The 3 Bar Play Momentum Trading Strategy – A Simple Yet Powerful Setup for Swing Traders

The 3 Bar Play Trading Strategy – A Simple Yet Powerful Setup for Swing Traders

When it comes to trading strategies that are both effective and easy to recognize, few setups rival the 3 Bar Play.

Popularized by professional trader Jared Wesley, this strategy is widely used by both day traders and swing traders who rely on momentum and price action to make their trading decisions.

In this article, we’ll break down the 3 Bar Play step-by-step, explain how to trade it, and discuss why it remains a favorite among active traders.

What Is the 3 Bar Play?

The 3 Bar Play is a bullish continuation pattern that appears after a stock has made a strong directional move. It signals that a brief pause in price is likely to be followed by a continuation in the same direction.

The pattern is composed of three key candles (with an optional fourth for confirmation), and it works well across different timeframes, from intraday charts to daily setups for swing trading.

The 3 Bar Play Setup

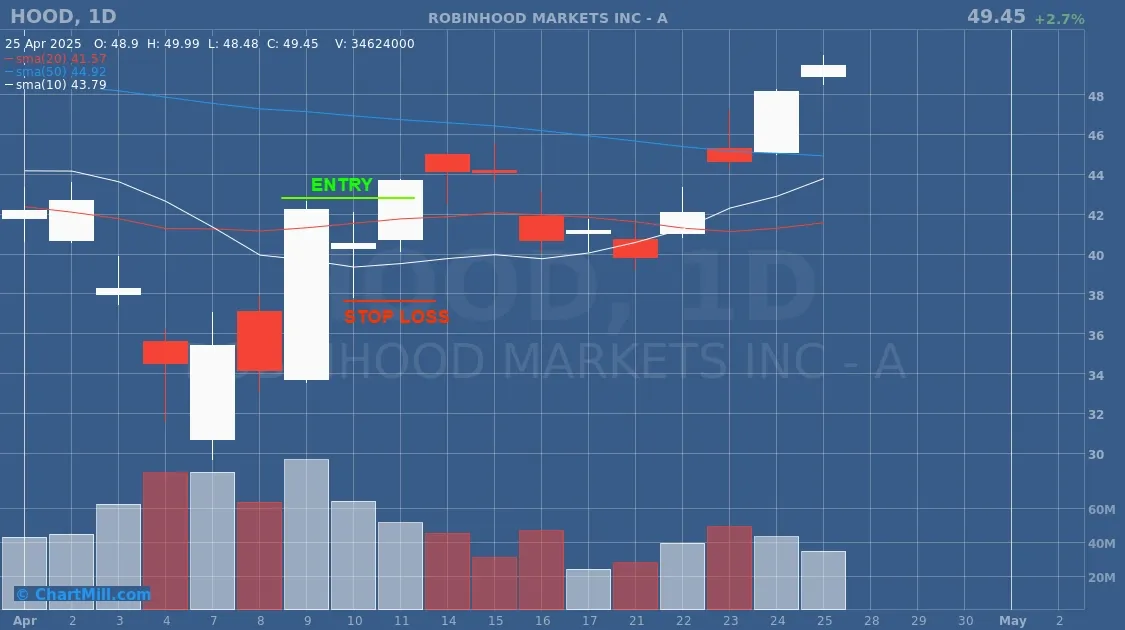

Here’s how a 3 Bar Play looks :

Bar 1 – The Momentum Bar

The first candle is a large bullish bar that breaks out from a consolidation zone or prior resistance level. This bar should have strong volume and indicate solid buying interest.

Bar 2 – The Resting Bar

The second candle is a small bar, often a doji or a narrow-range candle, that shows a brief pause or consolidation. It can be red or green, but it should stay within the upper half of the first bar. This shows that sellers are not strong enough to push the price back down.

Bar 3 – The Breakout Bar

The third candle breaks above the high of the second bar. This is your trigger for entry — it signals that momentum is returning and the uptrend is likely to continue.

(Optional): Some traders wait for a fourth candle to confirm follow-through after the breakout. This can give extra confidence in the setup.

Entry, Stop-Loss, and Target

Entry:

Go long when the price breaks above the high of bar 1.

Stop-Loss:

Place a stop just below the low of bar 2. This keeps your risk limited.

Profit Target:

Many traders aim for a 2:1 reward-to-risk ratio, or they use nearby resistance or support levels as price targets. Trailing stops can also help lock in profits if the move extends.

Why the 3 Bar Play Works

The beauty of the 3 Bar Play lies in its simplicity and effectiveness. This strategy capitalizes on momentum by waiting for a strong breakout followed by a brief, healthy pause, often appearing at key technical levels like consolidations or range breakouts.

It offers tight risk control through a clearly defined stop-loss and provides straightforward entry signals, making it an excellent setup for both beginners and experienced traders alike.

Tips for Using the 3 Bar Play

-

Look for setups on stocks with strong volume and relative strength.

-

Combine it with other factors, such as moving averages, support/resistance, or gap-ups for added confirmation.

-

This pattern works best in trending markets or on high-momentum stocks.

-

Avoid using it in choppy, sideways markets where momentum is weak.

The 3 Bar Play Trading Idea in ChartMill

In the trading Ideas section we've added a 3 Bar Play Screen. Due to the rather strict filters this screen rarely shows more than one or a couple of setups. In many cases they may even be no setups at all. At the moment of writing this article there is one stock that fits the criteria.

Final Thoughts

The 3 Bar Play strategy is a powerful tool that belongs in every trader’s toolkit. Whether you’re a short-term day trader or a swing trader holding positions for days, this setup can help you spot high-probability entries with clearly defined risk.

If you’re using a stock screener like ChartMill, you can even create custom filters to help identify potential 3 Bar Play candidates — just make sure to validate the pattern visually on the chart before entering a trade.