Market Monitor News July 08 BMO (Rocket Lab, WNS UP - Tesla, Royal Gold DOWN)

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Jul 8, 2025

If the market had a mood ring on Monday, it would’ve turned a stormy gray. Despite last week’s record highs, Wall Street kicked off this fresh week with a frown, dragged down by fresh tariff threats, political distractions, and a slew of stock downgrades.

I’ll walk you through what happened and why investors are hitting the brakes for now.

Geopolitical Tensions Turn Up the Heat

Let’s start with what really spooked the markets: a new round of tariff threats straight from President Trump’s playbook.

The White House announced steep import tariffs - 25 to 40% - on a list of countries including Japan, South Korea, South Africa, and even Myanmar and Laos, effective August 1st. The tariffs don’t come as a total surprise, but the timing and intensity reignited fears of a full-blown trade war.

The fact that any nation without a finalized trade deal with the U.S. is now on the radar only adds to the uncertainty.

Trump even pointed his tariff cannon at “strategic partners” of the BRICS nations, proposing a blanket 10% surcharge for good measure. While this isn’t April’s chaotic ‘Liberation Day’ all over again, the market is clearly jittery.

Dow Jones and Nasdaq both dropped 0.9%, while the S&P 500 slid 0.8%. For a market that had just popped champagne on record highs, this was a sobering Monday wake-up call.

Company News: From Downgrades to Drama

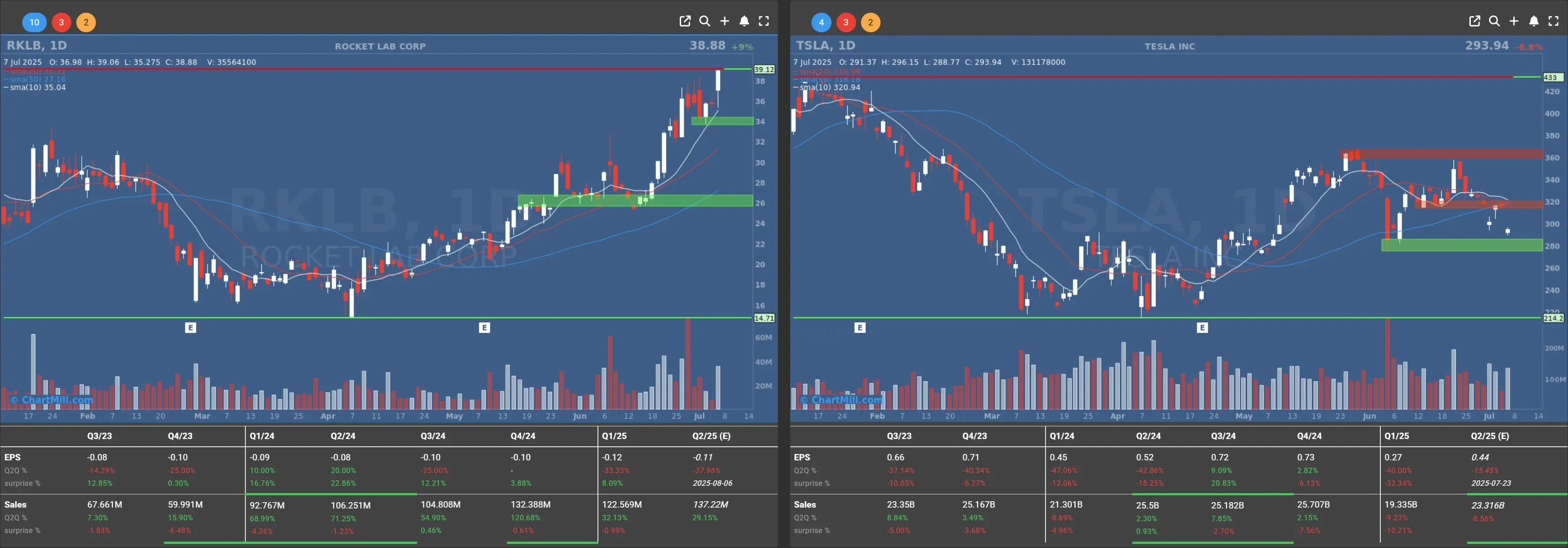

Tesla (TSLA | -6.79%) – Musk’s Politics Rattle Investors

Elon Musk just can’t stay out of the headlines and investors are starting to feel the fatigue. On Sunday, Musk unveiled plans to launch a new political faction: the “America Party.” Sounds bold, but Wall Street isn’t loving the distraction.

TSLA shares took a 7% dive, suggesting that investors would prefer their CEO focus on EVs, not elections. This marks yet another instance where Musk’s extracurriculars cast a shadow over Tesla’s valuation.

Rocket Lab Corp (RKLB | +9.02%) - Profiting from Escalating Public Conflict

shares of Rocket Lab Corp are trading higher on Monday amid an escalating public conflict between President Donald Trump and Elon Musk, CEO of Tesla and SpaceX. Investors hope this will create opportunities for Rocket Lab to win more NASA contracts.

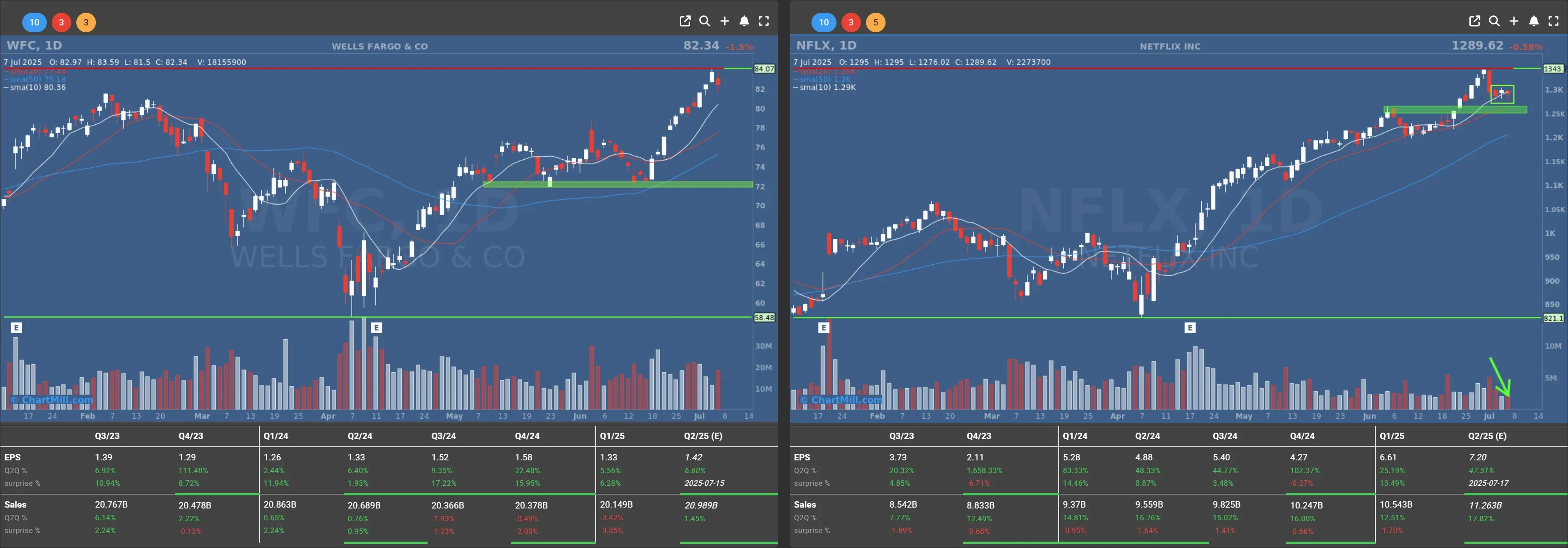

Netflix (NFLX | -0.58%) – Downgraded to “Hold” After a 50% YTD Rally

Seaport Global took Netflix off its “buy” list, citing limited upside after a blistering 50% rally in 2025. Analyst David Joyce thinks much of the streaming giant’s long-term potential is already priced in and pointed out the company hasn’t gained market share in the U.S. lately, unlike YouTube.

So while Netflix still has room to perform, it might be time for a breather.

Wells Fargo (WFC | -1.51%) – From ‘Buy’ to ‘Hold’

Raymond James analyst David Long thinks WFC has gotten a bit ahead of itself. Even though the Fed lifted restrictions on the bank’s balance sheet in June - a major positive - its valuation (12.4x 2026 EPS) now sits above peers.

That’s enough to trigger a downgrade from ‘Buy’ to ‘Hold.’

MGM Resorts (MGM | -1.49%) – High Stakes, Low Confidence

Goldman Sachs initiated coverage on MGM with a rare sell rating, citing high exposure to Las Vegas’ increasingly volatile market. Visitor numbers are down 6.5% YoY in May, and economic sensitivity makes MGM the most fragile name among casino stocks tracked by Goldman. Ouch.

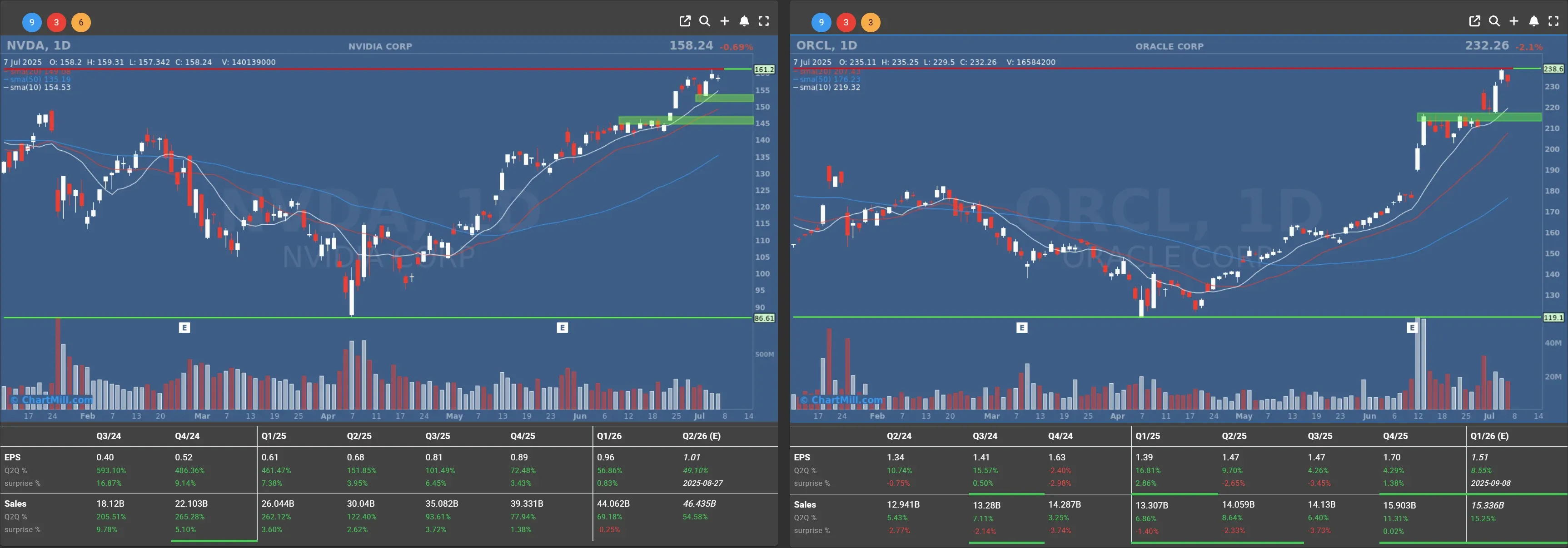

Tech Stutters, Oracle Slashes Prices

Nvidia (NVDA | -0.69%) cooled slightly after its record-setting run, now trailing only Apple in total market cap.

Meanwhile, Oracle (ORCL | -2.13%) is trimming prices aggressively to stay in the federal government's good graces. The company announced up to 75% discounts on software and major markdowns on cloud services through November.

This could set the tone for further price competition in the enterprise cloud space.

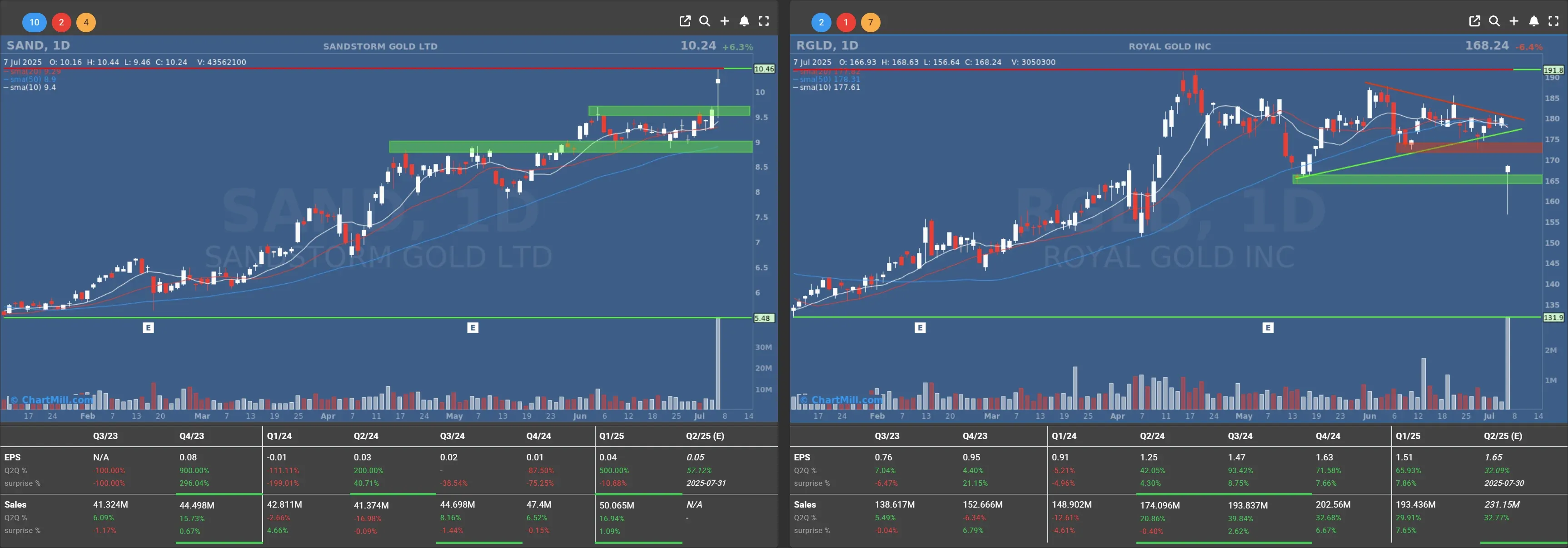

Deal Flow: Gold, Clouds, and Consulting

M&A Monday didn’t disappoint:

Sandstorm Gold (SAND | +6.33%) is merging with Royal Gold (RGLD | -6.44%) in a $3.5B deal to form a royalty and streaming powerhouse. SAND shareholders will own 23% of the combined entity.

WNS (WNS | +14.26%) got a buyout bid from Capgemini at $76.40/share—17% above last week’s close. Smart play from the French consulting giant.

CoreWeave (CRWV | -3.33%) is acquiring Core Scientific (CORZ | -17.61%) in a massive $9B transaction, though markets didn’t love the deal? both stocks fell sharply.

Oil Inches Up, Fed Minutes Ahead

Despite OPEC+ announcing a surprising supply hike of 548,000 barrels/day for August, WTI crude rose 1.4% to $67.93. Analysts suspect this is a pressure tactic aimed at squeezing U.S. shale producers.

Meanwhile, the euro dipped 0.5% to 1.1721 against the dollar, as renewed trade tension once again fuels greenback demand.

Looking ahead, all eyes are on Wednesday’s release of the Fed meeting minutes. While macro data is light this week, the tone from the FOMC could add clarity on rate path expectations in the second half of the year.

My Take

Markets are finally acknowledging what’s been lurking in the shadows: tariff risk is back. And it’s not just about economics anymore, it’s geopolitics, ego, and election cycles. This adds another layer of uncertainty that even AI-fueled bull runs can’t fully ignore.

In the short term, I’m watching industrials, exporters, and rate-sensitive financials closely. The combination of trade disruptions and a still-hawkish Fed could trigger a rotation or a deeper pullback if clarity doesn't emerge soon.

For now, keep some dry powder, stay nimble, and don’t underestimate the power of political headlines to hijack the narrative.

Kristoff - Co-Founder ChartMill

Next to read: Market Monitor Trends & Breadth Analysis, July 08

EPA:CAP (7/11/2025, 7:00:00 PM)

140.4

-5 (-3.44%)

159.96

+0.17 (+0.11%)

82.55

+0.19 (+0.23%)

74.7

-0.14 (-0.19%)

1245.11

-5.48 (-0.44%)

37.93

-0.91 (-2.34%)

230.56

-4.44 (-1.89%)

164.92

+0.82 (+0.5%)

313.51

+3.64 (+1.17%)

9.86

+0.02 (+0.2%)

11.57

+0.5 (+4.52%)

12.51

-0.67 (-5.08%)

125.84

-12.45 (-9%)

Find more stocks in the Stock Screener

CAP.PA Latest News and Analysis

5 days ago - ChartmillMarket Monitor News July 08 BMO (Rocket Lab, WNS UP - Tesla, Royal Gold DOWN)

5 days ago - ChartmillMarket Monitor News July 08 BMO (Rocket Lab, WNS UP - Tesla, Royal Gold DOWN)Tariffs, Tesla Trouble & Tech on the Rocks - Monday’s Market Mood Swing