Does QUALCOMM INC (NASDAQ:QCOM) meet Peter Lynch’s stock-picking criteria?

By Mill Chart

Last update: Mar 8, 2025

With a strategy that emphasized steady earnings growth and a strong market position, Peter Lynch sought out long-term winners. We put QUALCOMM INC (NASDAQ:QCOM) to the test against his stock-picking rules.

Is QUALCOMM INC (NASDAQ:QCOM) the type of stock Peter Lynch would love?

- The Return on Equity (ROE) of QCOM stands at 39.27%, reflecting the company's strong profitability and effective utilization of shareholder equity. This metric signifies the company's ability to generate returns for its investors.

- QCOM maintains a healthy Debt-to-Equity ratio of 0.49. This indicates the company's conservative capital structure and signifies its ability to effectively manage debt obligations while maintaining a strong equity position.

- QCOM has achieved 23.53 growth in EPS over the past 5 years, reflecting a sustained improvement in earnings performance.

- QCOM's PEG ratio of 0.63 suggests its current valuation aligns well with its earnings potential.

- A Current Ratio of 2.62 indicates that QCOM has a comfortable liquidity buffer.

What else is there to say on the fundamentals of NASDAQ:QCOM?

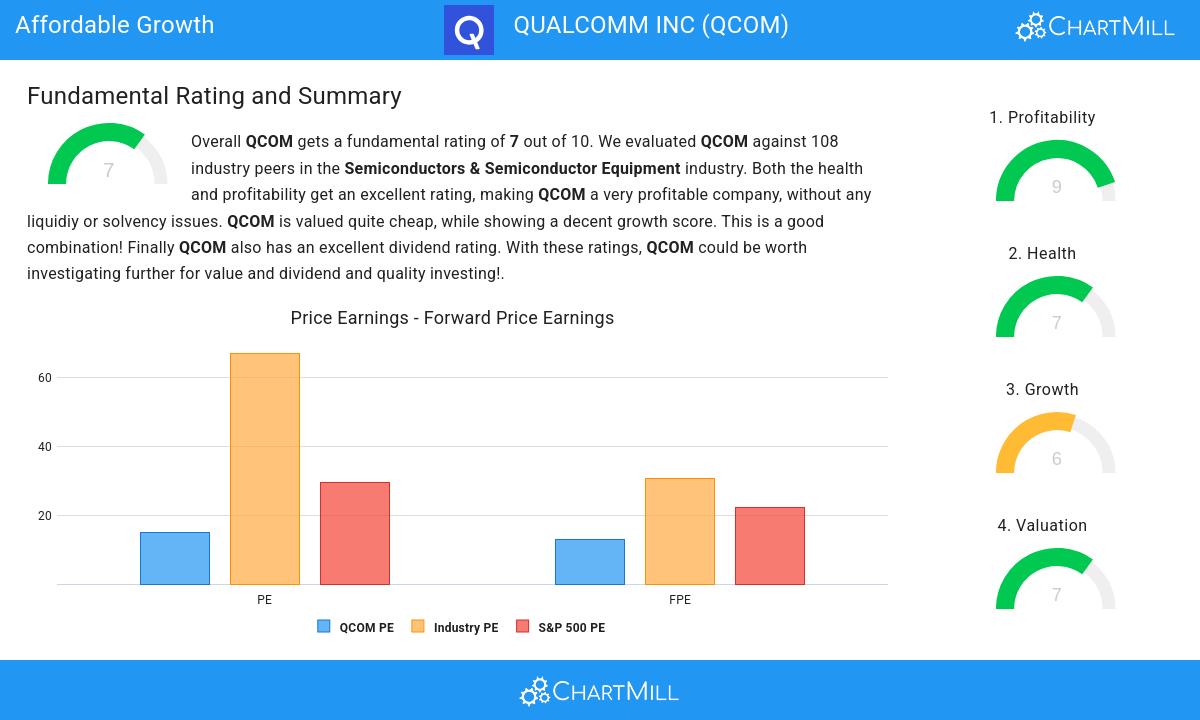

ChartMill utilizes a proprietary algorithm to assign a Fundamental Rating to every stock. This rating, ranging from 0 to 10, is computed daily by analyzing a variety of fundamental indicators and properties.

Overall QCOM gets a fundamental rating of 7 out of 10. We evaluated QCOM against 108 industry peers in the Semiconductors & Semiconductor Equipment industry. QCOM has outstanding health and profitabily ratings, belonging to the best of the industry. This is a solid base for any company. QCOM may be a bit undervalued, certainly considering the very reasonable score on growth QCOM also has an excellent dividend rating. This makes QCOM very considerable for value and dividend and quality investing!

Check the latest full fundamental report of QCOM for a complete fundamental analysis.

Every day, new Affordable Growth stocks can be found on ChartMill in our Peter Lynch screener.

Keep in mind

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents observations created by automated analysis but does not guarantee any trading or investment outcomes. Always trade responsibly and make independent judgments.

180.9

+3.64 (+2.05%)

Find more stocks in the Stock Screener

QCOM Latest News and Analysis