LAM RESEARCH CORP (NASDAQ:LRCX) stands out as an affordable growth candidate, meeting the criteria of solid growth, strong profitability, and reasonable valuation. The company, a key player in semiconductor manufacturing equipment, has demonstrated consistent performance, making it an interesting option for investors seeking growth without excessive risk.

Growth Prospects

- Past Growth: LRCX has delivered strong revenue and earnings growth, with a 20.33% increase in revenue over the past year and an average annual EPS growth of 15.80% in recent years.

- Future Expectations: Analysts project continued growth, with EPS expected to rise by 15.50% annually and revenue by 10.63% in the coming years.

- Stability: The company maintains a steady growth trajectory, with no significant slowdown anticipated.

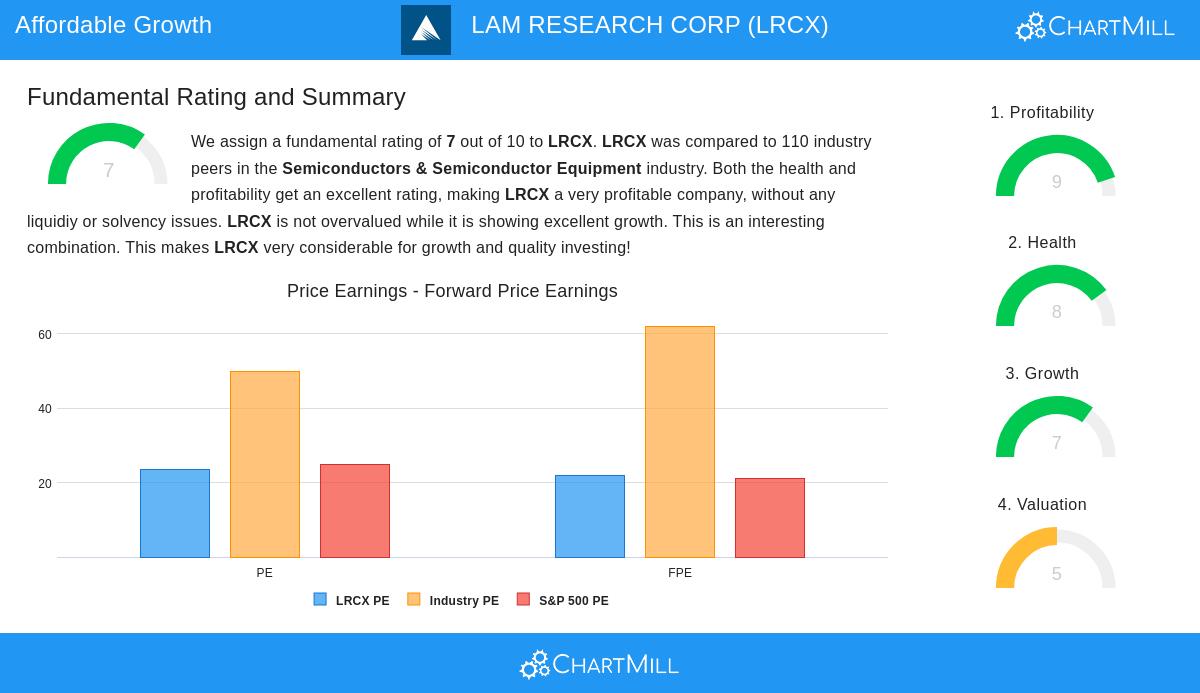

Valuation Assessment

- P/E Ratio: At 23.55, LRCX trades slightly below the S&P 500 average (24.95) and is cheaper than 70% of its industry peers.

- Forward P/E: The forward P/E of 21.80 suggests a reasonable outlook compared to industry averages.

- PEG Ratio: The low PEG ratio indicates that the stock’s valuation accounts for its expected growth, making it attractive relative to earnings expansion.

Profitability & Financial Health

- High Margins: LRCX boasts strong profitability metrics, including a 27.19% profit margin and a 30.88% operating margin, outperforming most competitors.

- ROIC & ROE: With a return on invested capital of 32.17% and return on equity of 48.98%, the company efficiently generates shareholder value.

- Solid Balance Sheet: A healthy debt-to-equity ratio of 0.39 and strong solvency metrics (Altman-Z score of 10.40) reflect financial stability.

Our Affordable Growth screener lists more stocks with similar characteristics and is updated daily.

For a deeper dive, review the full fundamental analysis of LRCX.

Disclaimer

This is not investing advice. The observations here are based on current data, but investors should conduct their own research before making decisions.