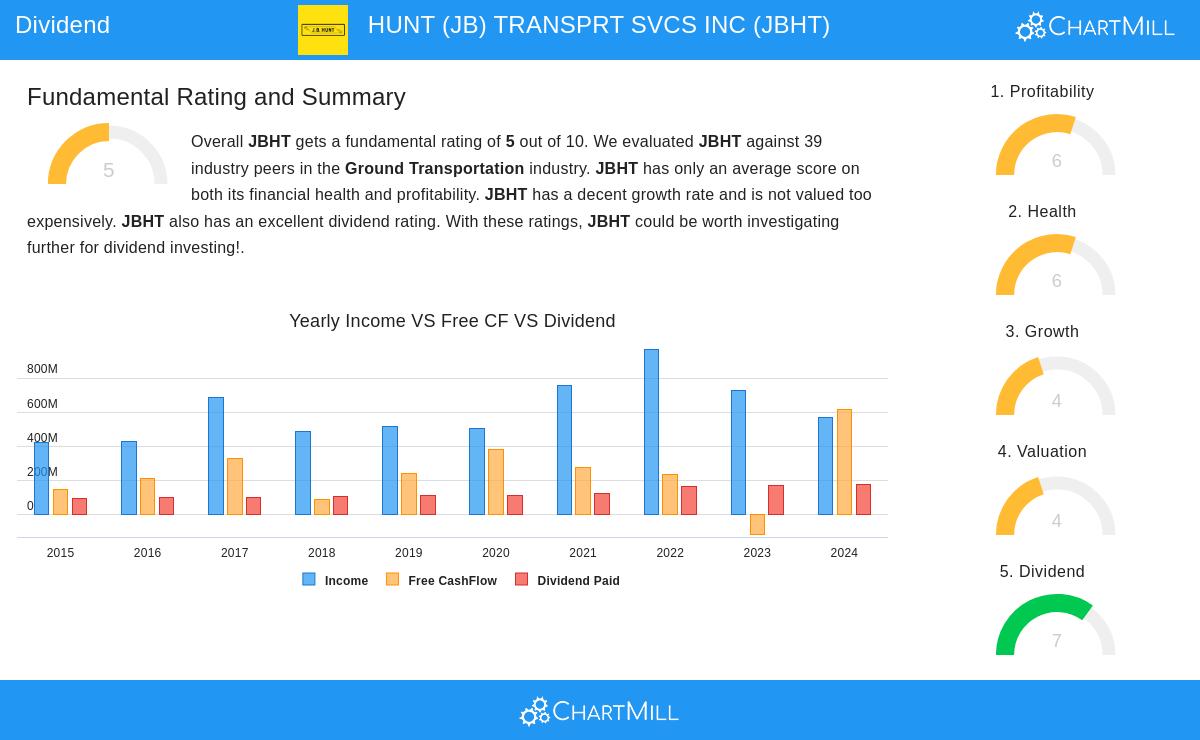

J.B. Hunt Transport Services Inc (NASDAQ:JBHT) stands out as a strong candidate for dividend investors, according to our screening criteria. The company combines a solid dividend profile with reasonable profitability and financial health, making it an appealing choice for income-focused portfolios.

Key Dividend Strengths

- Consistent Dividend Growth: JBHT has increased its dividend at an average annual rate of 10.61% over the past five years, demonstrating a commitment to rewarding shareholders.

- Reliable Track Record: The company has paid dividends for at least 10 years without reductions, indicating stability in its payout policy.

- Sustainable Payout Ratio: Only 31.21% of earnings are allocated to dividends, leaving ample room for reinvestment and future increases.

Profitability and Financial Health

- Solid Profitability: With a Return on Equity (ROE) of 14.51% and a Return on Invested Capital (ROIC) of 9.78%, JBHT performs better than most peers in the ground transportation industry.

- Strong Balance Sheet: The company maintains a Debt-to-Equity ratio of 0.23, well below industry averages, and has an Altman-Z score of 4.93, signaling low bankruptcy risk.

- Moderate Valuation: While the P/E ratio of 25.38 is slightly above the S&P 500 average, it remains reasonable compared to industry peers.

Considerations for Investors

- Recent Earnings Dip: JBHT reported a 12.54% decline in EPS over the past year, though analysts expect a rebound with 17.13% growth in the coming years.

- Low Current Ratio: The company’s liquidity metrics are weaker than some competitors, with a Current Ratio of 0.89, which may require monitoring.

For a deeper dive into JBHT’s financials, review the full fundamental report.

Our Best Dividend Stocks screener provides more high-quality dividend stock ideas, updated daily.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.