ROLLINS INC (NYSE:ROL) stands out as a potential candidate for quality investors, meeting key criteria for long-term growth and profitability. The company, a global provider of pest and termite control services, demonstrates strong financial health, consistent growth, and efficient capital allocation.

Why ROLLINS Fits the Quality Investing Profile

- High Return on Invested Capital (ROIC): With an ROIC of 124.56%, excluding cash and goodwill, ROLLINS efficiently generates profits from its capital investments, far exceeding the 15% threshold for quality stocks.

- Strong Revenue and EBIT Growth: Over the past five years, revenue grew at an 8.4% annual rate, while EBIT expanded by 15.7%, indicating improving profitability.

- Low Debt Burden: The company’s debt-to-free cash flow ratio of 0.81 suggests it could repay all debt in less than a year, reflecting financial stability.

- Profit Quality: ROLLINS converts net income into free cash flow at a rate of 124%, well above the 75% benchmark, demonstrating reliable earnings.

- Industry-Leading Margins: Operating margins of 19.3% and profit margins of 13.8% rank in the top tier of its sector, supported by pricing power and operational efficiency.

Fundamental Analysis Summary

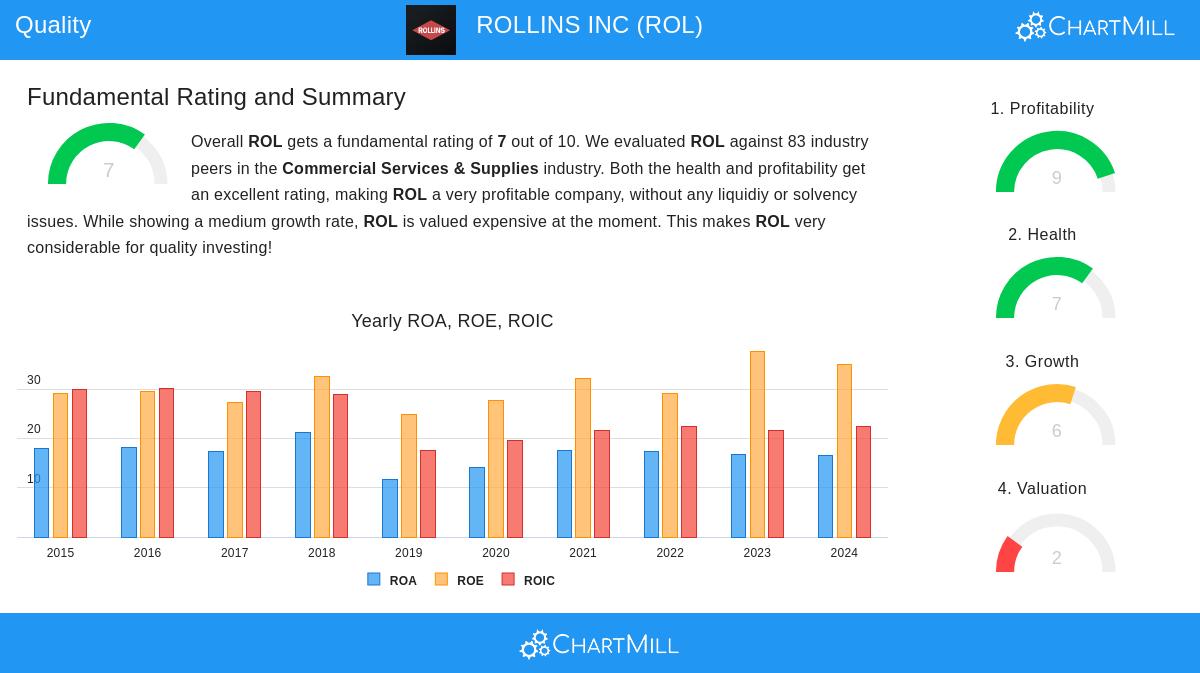

ROLLINS scores 7 out of 10 in our fundamental rating, with strengths in profitability (9/10) and financial health (7/10). Key highlights include:

- Profitability: High ROIC (21.4%), strong margins, and consistent earnings growth.

- Financial Health: Low debt, solid solvency metrics, and a reliable dividend history.

- Valuation: The stock trades at a premium (P/E of 57.3), but this may be justified by its growth prospects and industry position.

Our Caviar Cruise screener identifies more quality stocks like ROLLINS, updated daily. For a deeper dive, review the full fundamental report.

Disclaimer

This is not investing advice. Always conduct your own research before making investment decisions.