Technical investors often look for stocks showing both good underlying momentum and clear consolidation patterns that indicate possible breakouts. One methodical process involves filtering for securities with high technical ratings, which assess overall trend condition, combined with high setup quality scores that pinpoint tight trading ranges providing good risk-reward entry points. This system favors stocks that are not only trending positively but are also situated at possible turning points where breakouts become more likely from a statistical standpoint.

TORONTO-DOMINION BANK (NYSE:TD) has been identified by such a screening process with noteworthy attributes that call for more detailed study from a technical viewpoint. The Canadian banking institution shows the exact mix of technical condition and consolidation pattern that breakout strategists look for.

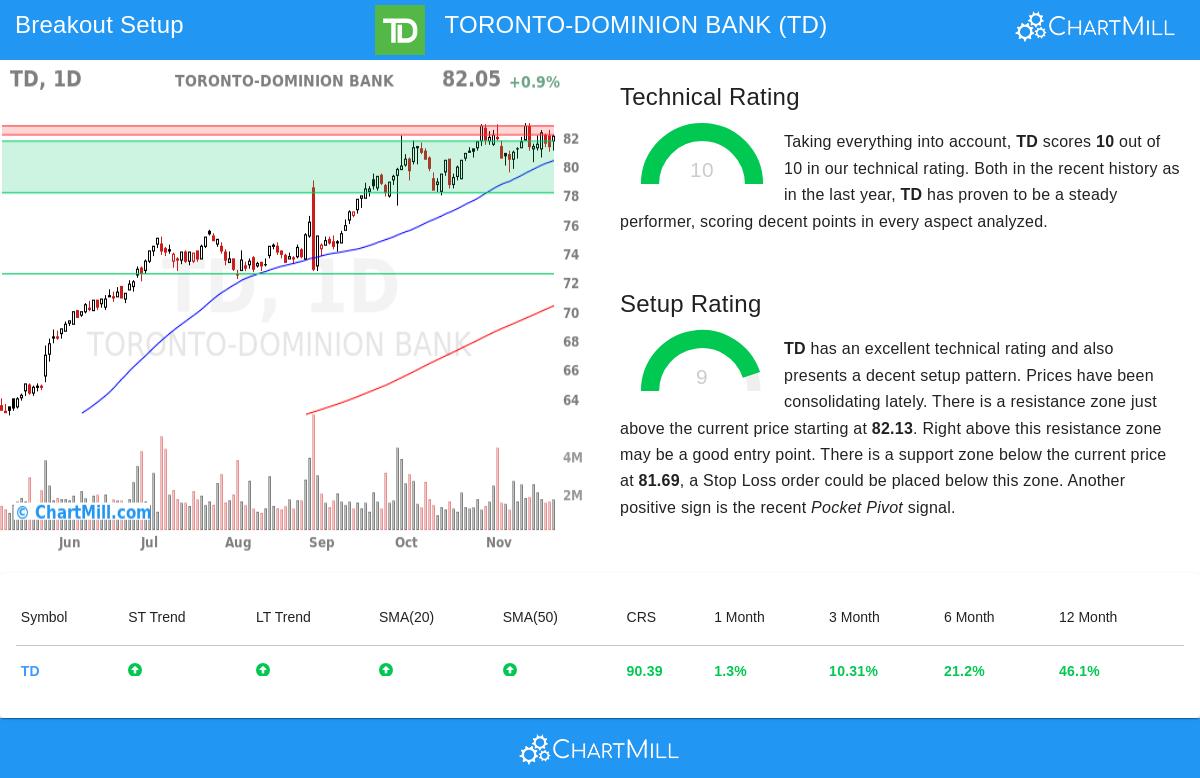

Technical Strength Assessment

TD Bank's technical base looks very strong, reaching a full ChartMill Technical Rating of 10 out of 10. This top score shows high performance over several technical areas that are important for finding stocks with continuing momentum. The detailed technical analysis report shows a number of elements that build this notable rating:

- Both long-term and short-term trends are clearly positive, showing agreement across different time periods

- The stock performs better than 90% of all stocks on a yearly performance basis with gains spread evenly over the time

- In the competitive banking industry including 388 stocks, TD performs better than 96% of its competitors

- Present trading near 52-week highs shows leadership while the wider S&P500 stays below its highs

The technical rating's value is in its capacity to find stocks with lasting strength across different measures such as relative performance, trend steadiness, and moving average placement. For breakout traders, beginning with stocks having a strong technical base gives an important foundation, as breakouts from these stocks usually have a greater chance of continuation.

Setup Quality Examination

Apart from basic technical condition, TD shows a very good setup pattern with a Setup Quality Rating of 9 out of 10. This high score shows the stock has been trading in a narrow consolidation range, forming the pressure that frequently comes before notable price moves. Important setup features are:

- A clear resistance area between $82.13 and $82.74 that the stock is presently challenging

- A support area between $78.13 and $81.69 giving defined risk management levels

- A recent Pocket Pivot signal, showing institutional buying

- A trading range between $79.52 and $82.94 over the last month showing consolidation

The setup quality measure answers the essential question of timing by finding stocks that have formed bases through price consolidation. For breakout approaches, these consolidation phases build the force for possible large moves, while the set support and resistance levels give clear entry and exit points for risk management.

Market Context and Trading Considerations

While TD shows notable independent technical features, it is important that the stock is reaching this condition during a time of uncertain market signals. The S&P500 currently shows a negative long-term trend even with short-term positivity, making TD's leadership more meaningful as it performs better in a difficult setting.

The automatically created trading setup proposes:

- Entry above resistance at $82.75 using a buy-stop order

- Stop-loss position at $80.22 under the 10-day low and support area

- Position sizing that restricts portfolio risk to about 0.76%

Traders should be aware that while these automatic ideas give a structure, personal risk comfort, future earnings events, and wider market conditions justify individual changes to any trading plan.

Finding Additional Opportunities

The process that found TD Bank as a possible breakout candidate can be used methodically throughout the market. Investors looking for comparable technical setups can use the Technical Breakout Setups screen to find other stocks displaying both good technical ratings and high-quality setup patterns. This filtering method effectively reduces the field of potential trades to those meeting particular technical requirements.

Disclaimer: This analysis is based on technical indicators and automated screening methodologies. It is not investment advice and does not consider fundamental factors, individual financial circumstances, or risk profiles. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance does not guarantee future results, and trading involves risk including potential loss of principal.