Investors looking for undervalued possibilities frequently use screening methods that find companies trading for less than their inherent value while also showing good basic financial condition. One method uses filters for stocks with good valuation marks together with acceptable results in profitability, financial soundness, and growth measures. This system follows value investing ideas by focusing on companies that seem to be priced lower than their actual value while still keeping operational soundness and future prospects. These filters assist in finding possible options where market prices might not completely show the fundamental business quality.

Valuation Review

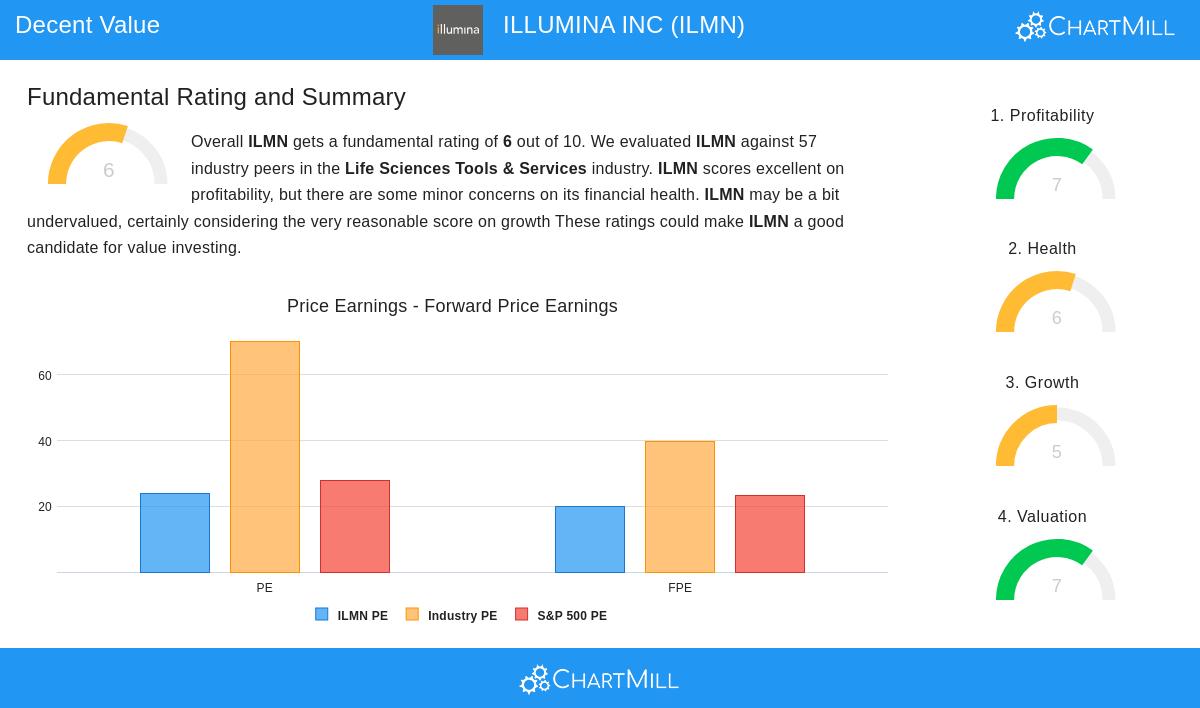

Illumina Inc (NASDAQ:ILMN) shows an interesting valuation situation based on the fundamental analysis report. The company receives a valuation mark of 7 out of 10, suggesting good pricing compared to both industry similar companies and wider market measures. A number of measures back this review:

- Enterprise Value to EBITDA ratio positions ILMN as less expensive than 96% of industry rivals

- Price to Free Cash Flow ratio is better than 95% of sector similar companies

- PEG ratio, which changes P/E for growth projections, implies fair valuation

- Current P/E ratio of 23.79 looks good next to industry average of 70.26

For value investors, these valuation measures imply the market could be setting too low a price on Illumina's assets and earnings capacity. The company trades at a notable price reduction compared to its industry while maintaining profitability measures that usually get higher valuations.

Financial Soundness and Steadiness

The company's financial soundness mark of 6 out of 10 shows a varied but mostly steady situation. Important solvency measures show strength, while some liquidity indicators have potential for development:

- Altman-Z score of 3.61 shows low bankruptcy danger, performing better than 68% of industry similar companies

- Debt to Free Cash Flow ratio of 1.93 implies good capacity to handle debts

- Current ratio of 1.81 gives sufficient short-term liquidity protection

- Debt to Equity ratio of 0.66 shows average debt use

Value investors focus on financial soundness to make sure companies can manage economic declines and continue working while waiting for market acknowledgment of inherent value. Illumina's good solvency measures supply this required steadiness base.

Profitability Soundness

Illumina shows firm profitability with a mark of 7 out of 10, led by outstanding margin results and returns on capital:

- Profit margin of 29% puts the company in the leading 2% of its industry

- Return on Equity of 56% is better than 96% of sector rivals

- Operating margin of 21% is higher than 88% of industry similar companies

- Gross margin steadiness near 67% implies pricing strength

Good profitability is important for value investments because it indicates lasting competitive benefits and the capacity to produce cash flows that finally decide inherent value. Illumina's outstanding margins give assurance in the company's business model strength.

Growth Direction

With a growth mark of 5 out of 10, Illumina displays a changing pattern with positive future outlooks in spite of recent difficulties:

- EPS anticipated to increase 24% each year in coming years

- Revenue forecast to rise 4% yearly going forward

- EPS growth rate displays quickening from past patterns

- Recent revenue decrease of 3% differs with longer-term growth trends

Value investors look for companies where growth outlooks are not completely shown in current prices. Illumina's predicted earnings quickening joined with fair valuation multiples makes this possible chance.

Investment Points

The mix of good valuation, firm profitability, acceptable financial soundness, and developing growth prospects makes Illumina a noteworthy option for value-focused investors. The company's leading place in genomic sequencing technology gives a protective barrier that supports its outstanding profitability measures, while current market pricing seems to lower the importance of some short-term difficulties.

Investors can review the full fundamental analysis for more detailed understanding of Illumina's financial position and comparison measures. The complete report separates each mark part with particular data points and industry comparisons.

For investors looking for similar possibilities, more screening outcomes using this value-focused method can be located using this preset filter that finds companies with good valuation features together with solid basic measures.

Disclaimer: This analysis is for information purposes only and does not form investment guidance, suggestion, or support of any security. Investors should do their own investigation and talk with financial consultants before making investment choices. Past results do not ensure future outcomes.