Market Monitor News June 17 (ROKU, Advanced Micro Devices UP - Sarepta Therapeutics DOWN)

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Jun 17, 2025

Monday felt… different.

Markets rebounded as if a collective sigh of relief swept through the trading floors. Tensions between Iran and Israel didn’t spiral further, at least, that was the hope investors clung to. The Wall Street Journal reported Iran might be open to resuming talks on its nuclear program.

That one headline was enough to send oil prices tumbling: WTI crude dropped to $71.77 per barrel after touching $77 earlier in the session.

And yes, this matters.

Any sign of de-escalation reduces the risk of the Strait of Hormuz being blocked. That narrow shipping route handles nearly 20% of global oil flows. No surprise that oil cooled off fast when the war drums quieted a bit.

But let’s not get too cozy. Israeli Prime Minister Netanyahu promptly poured cold water on the idea of diplomacy, calling Iran “deceitful” and accusing it of lying its way through missile programs and nuclear ambitions.

He made it very clear: talks aren’t happening. Meanwhile, Donald Trump, who’s once again on center stage, added his two cents: “Iran’s not going to win this war. They need to talk, and they need to do it now.” Subtle as a sledgehammer, as usual.

Market Rally: Green Across the Board

Despite the geopolitical noise, US markets were all smiles. The Dow Jones added +0.8%, S&P 500 rose +0.9% to 6,033.11, and the Nasdaq jumped +1.5% to 19,701.21.

Traders were clearly betting on diplomacy (or at least a pause in the chaos).

Bond yields inched up slightly, and the EUR/USD pair held steady at 1.1562, as currency markets stayed focused on the upcoming Fed decision. The Fed kicks off its two-day meeting Tuesday, with a widely expected rate hold.

ING’s James Knightley hit the nail on the head: unless the economic picture clears up, don’t expect cuts before Q4. And the Fed? They’ll keep their powder dry for now.

Company Highlights: Some Big Movers

Let’s talk names. A few tickers were lighting up screens Monday:

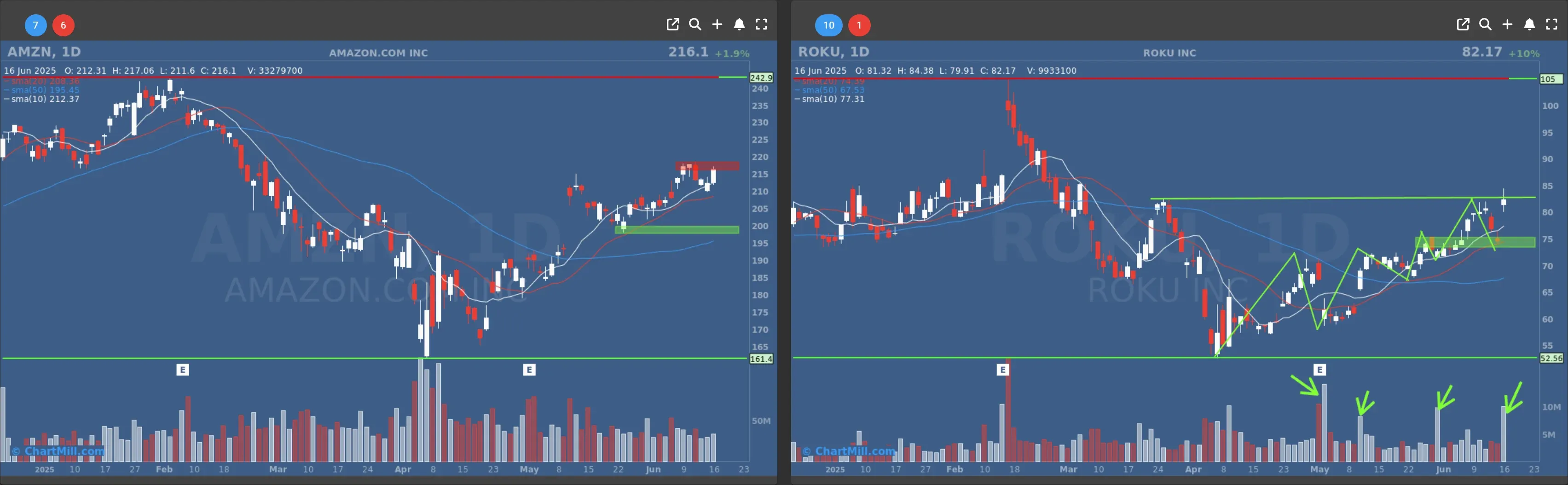

Roku (ROKU | +10.18%) absolutely soared after announcing a strategic ad partnership with Amazon (AMZN | +1.89%). Roku users can now be reached via Amazon Ads, allowing for better targeted campaigns across platforms.

Roku’s smart TV OS and streaming sticks just became a lot more attractive to advertisers, and Bloomberg Intelligence thinks this could help Roku scale in a brutally competitive market. No concrete financial impact yet, but sentiment clearly flipped.

Read our latest view in this Roku/Amazon deal: 'Roku and Amazon Ads: A Game-Changer or a Fleeting Hype?'

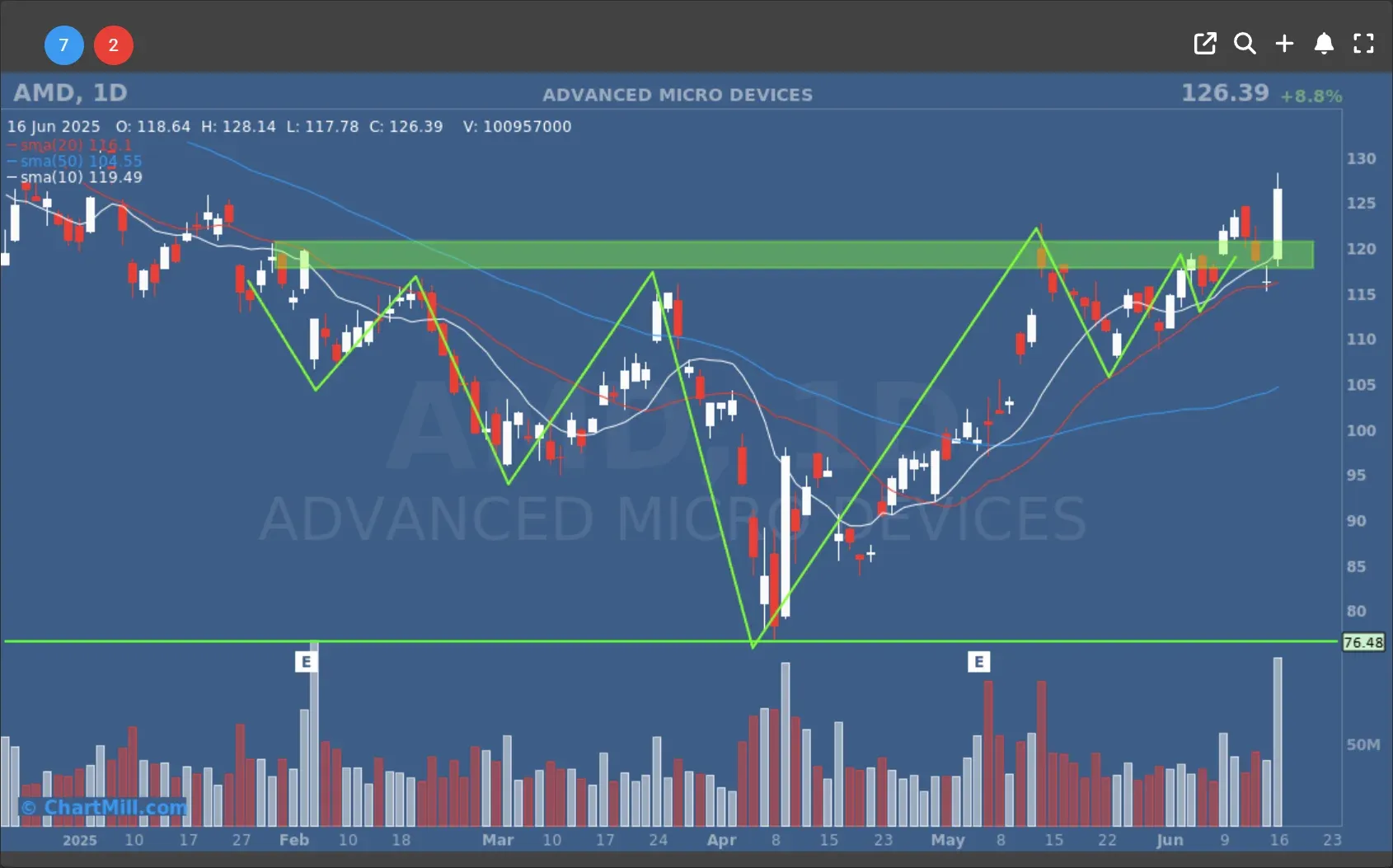

Advanced Micro Devices (AMD | +8.81%) kept riding the AI hype wave after unveiling its latest chips.

Tesla (TSLA | +1.17%) crept higher too. Elon Musk confirmed the robotaxi rollout is set for June 22 in Austin. Whether it drives revenue or just headlines remains to be seen, but the stock seems happy either way.

US Steel (X | +5.1%) caught a strong bid after its acquisition by Japan’s Nippon Steel cleared regulatory hurdles. The US gets a so-called “golden share” and a $14 billion long-term investment commitment. That’s a win, optics-wise.

On the flip side…

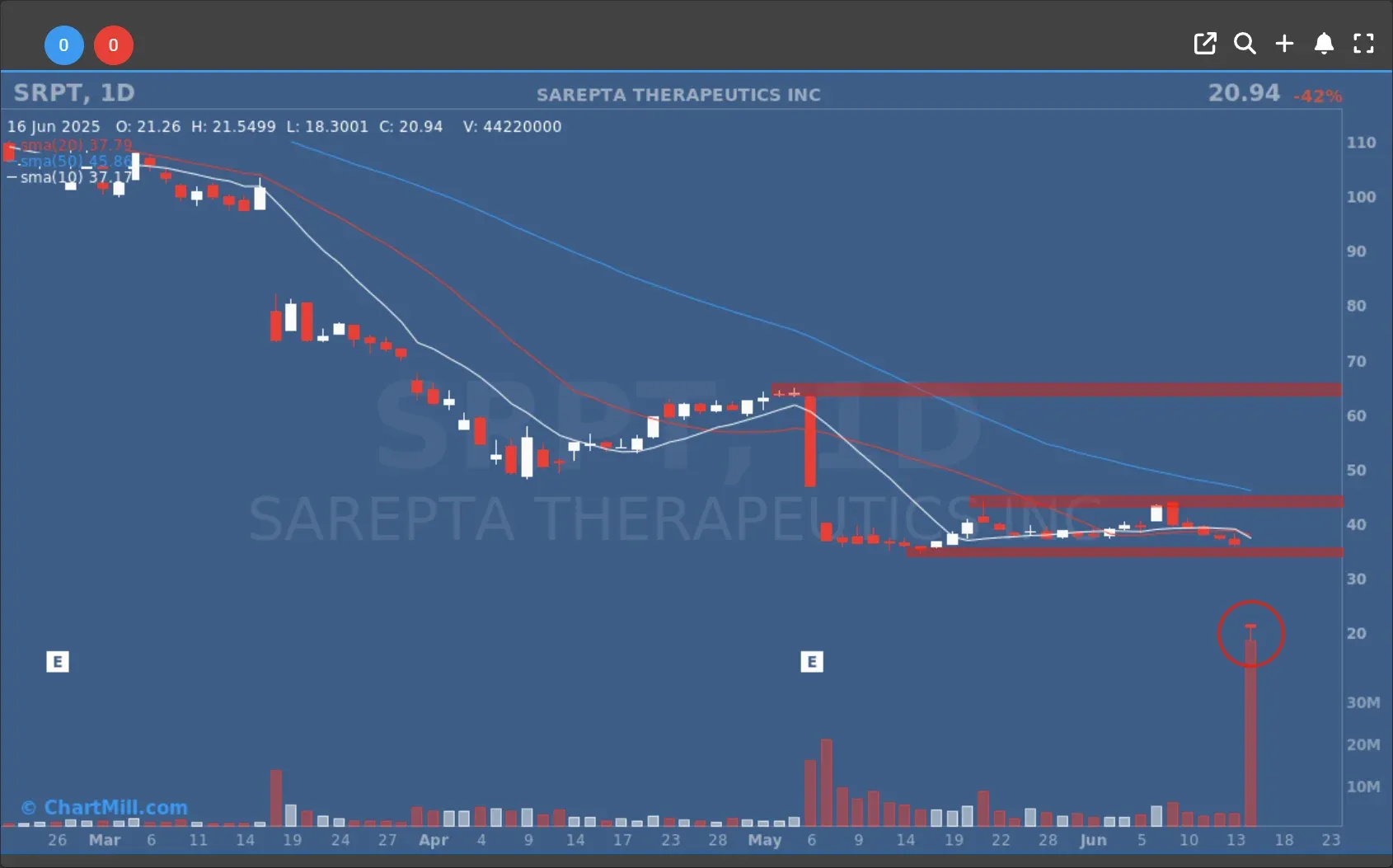

Sarepta Therapeutics (SRPT | -42.12%) crashed hard. A second death tied to its gene therapy Elevidys forced the company to halt dosing in non-ambulatory patients with Duchenne muscular dystrophy.

What’s Next: Central Banks in Focus

Looking ahead, it's central bank week on steroids. We’ll hear from the Fed (US), BoE (UK), SNB (Switzerland), PBoC (China), and others. The only bank with a solid chance of a move is the Swiss National Bank, markets expect them to cut.

Volatility could tick up mid-week. Until then, we’re watching oil, watching Iran, and watching for headlines that could turn this fragile relief rally into just another dead-cat bounce.

Let’s be clear: this rally feels like hope more than conviction. The narrative can flip on a dime, especially with missiles still flying in the Middle East and macro data still ambiguous at best.

Stay sharp out there.

Kristoff - Co-Founder ChartMill

Next to read: Market Monitor Trends & Breadth Analysis, June 17

54.84

-0.01 (-0.02%)

214.82

-1.28 (-0.59%)

127.1

+0.71 (+0.56%)

316.35

-12.78 (-3.88%)

21.56

+0.62 (+2.96%)

80.63

-1.54 (-1.87%)

Find more stocks in the Stock Screener

X Latest News and Analysis

18 hours ago - ChartmillMarket Monitor News June 17 (ROKU, Advanced Micro Devices UP - Sarepta Therapeutics DOWN)

18 hours ago - ChartmillMarket Monitor News June 17 (ROKU, Advanced Micro Devices UP - Sarepta Therapeutics DOWN)Markets rebound on hopes of Iran de-escalation; oil drops, Roku surges on Amazon deal, Fed decision looms.

21 days ago - ChartmillMarket Monitor News May 28 (Tesla, Nvidia UP - PDD Holdings, Trump Media DOWN)

21 days ago - ChartmillMarket Monitor News May 28 (Tesla, Nvidia UP - PDD Holdings, Trump Media DOWN)Wall Street Rallies on Tariff Truce and Consumer Optimism