The ChartMill Dividend Rating

The ChartMill Dividend Rating evaluates the yield, growth, reliability and sustainability of a dividend. The dividend rating is explained and visualized in the dividend section of the fundamental report of each stock. In this article we will describe how the rating score is reached.

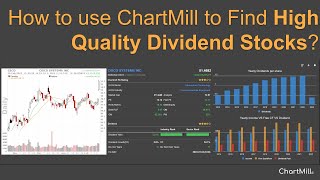

Example report from INTC

Below is a screenshot at the time of writing, you can always find the most current report here

The summary can be found in the rating number. As you can see INTC only scores 5 out of 10. Although the dividend is growing, very reliable and sustainable, it only has a yield of 2.17%, which is average for the sector and below the S&P 500 index average yield. All things considered this gets a score of 5.

The charts should give some more insight into the statements in text:

- In the upper right corner you can see a comparison between the stock evaluated and all other stocks in the same industry. In this case INTC has a better yield than 57% of the other stocks.

- The chart below shows the dividend per share per year for the past years as well as the estimate for the current year. When hovering of the bars you can see the details. Typically the dividends are paid out per quarter.

- The chart in the lower right corner visualizes the payout ratio. The payout ratio is the percentage of income spent on the dividend payment. You can see that INTC uses below 27% of their income for dividend. This is a very healthy ratio.

- The big chart in the middle below displays the historical Income, Free Cash Flow and Dividend Paid. Comparing the dividend (what goes out) to the income and Free Cash Flow (what comes in) gives you a good idea on how sustainable the dividend and its growth are. Having the history allows you to put some things in perspective as the payout ratio is based on the last known data and may be off because of 1 time events.

Finally we would like to add that it is always important to interpret the data. In last red statement of the example report says for instance that the dividend is growing faster than the earnings, which is not sustainable. While this is technically true, looking at the growth section of the same report shows us that the earnings are only expected to decrease slightly and if we take into account the low payout ratio, we should decide not to put too much weight on this.