In the field of growth investing, few methods have endured like William O’Neil’s CAN SLIM system. This structured process joins detailed fundamental study with important technical signs to find leading stocks ready for major price gains. The method looks for companies with powerful recent and yearly profit increases, new products or services, and notable institutional support, all while requiring positive general market circumstances. A stock that satisfies this detailed test is seen as a top possibility for what O’Neil called a "winning system in good times and bad."

NVIDIA CORP (NASDAQ:NVDA) stands as a strong candidate when assessed using the CAN SLIM structure. The company, a leading player in accelerated computing and artificial intelligence (AI) hardware and software, seems to meet many of the system's important conditions. Its fundamental soundness and market leader status make it a stock deserving of more study for investors using this method.

Matching the Main CAN SLIM Conditions

The CAN SLIM acronym describes particular, measurable standards. NVIDIA's recent results indicate a solid fit with these central growth and quality filters.

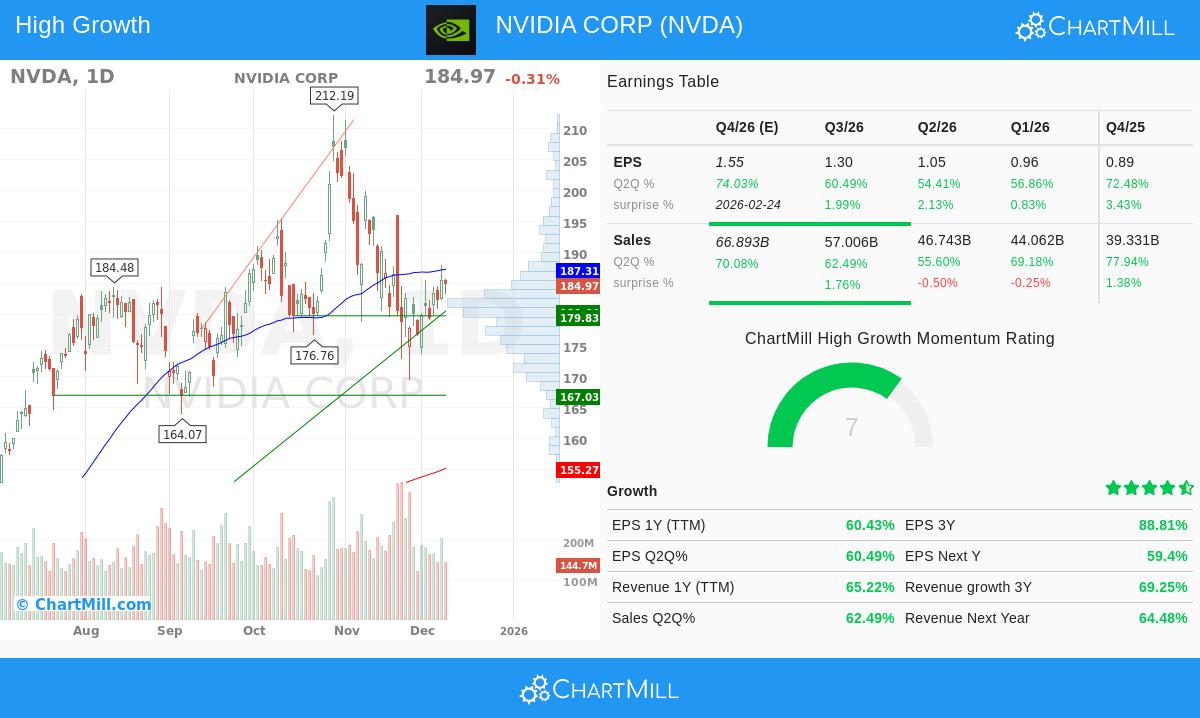

- C - Current Quarterly Earnings & Sales: The system requires large or speeding quarterly growth. NVIDIA states a remarkable 60.5% year-over-year earnings per share (EPS) growth and a 62.5% rise in revenue for its latest quarter, greatly passing the usual minimum of 20-25%. This rapid growth is the main force for the stock's movement.

- A - Annual Earnings Increases: CAN SLIM seeks a record of large yearly growth. NVIDIA’s three-year EPS compound annual growth rate (CAGR) is an outstanding 88.8%, indicating a long stretch of huge profit growth that well exceeds the method's 25-50% guide.

- N - New Products & New Highs: While not quantitative, NVIDIA’s key part in the AI shift represents the "new product" condition. Its GPUs are essential to generative AI, large language models, and data center progress. From a chart view, the stock has repeatedly traded near peak prices over the last year, showing market acceptance of this changing role.

- S - Supply, Demand & Financial Health: The company holds a very strong balance sheet. Its Debt-to-Equity ratio is a small 0.06, showing very little use of debt funding and clearly meeting the system's choice for a ratio under 2. This financial strength aids stability and future spending.

- L - Leader or Laggard: Relative strength is a key part of CAN SLIM, finding stocks that are doing better than the wider market. NVIDIA has a high relative strength number of 85.2, meaning it has done better than about 85% of all stocks. This verifies its place as a definite market leader.

- I - Institutional Sponsorship: The method prefers stocks with rising institutional ownership, but not so much that all possible buying is done. NVIDIA’s institutional ownership is at 69.2%, under the 85% limit often used in filters. This implies there is still space for more institutional buying, which can give continued upward pressure.

Fundamental and Technical Condition Review

A closer look at NVIDIA’s separate reports supports the image shown by the CAN SLIM filter.

The company’s fundamental analysis report gives it a nearly full score of 9 out of 10. The report notes outstanding profit, with a Return on Equity (ROE) of 83.4% and growing profit margins above 53%. Its growth numbers are called "very strong," with earnings growing over 83% on average each year for the past several years. While its current Price-to-Earnings (P/E) ratio is high—a typical feature for high-growth leaders—the report states that its excellent profit and future growth forecasts of over 30% each year may support the high price for growth-focused investors.

From a market timing and price movement view, the technical analysis report gives a score of 8 out of 10. It mentions the long-term direction stays positive, and the stock’s yearly result has beaten 85% of the market. The report also finds an acceptable price pattern, with prices settling and clear support levels under the present trading price. This chart setting is important for CAN SLIM, as the "M" (Market Direction) condition stresses entering positions when both the stock and the overall market show positive directions.

A Top Possibility for Growth Investors

NVIDIA CORP shows a clear example for investors applying the CAN SLIM method. It displays rapid current and yearly profit growth, is leading a major technological change, keeps excellent financial health, and is accepted as a market leader through its high relative strength. The mix of excellent fundamentals and a helpful chart pattern, within the setting of a positive wider market direction, fits well with the system's ideas for finding high-opportunity growth stocks.

For investors wanting to find other companies that satisfy similar strict growth conditions, the ready-made O'Neill CANSLIM High Growth screen can act as a useful beginning for more study.

Disclaimer: This article is for information only and is not financial advice, a support, or a suggestion to buy, sell, or hold any security. The CAN SLIM method includes risk, including the loss of initial investment. Investors should do their own complete study and think about their personal financial position and risk comfort before making any investment choices. Past results do not guarantee future outcomes.