Wall Street Rallies on Strong Jobs Report and Renewed Trade Optimism

Markets Rebound as Key Index Crosses Milestone

U.S. stocks closed sharply higher on Friday, lifted by a better-than-expected jobs report and rising hopes for a breakthrough in U.S.-China trade negotiations.

The S&P 500 reclaimed the symbolic 6,000-point level for the first time since February, finishing up 1.0% at 6,000.36. The Dow Jones advanced 1.1%, while the Nasdaq climbed 1.2%.

Investor sentiment got a lift after the U.S. Labor Department reported a gain of 139,000 jobs in May, outpacing economists’ expectations of 125,000. The unemployment rate held steady at 4.2%, and average hourly wages rose 3.87% year-over-year to $36.24.

Despite downward revisions for March and April, the figures soothed recession fears.

Trade Talks Set to Resume

Further boosting optimism was news from President Donald Trump, who confirmed via Truth Social that trade talks with China would resume Monday, June 9, in London.

According to Trump, the upcoming meeting, featuring key U.S. officials including Treasury Secretary Scott Bessent, follows a "very good" call with President Xi Jinping.

China also signaled goodwill by issuing temporary export licenses for rare earth minerals used by top U.S. automakers.

Rate Cut Pressure Resurfaces

In response to the jobs data, Trump once again called for a 1% interest rate cut from Federal Reserve Chair Jerome Powell, accusing him of costing the country a fortune with overly tight policy.

U.S. Treasury yields rose Friday, with the 10-year note jumping 12 basis points to 4.514%, and the 2-year yield up 11 basis points to 4.039%.

Energy and Currency Markets

Oil prices surged, with the July WTI crude contract closing up 1.9% at $64.58 per barrel, marking a weekly gain of 6.2%. Meanwhile, the euro edged slightly lower, trading at $1.1398 against the U.S. dollar.

Corporate Highlights

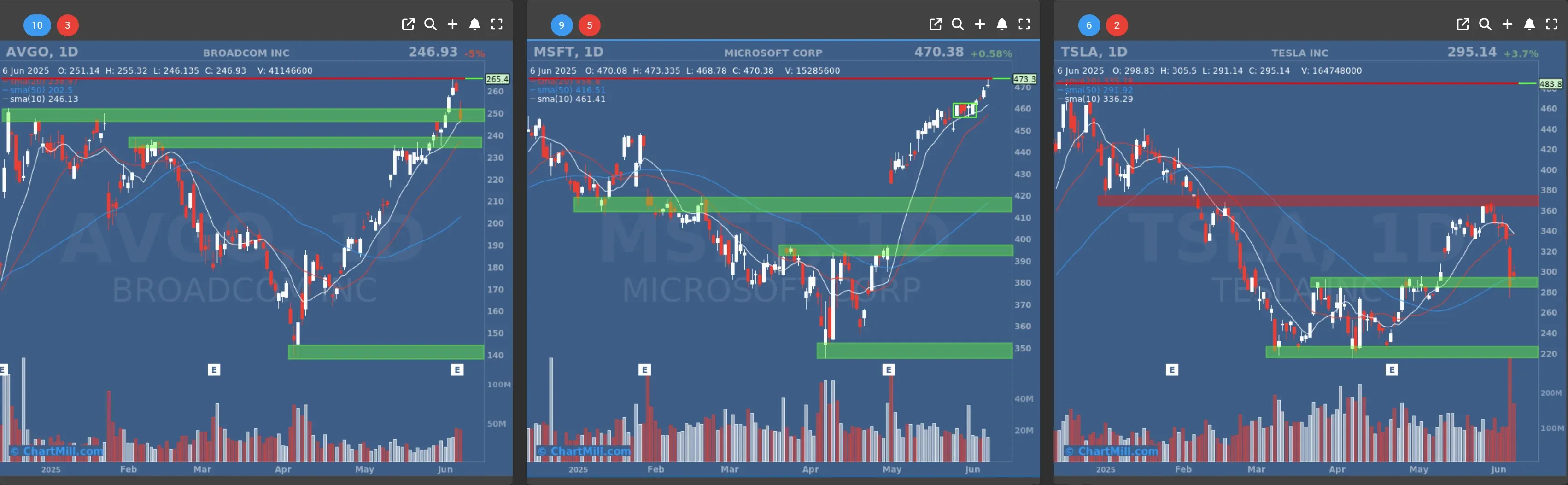

Tesla (TSLA | +3.67%) rebounded Friday, regaining ground after plunging over 14% the previous day amid a public spat between Elon Musk and Trump over budget policy.

A calmer tone from Musk, who agreed with a user's suggestion to "cool off for a few days", reassured investors, sending Tesla’s market cap up by roughly $50 billion.

Despite beating Q2 expectations and reporting a 46% YoY increase in AI revenue, Broadcom (AVGO | -5.0%) dropped sharply after issuing a revenue forecast of $15.8 billion for the current quarter, below some analyst estimates.

Nonetheless, the company projects continued AI momentum, forecasting $5.1 billion in AI-related sales for Q3.

Microsoft (MSFT | +0.58%) continued its steady climb, ending near $468 per share and overtaking Nvidia and Apple as the most valuable U.S. company with a market cap of $3.5 trillion.

Shopify (SHOP | +6.17%) shares were up 6% Friday afternoon after a Wells Fargo analyst raised the stock’s price target from $107 to $125 and labeled it a “signature pick.”

Big Moves in Tech and IPO Markets

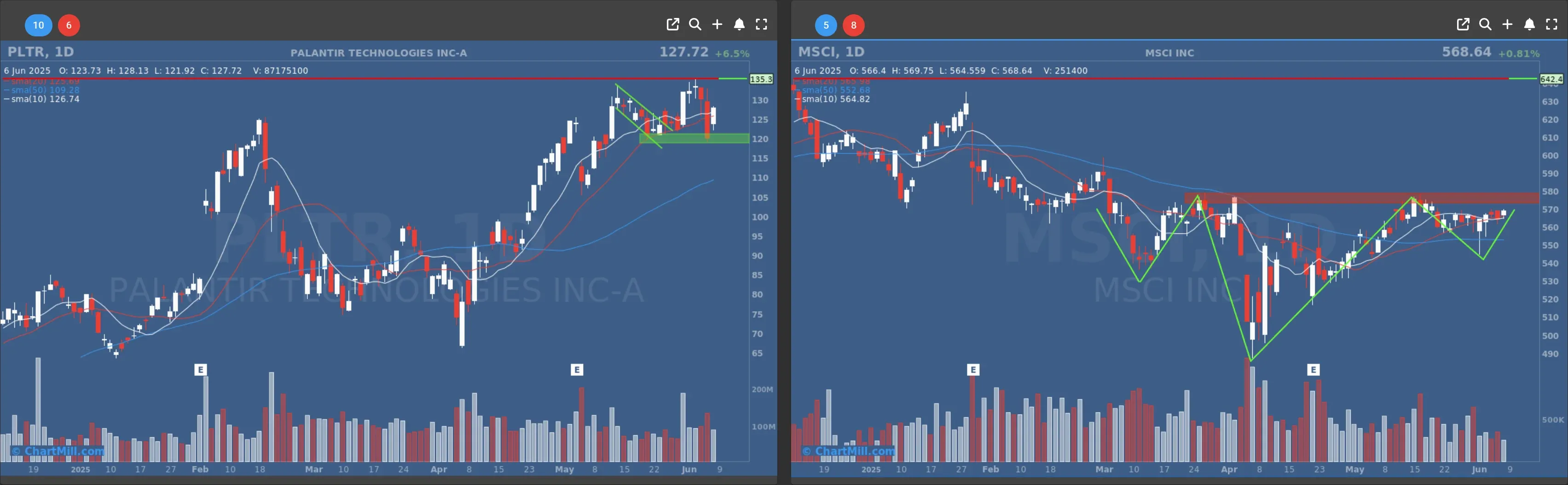

AI-focused firms had a strong session: Palantir Technologies (PLTR | +6.51%) and Super Micro Computer (SMCI | +1.91%) both posted gains.

In IPO news, Circle (CRCL | +29.40%), the issuer of the USDC stablecoin, extended Thursday’s explosive debut rally. Now trading over 200% above its IPO price, Circle’s performance is a major win for early investor Cathie Wood, who acquired more than 3 million shares.

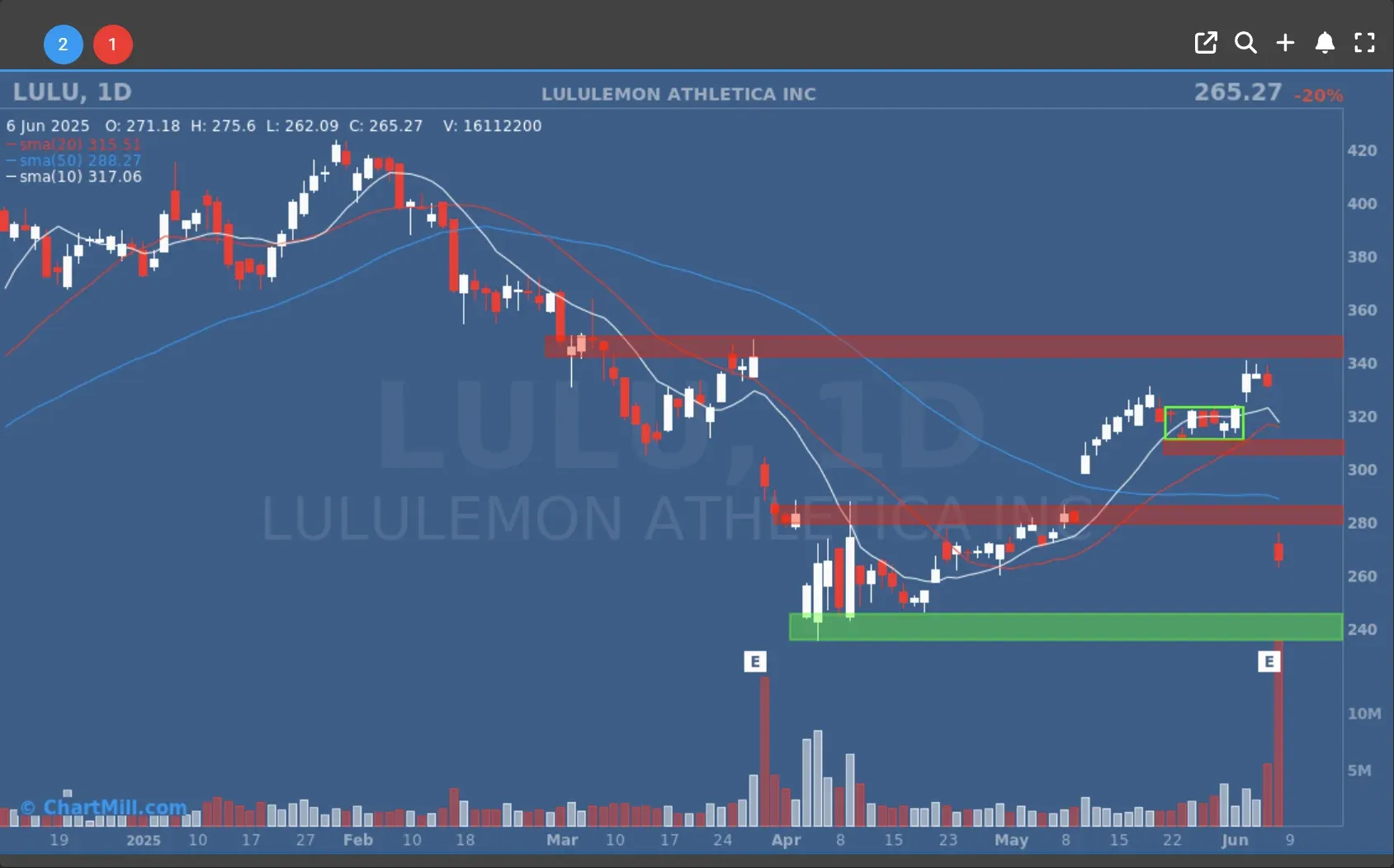

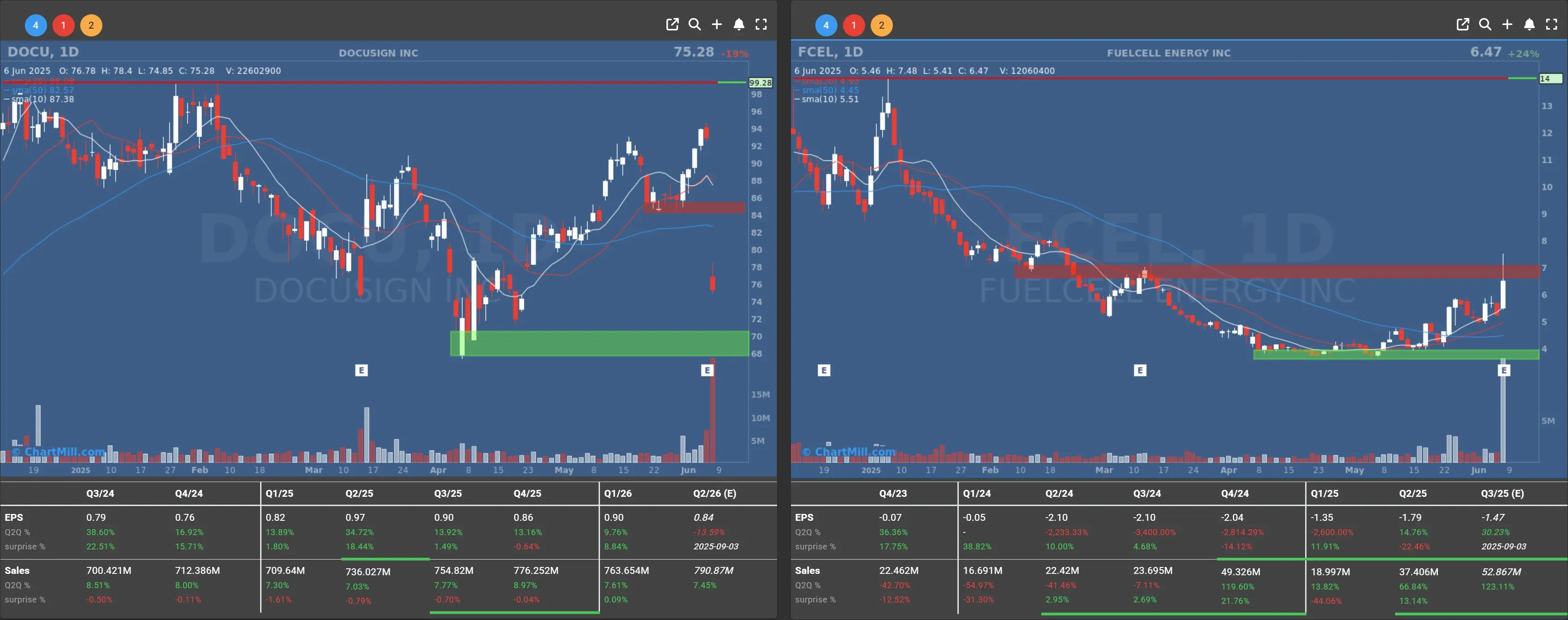

Lululemon (LULU | -19.8%) plummeted despite beating Q1 estimates, as the company cut its full-year forecast.

Similarly, DocuSign (DOCU | -18.97%) tumbled on disappointing results and a lowered outlook.

FuelCell (FCEL | +24.42%) jumped after announcing a 22% workforce reduction and progress toward scaling its core carbonate fuel cell technology, aiming for long-term profitability.

Looking Ahead

As Wall Street heads into a new week, all eyes will be on the U.S.-China trade discussions in London and any fresh signals from the Federal Reserve.

While macro data hints at a cooling but stable labor market, market volatility may persist as investors weigh economic resilience against policy uncertainty.

Next to read: ChartMill Market Monitor Trends & Breadth Analysis, June 09