Pharmaceutical companies often work in intricate, highly controlled settings, but some succeed in creating lasting businesses that provide steady expansion without high risk. One way to spot these companies is by using long-term investment plans that stress basic financial soundness and fair price. The Peter Lynch investment method, taken from the famous investor's works, centers on locating companies with durable, maintainable profit expansion, sound financial condition, and prices that do not exaggerate their future. This plan steers clear of speculative high-expansion picks in favor of businesses that can build value over many years, using measures like profit expansion, earnings ability, acceptable debt, and price ratios such as the PEG ratio.

Fitting the Peter Lynch Standards

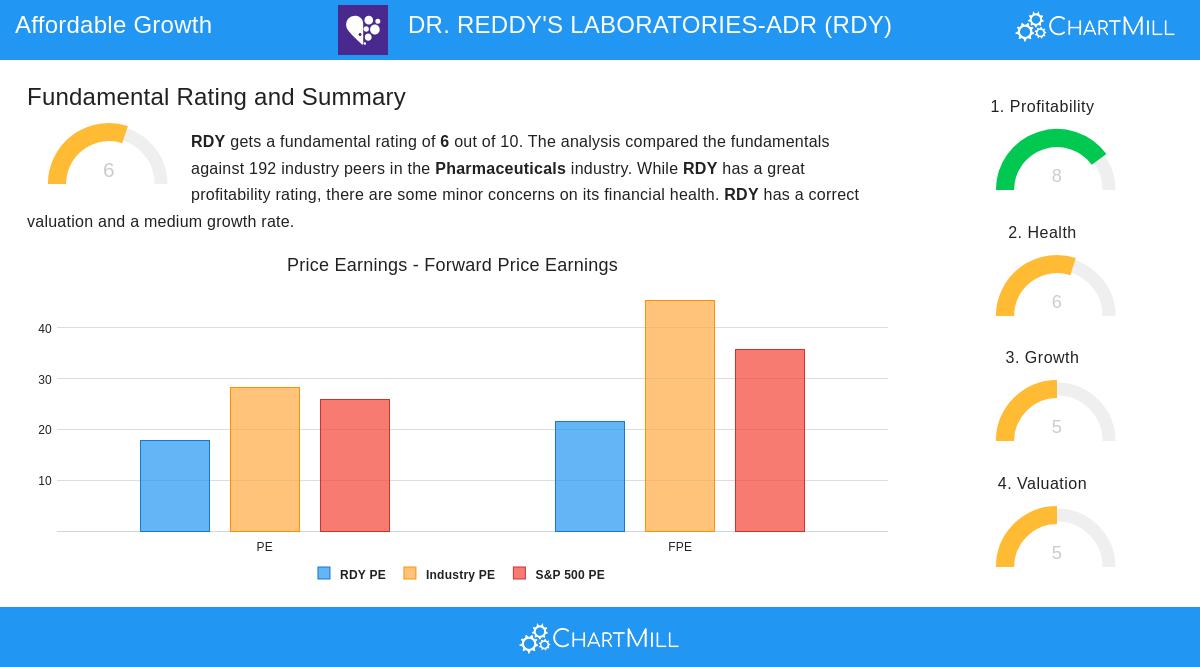

DR. REDDY'S LABORATORIES-ADR (NYSE:RDY) appears from a filter using Peter Lynch’s plan, fitting a number of its main needs. The plan favors companies with profit expansion that is significant but not extreme, confirming it can continue, and it puts a high priority on price compared to that expansion. Here is how RDY matches those ideas:

- Earnings Per Share Expansion: RDY’s EPS has expanded at a typical yearly speed of 23.62% over the last five years. This fits inside Lynch’s desired span of 15–30%, showing good expansion without entering into unmaintainable areas.

- PEG Ratio: The stock’s PEG ratio, using past five-year expansion, is at 0.75. Lynch viewed a PEG under 1 as a signal of fair price, meaning the market might not be completely valuing the company’s past expansion.

- Debt/Equity Ratio: With a debt-to-equity ratio of 0.03, RDY works with very little borrowing, matching Lynch’s liking for companies financed more by ownership than debt. This adds to financial strength.

- Return on Equity: The company’s ROE of 16.03% is more than the 15% limit Lynch supported, indicating good use of owner money and high earnings ability.

- Current Ratio: At 1.85, RDY’s current ratio shows enough immediate cash availability, meeting Lynch’s need for a ratio of at least 1.

Basic Financial Soundness and Results

A thorough basic financial review of DR. Reddy’s Laboratories backs the opinion that it has traits attractive to long-term investors. The company gets a good earnings ability score, with high grades for return on assets, return on invested capital, and profit margins compared to industry competitors. Its financial condition is acceptable, supported by a strong ability to pay debts and acceptable debt levels, although cash ratios are a bit under industry norms. Expansion has been strong in recent years, especially in sales and profits, although analysts expect a slowing in EPS expansion in the future. Price measures show a varied view: while the P/E ratio is higher than the company’s own past average, it stays under industry and S&P 500 comparisons, implying the stock is not overly costly considering its earnings ability.

Appeal for GARP Investors

For investors looking for expansion at a fair price (GARP), DR. Reddy’s presents an interesting case. The company has shown a capacity to grow profits at a double-digit rate while keeping high earnings ability and a clear balance sheet—main parts of the Peter Lynch way. The under-1 PEG ratio suggests that its expansion has not been completely acknowledged in its price, providing a possible safety buffer. Also, as a supplier of generic medicines, APIs, and branded generics, it works in a stable industry with worldwide demand support, fitting with Lynch’s thought of putting money in understandable businesses with consistent demand.

Finding More Possibilities

For investors curious about using this plan on other companies, the Peter Lynch stock filter provides a changing list of stocks that fit these standards. Regular filtering can assist in finding companies that show the same mix of expansion, value, and financial soundness that Lynch liked.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consider their financial situation and risk tolerance before making investment decisions.