Investors looking for long-term growth chances at fair prices frequently use established methods that mix basic strength with steady development. The Peter Lynch investment style, explained in his book One Up on Wall Street, highlights finding companies with strong profitability, low debt, and earnings growth that is steady but not too fast. This system concentrates on businesses that are financially sound and available at prices that do not overstate their future potential, making it especially interesting for those following a growth at a reasonable price (GARP) plan. By searching for particular financial measures, investors can find possible choices that fit these ideas.

Meeting Peter Lynch Criteria

Dr. Reddy's Laboratories-ADR (NYSE:RDY) shows a number of traits that match closely with the filters used in a Peter Lynch-based screen. The method favors companies with a history of earnings growth, fair price relative to that growth, good profitability, and a sound financial base to handle market changes. RDY's financial numbers suggest it fits these main needs, which are set to find businesses able to provide continued results without too much debt or high cost.

- Earnings Growth and PEG Ratio: Lynch liked companies with earnings per share (EPS) growth from 15% to 30% each year over five years, as this points to steady development. RDY's EPS has increased at an average yearly rate of 23.62% over this time, putting it well inside the desired span. Importantly, its PEG ratio, which measures the price-to-earnings (P/E) ratio against this growth rate, is 0.79. A PEG under 1.0 is a key part of the Lynch method, suggesting the stock might be priced low for its growth path.

- Profitability and Financial Health: A return on equity (ROE) over 15% is needed to make sure the company is effectively creating profits from shareholder money. RDY's ROE of 16.86% is above this mark. Also, Lynch stressed minimal debt, with a liking for a debt-to-equity ratio under 0.25. RDY does much better than this with a very low ratio of 0.02, showing little dependence on loans. The company also keeps a current ratio of 1.92, indicating it has enough near-term assets to pay its upcoming bills, which fits with Lynch's interest in financial steadiness.

Fundamental Analysis Overview

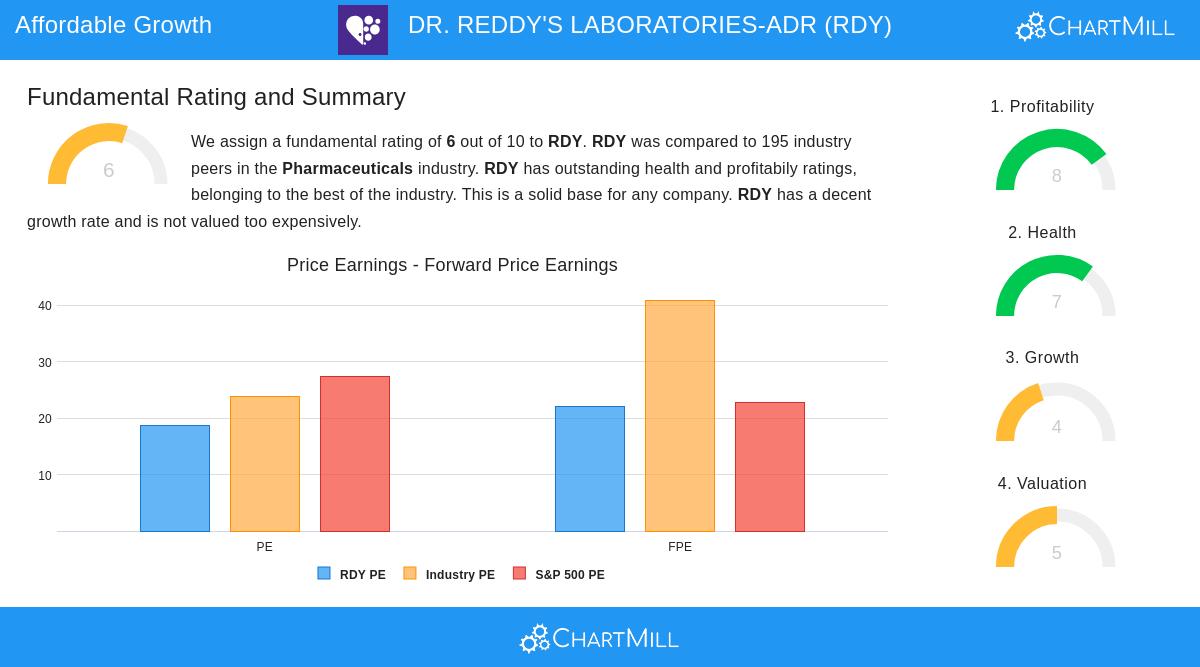

A closer examination of the company's complete basics supports the view taken from the Lynch screen. The full fundamental report gives RDY a score of 6 out of 10, pointing out its very good health and profitability marks in the pharmaceuticals field. The company's ability to pay debts is very high, with a high Altman-Z score suggesting a very small chance of failure. Its profit margins are some of the top in its industry, and it uses money effectively, as seen in a good return on invested capital (ROIC). While the price is seen as acceptable and growth is predicted to slow from its past levels, the mix of first-class profitability and a sturdy financial statement offers a good base for long-term investors.

Investment Considerations

For investors who agree with the Peter Lynch thinking, RDY stands as an interesting example of a company that has already reached large size but keeps increasing at a maintainable speed. Its place in the generic drugs and active ingredients industry might be seen through the "invest in what you know" idea, as it supplies necessary health items with steady worldwide need. The company's small level of institutional ownership, a point Lynch saw as good for hidden chances, could be a topic for more study, along with watching any insider purchases or stock buyback plans.

The Peter Lynch screen is a useful first step for finding companies that match a GARP plan. If you want to look into other businesses that currently pass this screen, you can see the current list of outcomes here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. The opinions expressed are based on current market conditions and available data, which are subject to change. Investors should conduct their own independent research and consult with a qualified financial advisor before making any investment decisions.