Fundamental Dividend Filters

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Mar 8, 2024

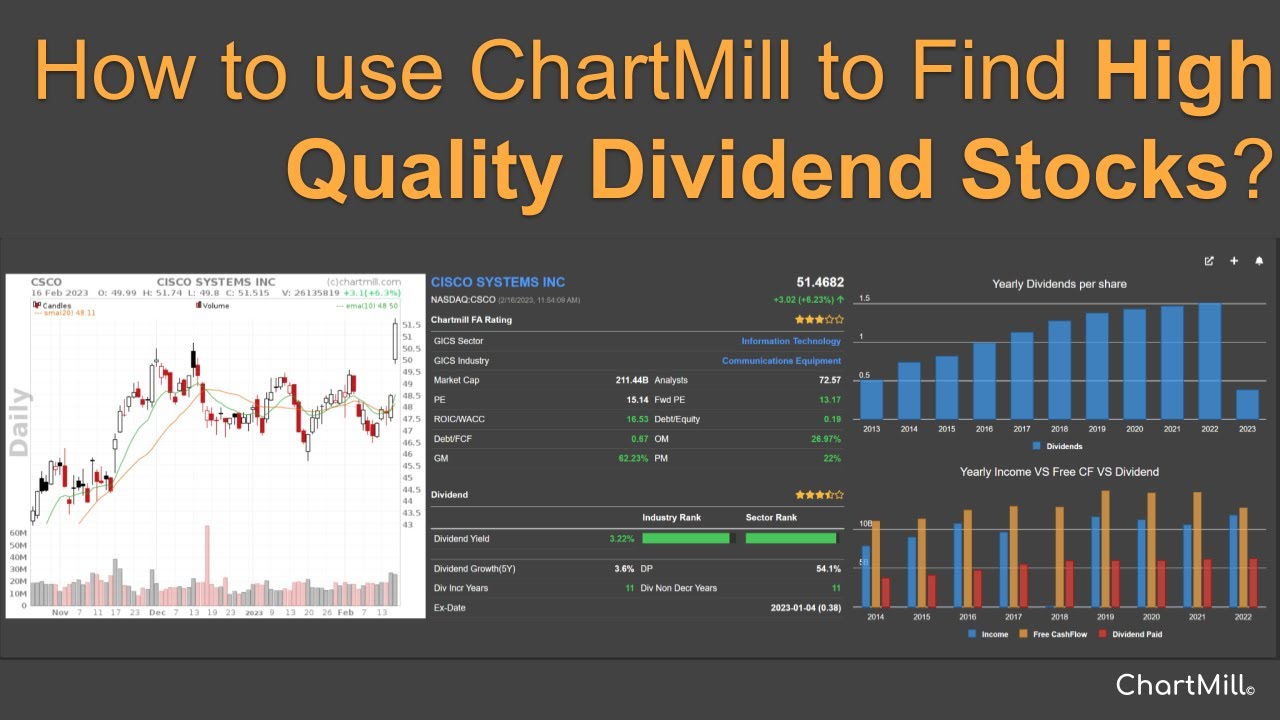

In this article we will discuss the fundamental filters related to the Dividend of a stock. All these filters are available in our stock screener and can be found on the Dividend tab.

Dividend Yield

Dividend is the portion of the final profit paid to the shareholders. But what gross return is achieved with the dividend? The dividend yield is calculated by dividing the total annual dividend by the current share price. For example, if you only want shares with a dividend yield greater than 4%, you can use this filter.

Dividend Growth

The payment of a dividend is just one thing. Yet, there is another important dividend filter which you should definitely keep in mind. The dividend growth filter tells you exactly how much the dividend yield has risen over the last 5 years. High dividend shares will be less likely to increase their dividend than shares that start with a lower dividend policy but consistently increase their dividend yield year after year.

An example: you buy a share of 20 dollars and receive a dividend yield of 5%, which amounts to 1 dollar. Suppose the return over the next five years has increased by 20%, giving you 1,20 instead of 1 dollar. This means an increase of the dividend of 6% compared to your original purchase price. Suppose you make the same investment in another 20 dollar share but you initially received 4 instead of 5% dividend (0.8 dollar). However, the dividend yield in this share has risen by 75% after five years. This means that your dividend has risen to 1.4 dollars and the dividend yield at the original purchase price is no longer 5% but 7%.

Dividend Payout

How much of the net profit does the company distribute to the shareholders? To find out, the payout filter was included. The payout is calculated by dividing the dividend by the net profit of the company (after taxes). The result is then multiplied by 100% to calculate the ratio. New companies generally know a low payout ratio because a large part of the profit is reinvested (with the intention of realizing / financing further growth). Large-scale companies, where the further opportunities for growth are a lot smaller, usually outweigh a greater part of the profit in the form of a dividend, and will also do every effort to keep the dividend as stable as possible.

Dividend Increase Years

This filter allows you to set how many consecutive years the company has increased its dividend. Keep in mind that this is a very strict filter. For example, if you set this filter to 10 it means that in the past 10 years there has not been a single year that the dividend was lower or stayed at the same level as the previous year.

Dividend Non Decrease Years

As explained, the previous filter is quite strict and filters out all stocks whose dividends are not explicitly increased year after year. However, if you also want to see the stocks whose dividend stays the same (OR grows) year after year then you are better off using this filter. The number of stocks will be considerably higher with this filter because in this case also a constant dividend is accepted by screener.

Dividend Yield Industry and Sector Rank

Allows filtering based on dividend yield performance within industry or sector.

Related Articles

Fundamental Growth Filters

In this article we will discuss all the available fundamental filters related to the Growth of a stock. Read more...

Fundamental Valuation Filters

In this article we will discuss all the available fundamental filters related to the Valuation of a stock. Read more...

Fundamental Profitability Filters

In this article we will discuss all the available fundamental filters related to the Profitability of a stock. Read more...

Fundamental Health Filters

In this article we will discuss the available fundamental filters related to the Financial Health of a stock. Read More...