When looking for good dividend stocks, investors often face the task of balancing appealing income with financial soundness. A methodical process using set filters can help find companies that satisfy these two goals. One such process involves sorting for stocks with good dividend traits while keeping sufficient profitability and financial soundness. This method aims to find companies able to maintain and possibly increase their dividend payments over time, instead of just seeking the highest yields which might have hidden risks. The filtering rules usually include minimum levels for dividend quality, profitability measures, and financial soundness markers to make sure of a well-rounded investment profile.

Dividend Profile Assessment

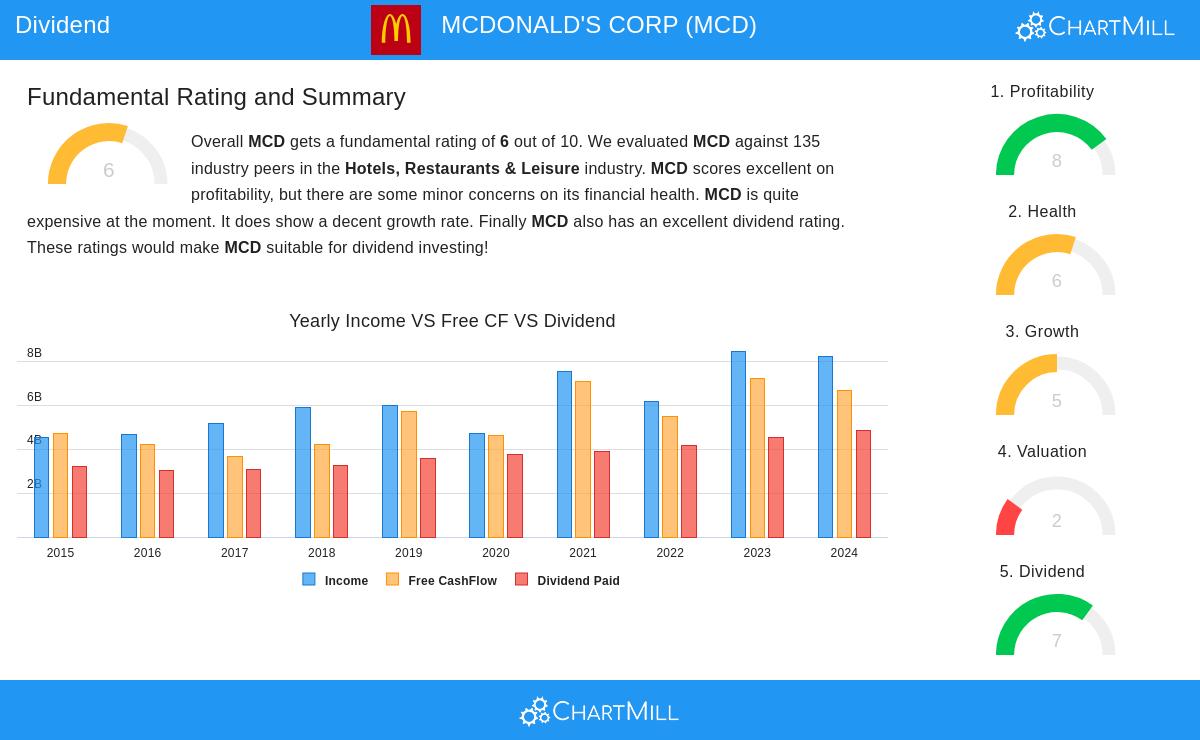

MCDONALD'S CORP (NYSE:MCD) presents a strong case for dividend-focused investors according to the fundamental review. The company's dividend rating of 7/10 shows several good qualities that match sustainable income investing ideas. For dividend investors, regularity and growth possibility often matter more than basic yield figures, and McDonald's shows strength in these parts.

Key dividend traits include:

- A good 2.33% dividend yield that is higher than 82% of industry peers

- A steady history of dividend payments lasting over ten years

- Steady yearly dividend growth of 7.43% over recent years

- No dividend cuts during its payment history

The sustainability measures further back the dividend story. While the 59.52% payout ratio is at the higher side of the acceptable range, it stays workable given the company's stable earnings profile. More significantly, earnings growth has been faster than dividend growth, showing the current payment level is maintainable without stressing financial means.

Profitability Foundations

Good profitability gives the base for steady dividend payments, and McDonald's does well in this area with an 8/10 profitability rating. The company's excellent margins and returns show its capacity to create sufficient profits to support shareholder payouts.

Notable profitability measures:

- Excellent 32.20% profit margin, higher than 99% of industry competitors

- Notable 46.13% operating margin, the top in its industry

- Solid 14.09% return on assets, higher than 91% of peers

- Good 17.40% return on invested capital, better than 87% of industry companies

These profitability numbers are important for dividend investors because they show the company's capacity to keep up payments through different economic periods. The steady betterment in margins over recent years hints at management's successful cost control and pricing ability, both good signs for future dividend sustainability.

Financial Health Considerations

With a health rating of 6/10, McDonald's keeps sufficient financial stability even with having notable debt. The company's solvency and liquidity situations give confidence about its capacity to handle economic declines while maintaining dividend payments.

Financial health points:

- Good Altman-Z score of 4.84, showing low bankruptcy risk and doing better than 84% of industry peers

- Careful share reduction program over several years

- Satisfactory current and quick ratios near 1.30, better than most competitors

- Debt-to-FCF ratio of 6.00, although high, stays better than 73% of industry companies

While the debt amounts need watching, the company's steady cash flow creation and high profitability give assurance about its capacity to handle debts while maintaining dividend payments. The better-than-average health rating within the setting of dividend investing suggests the company is not risking its financial stability to fund shareholder payouts.

Valuation and Growth Context

The valuation situation shows some difficulties, with McDonald's trading at high multiples compared to its own history. However, for dividend investors concentrated on income creation and long-term compounding, the current valuation might be reasonable given the company's quality traits.

Growth measures show slight but steady expansion:

- Expected EPS growth of 9.09% each year in coming years

- Projected revenue growth of 5.07% per year

- Historical EPS growth of 8.20% over recent years

The quickening in expected revenue growth compared to past patterns gives hope for future dividend rises. While the current P/E ratio of 25.61 seems high, the company's exceptional profitability and defensive traits may validate the premium for income-focused investors.

For investors looking for similar dividend chances, more filtering results can be found using the Best Dividend Stocks screener. The full fundamental review for McDonald's is available through the detailed assessment report.

Disclaimer: This review is based on current fundamental data and does not form investment advice. Investors should do their own research and think about their personal financial situation before making investment choices. Past performance does not assure future outcomes, and dividend payments depend on company decisions and financial situations.