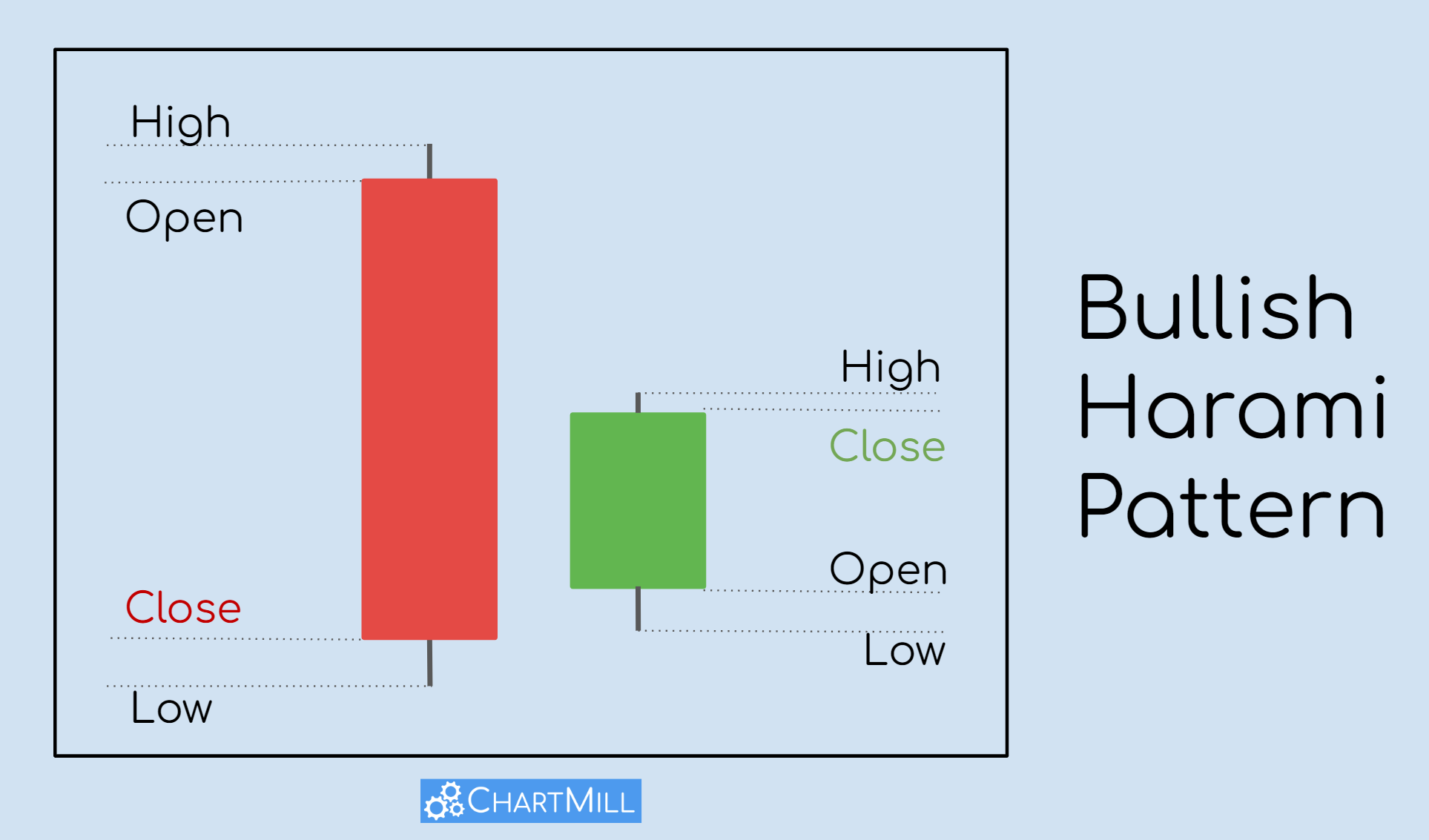

The pattern is one of the many Japanese candlestick patterns used to analyze price charts. This particular Bullish Harami pattern is formed by two candles. The first candle is a negative (bearish) candle where shortly after the opening the price falls and by the end of the trading day, it closes near the daily low. As a result, a fairly long body is visible, as a sign of a clear negative trend.

The next day, the price opens higher than the closing price of the first candle (gap up) and rises during the day. The body of the second candle is relatively short, with little to no outliers intraday. The close of the second candle is higher but lower than the opening price of the first candle.

Contrary to what the market expected based on the first candle - where there was negative momentum - there is some slight price recovery.

Fun fact: Harami means "pregnant" and was used because this pattern was said to resemble a pregnant woman.

Key Notes

-

The bullish harami pattern is a candlestick pattern consisting of two consecutive candles where the second candle is completely enclosed by the body of the first candle.

-

This pattern is used to identify early changes in price trends. In a downtrend, it is the first sign of bullish momentum.

-

The pattern occurs frequently on price charts and therefore should be confirmed by other technical indicators.

How to interpret the Bullish Harami Pattern?

The pattern is considered an early warning signal and this specific combination of two candles tells us several things :

The opening price of the second candle is higher than the closing price of the first bearish candle, so the day starts with a gap up and buyers are gaining control.

A slightly positive closing price is a sign that buyers, after the initial gap up, have maintained control. However, there was not yet enough momentum to raise the price above the opening price of the previous day. As a result, we see an 'inside candle'.

Just like the Bullish Engulfing Pattern, a Bullish Harami pattern is a reversal pattern. It is an indication that the current existing downward trend (short or long-term) is coming to an end and a positive trend reversal is imminent.

Please keep in mind that the pattern in itself is only an indication of a change of direction, but is by no means sufficient on its own to be used arbitrarily as an entry setup.

The chart above shows two nice bullish harami setups (green circles) but at least as important is the observation that other elements support a long setup:

-

The price may be down in the short term but the long-term trend of the share remains bullish as the price is still above the 200-day average. A long setup, therefore, means that we will act in the direction of the long-term trend.

-

The Bullish Harami patterns are at the level of the important 200SMA that serves as support.

Using this Pattern in a Trading Strategy.

VRTX stock had fallen sharply since December 2022. In early 2023, its price was trading against the ascending 200SMA line. A mini sideways range formed (indicated on the chart by a horizontal green and red line).

The Slow Stochastic fell below the 20-level and a cross was visible in late December. This was an indication that the stock was oversold (5).

The blue box (1) shows the two candlesticks that formed the Bullish Harami pattern.

In this case, a long position could be taken as soon as the price rose above the top of the then prevailing sideways range (2).

A stop-loss was set below the Bullish Harami formation (and below the 200SMA) (3).

The next resistance (and price target) on the chart was $323.

Important

Take note that for the setup on the chart above, not only the Bullish Harami pattern was considered. Other elements were also included to assess the quality of this setup.

-

The stock quoted above the 200SMA, so the long-term trend was positive.

-

Moreover, the price found support on that same rising 200SMA line and the Stochastics indicator simultaneously gave a buy signal.

-

A confirmation signal was awaited, namely a price rising above the top of the existing mini-range.

All these additional signals, together with the Bullish Harami, ensured that this was a low-risk long setup.

Recognizing a Bullish Harami

Bullish Harami patterns are not that exceptional. They occur frequently on all timeframes and are fairly easy to identify manually. As already touched upon several times, it is important to combine the pattern with other elements before taking a position.

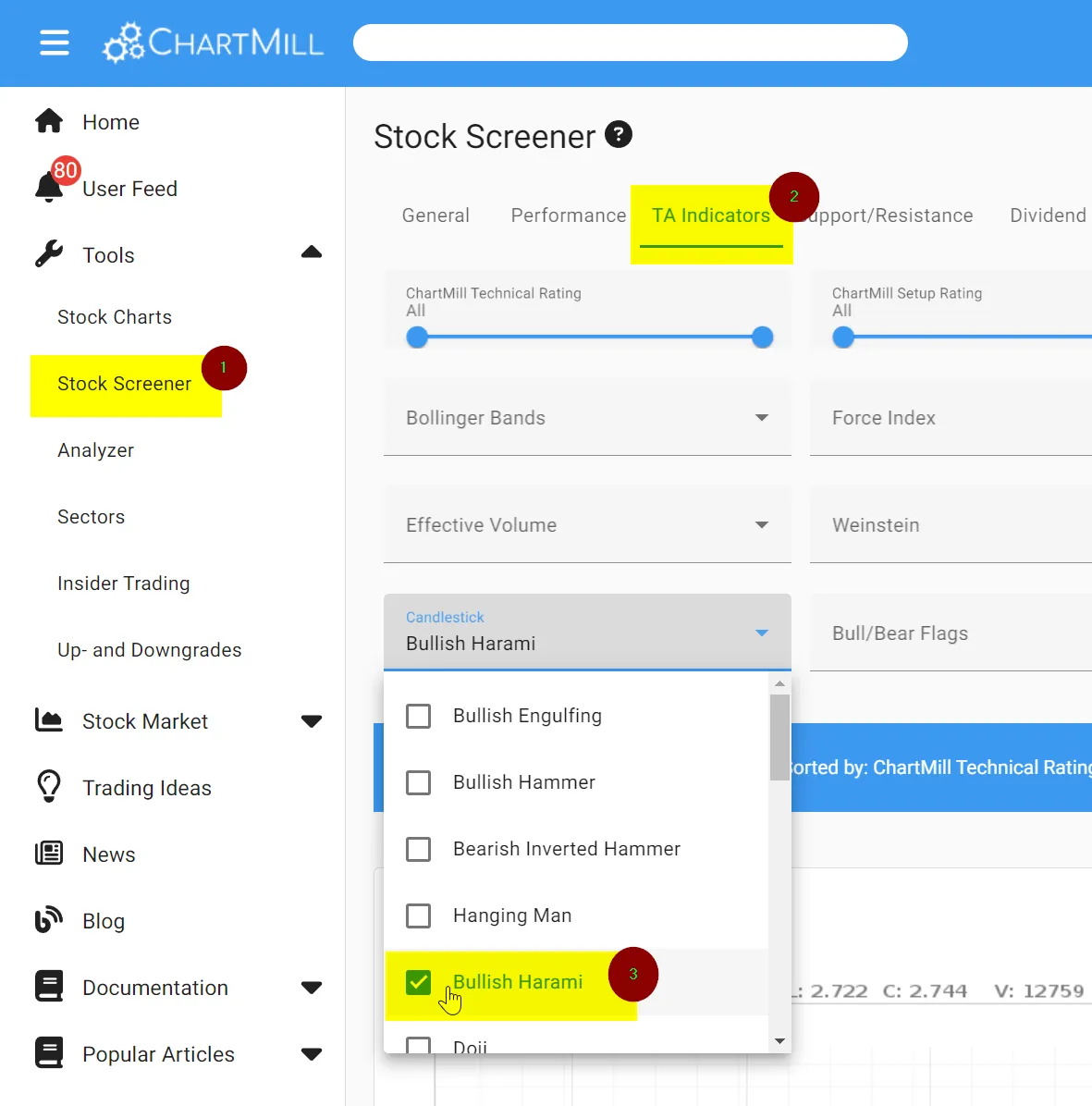

ChartMill can recognize multiple candlestick formations automatically. This allows you to very quickly and efficiently find stocks in which the pattern has just formed. You can then use this list as a basic selection for further manual analysis.

The function can be found on the stock screener page (1) under the menu 'TA indicators' (2). Then select the tab 'candlesticks' (3) and choose the desired candlestick pattern.

Indicators to use in conjunction with the Bullish Harami

Both the RSI, Stochastics, and MACD indicator can be used as confirmation signals. On the chart below, we have highlighted the Bullish Harami formation (blue box) with the three indicators below it. All three show a buy signal shortly after the candlestick pattern, confirming that the downward trend was coming to an end. Eventually, the trend reversed and a new bullish trend was started.

FAQ

How accurate is the Bullish Harami?

As with all other candlestick patterns, you should only use them as part of a complete trading strategy. Especially for this pattern. Because it occurs frequently on price charts, there is a need for additional elements to help support a trend change.

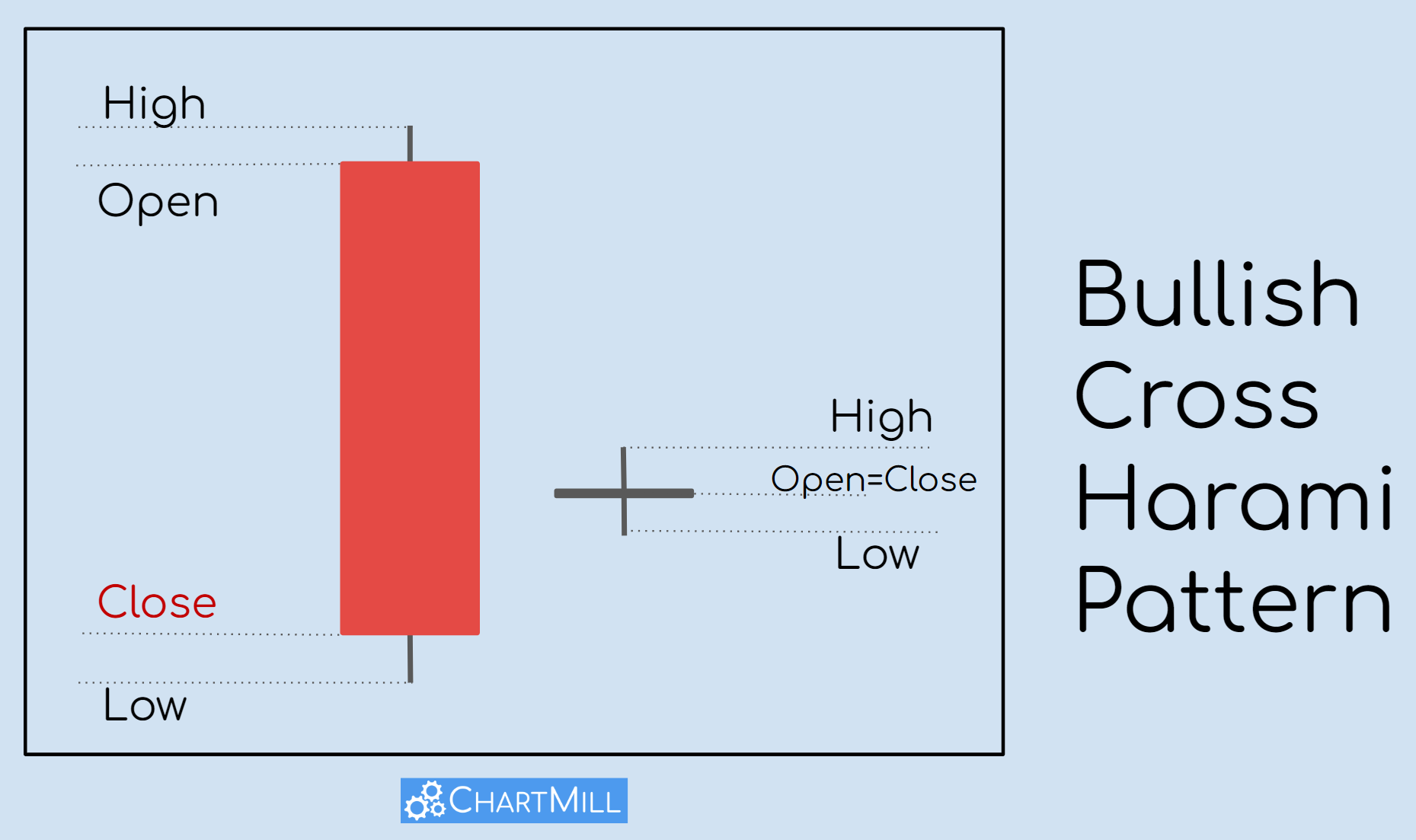

What is meant by the Bullish Harami Cross?

The only difference from the regular bullish harami pattern is the shape of the second candle. That is a doji candle, a candle where the body is barely visible but the lower and upper shadows are distinguishable. This causes the candle to take the shape of a cross. A doji indicates indecision among traders. The price moves a little as buyers and sellers are balancing each other.

Further Readings

The Bullish Engulfing Pattern: A Powerful Candlestick Pattern For Trend Reversal Trading

The bullish engulfing pattern is a candlestick pattern consisting of two consecutive candles where the body of the second candle surrounds the body of the first candle. More details

The Bullish Hammer Candlestick Pattern | Definition

The hammer pattern consists of a small body (the color is less important). However, a typical feature is the long shadow at the bottom which is at least twice the size of the actual body. More details