Trading Bull Flags, 5 Common Mistakes You Should Definitely Avoid!

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: May 12, 2025

Ever spotted what looked like the perfect bull flag… jumped in with full confidence… and then watched your trade fall apart?

Yeah, you're not alone — and chances are, you made one of 5 mistakes listed below.

Bull flags are one of the most powerful continuation patterns in trading — when they actually work. But if you don’t know what to look for, or worse, if you overlook key warning signs, that same pattern can turn into a costly trap.

In this blog article, we’re breaking down 5 of the most common mistakes traders make when trading bull flags — and more importantly, how to avoid them.

Ready? Let’s dive in!

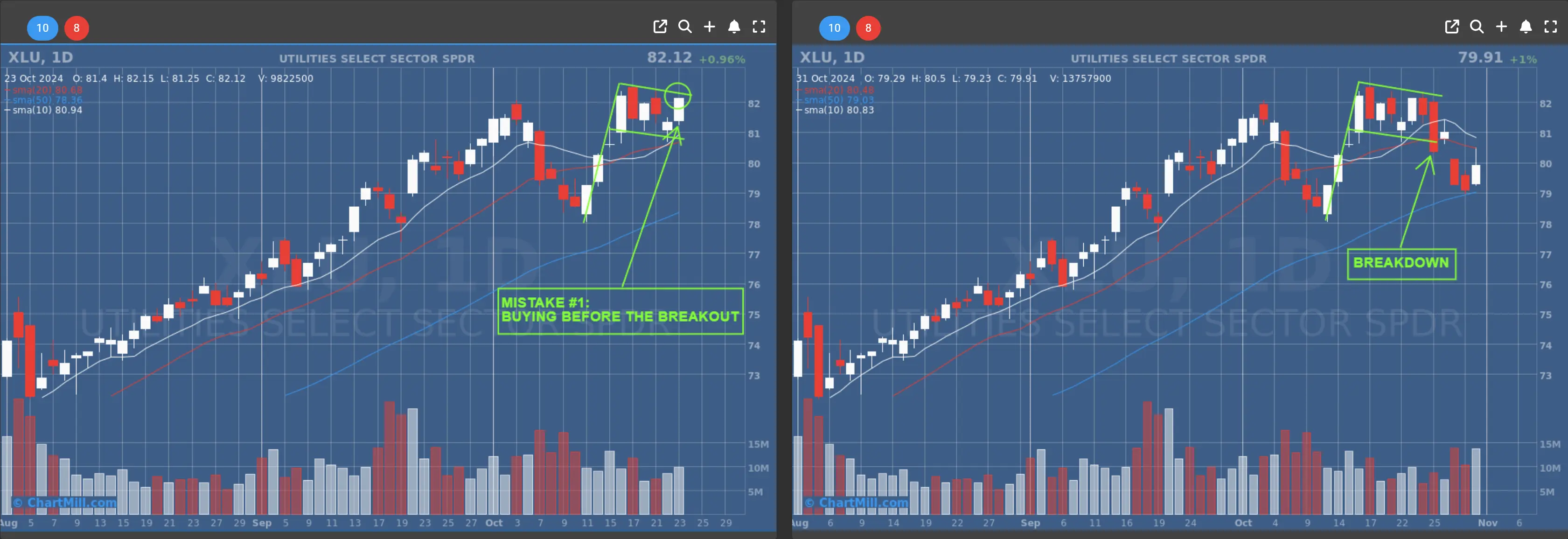

Mistake #1: Buying Before the Breakout

This one’s a classic. You spot a perfect-looking flag and you jump in — before it actually breaks out. I’ve done it. But here’s the problem: just because it looks like a bull flag doesn’t mean it’ll play out like one. Price could just keep drifting sideways or even roll over.

Solution? Wait for confirmation. That usually means a strong breakout candle closing above the upper flag line, ideally on rising volume.

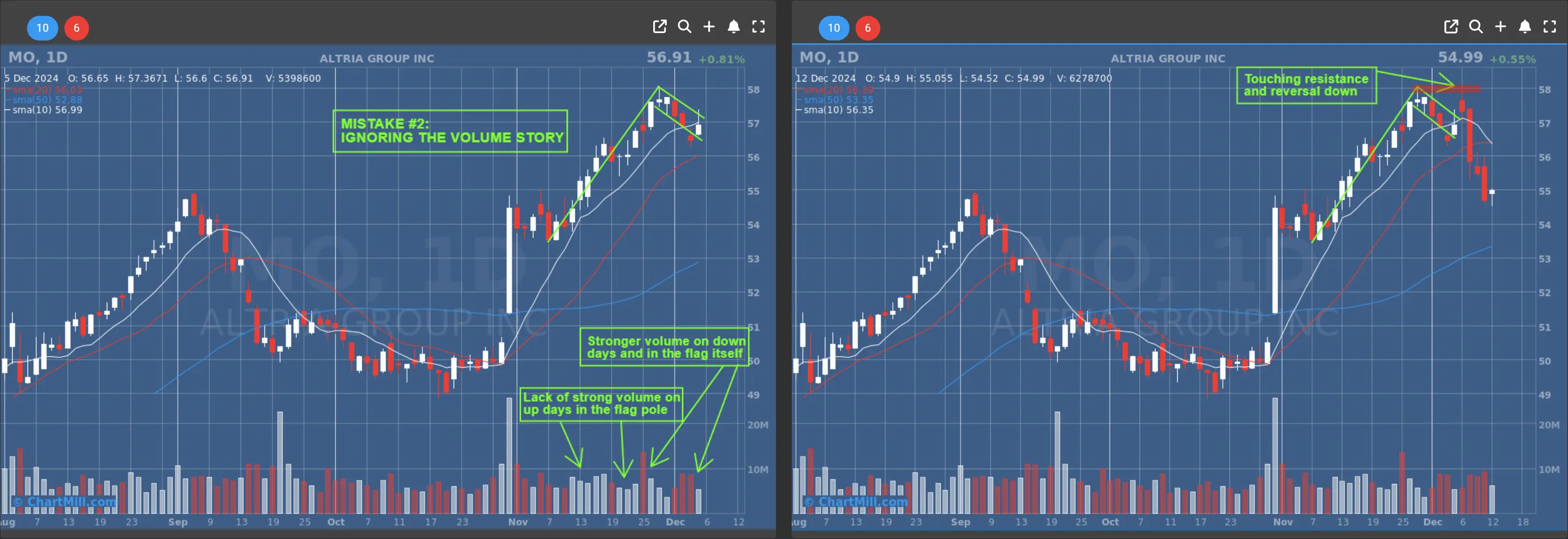

Mistake #2: Ignoring the Volume Story

Volume is the fuel behind the pattern — and too many people ignore it. A proper bull flag should start with a strong volume surge on the flagpole, then decline during the pullback.

If the breakout doesn’t come with a new volume spike? Warning sign.

Volume tells you who’s really behind the move. Institutions don’t tiptoe into trades, they stomp. No volume? No edge.

Mistake #3: Trading Flags That Pull Back Too Deep

Not every pullback is a healthy one. If the stock retraces more than 50% of the initial move, or drops below key moving averages like the 20 EMA — you’re not looking at a tight flag anymore. It might be the start of a full-blown reversal.

Remember: a bull flag should show controlled selling, not panic. A deep pullback usually means buyers are backing off.

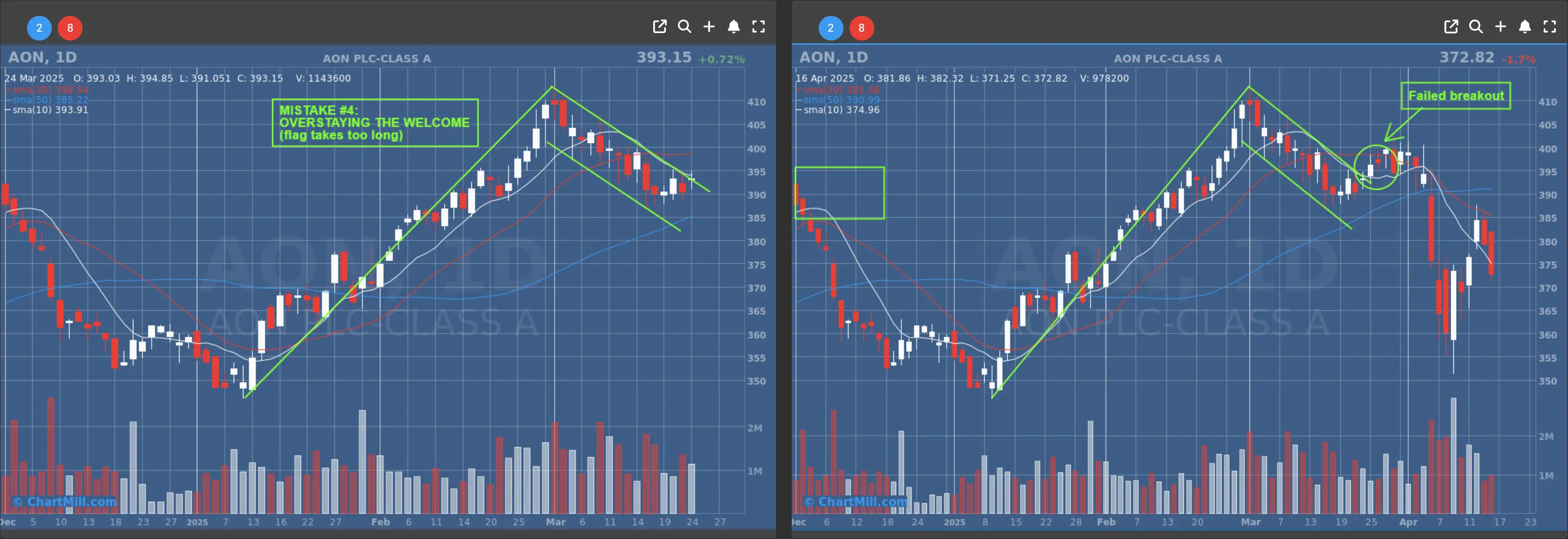

Mistake #4: Overstaying the Welcome

Bull flags are quick patterns. If a stock sits in a flag for too long — like more than 10–15 candles on a daily chart — the setup weakens. Momentum fades, and interest dies out.

Think of it like this: the longer a stock rests, the less energy it has left to move explosively. Watch for tight, fast patterns. Time matters just as much as structure.

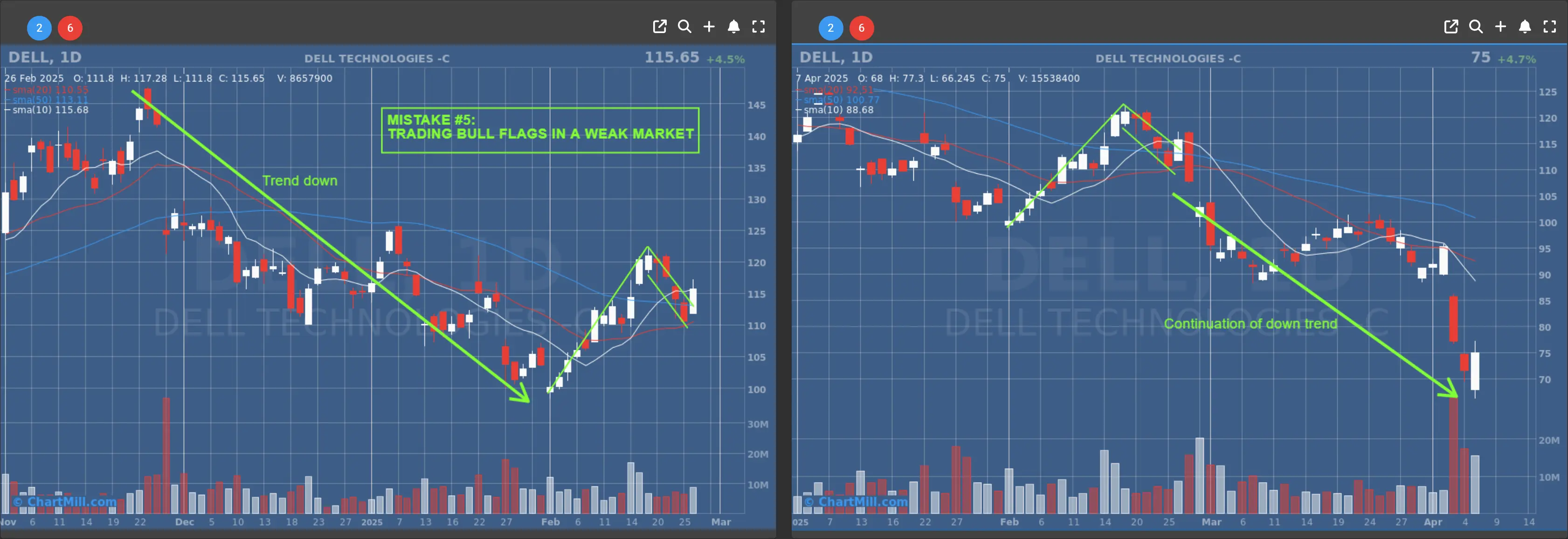

Mistake #5: Trading Bull Flags in a Weak Market

This one hurts. You find the perfect bull flag setup… but the overall market is tanking. Unless your stock is showing extreme relative strength, the odds are stacked against you.

Always zoom out. The best setups work even better when you have the wind at your back.

Use our daily ChartMill's market updates & 'Relative Strength' filters to stay aligned as you trade the strongest stocks.

So there you have it — 5 common bull flag mistakes that can quietly sabotage your trades.

The good news? Once you recognize them, they’re easy to avoid — and your success rate with this powerful setup can improve dramatically.