3 Reasons DXC is Risky and 1 Stock to Buy Instead

Provided By StockStory

Last update: Apr 4, 2025

What a brutal six months it’s been for DXC. The stock has dropped 21.4% and now trades at $16.38, rattling many shareholders. This might have investors contemplating their next move.

Is there a buying opportunity in DXC, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even with the cheaper entry price, we're cautious about DXC. Here are three reasons why you should be careful with DXC and a stock we'd rather own.

Why Do We Think DXC Will Underperform?

Born from the 2017 merger of Computer Sciences Corporation and HP Enterprise's services business, DXC Technology (NYSE:DXC) is a global IT services company that helps businesses transform their technology infrastructure, applications, and operations.

1. Core Business Falling Behind as Demand Declines

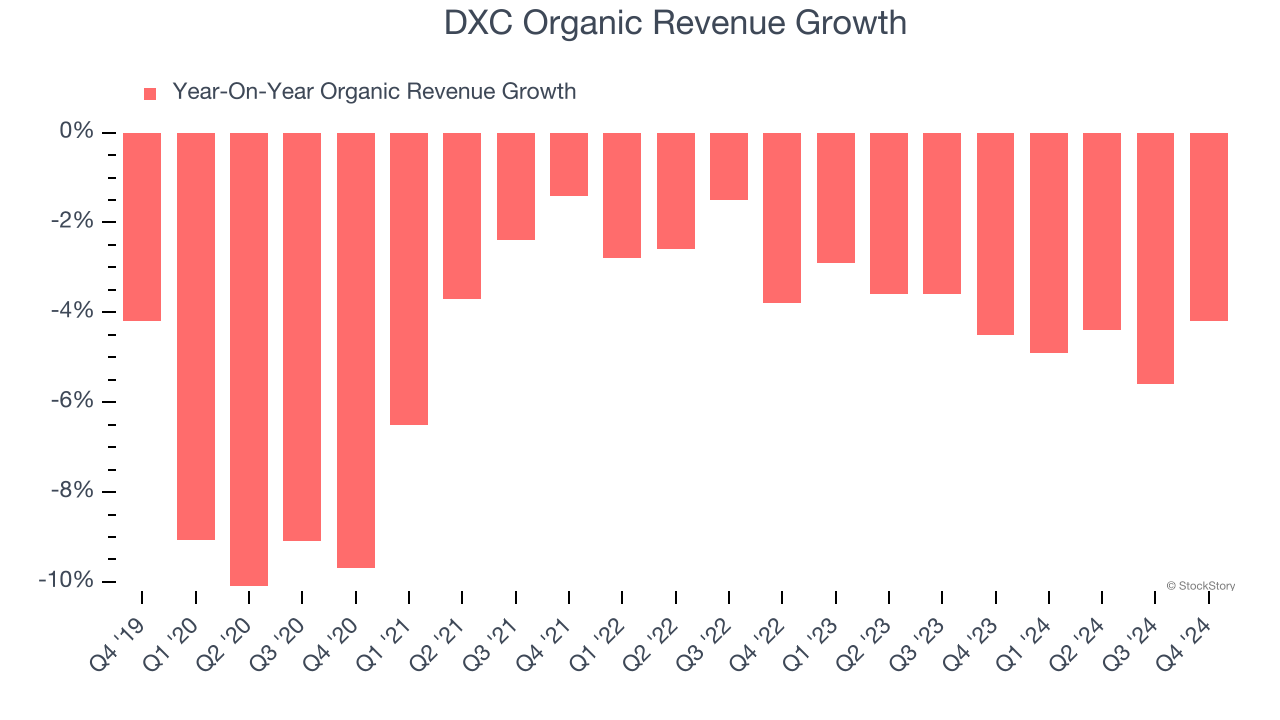

We can better understand IT Services & Consulting companies by analyzing their organic revenue. This metric gives visibility into DXC’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, DXC’s organic revenue averaged 4.2% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests DXC might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. EPS Trending Down

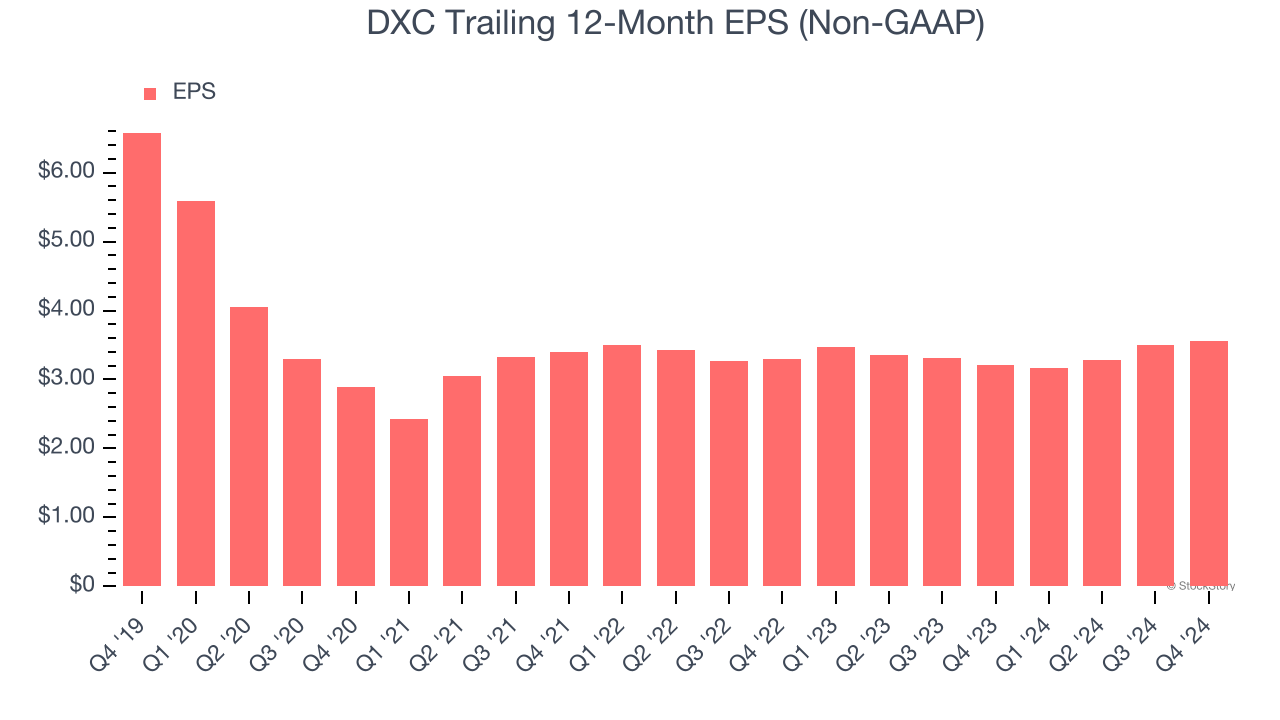

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for DXC, its EPS declined by 11.5% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

3. New Investments Fail to Bear Fruit as ROIC Declines

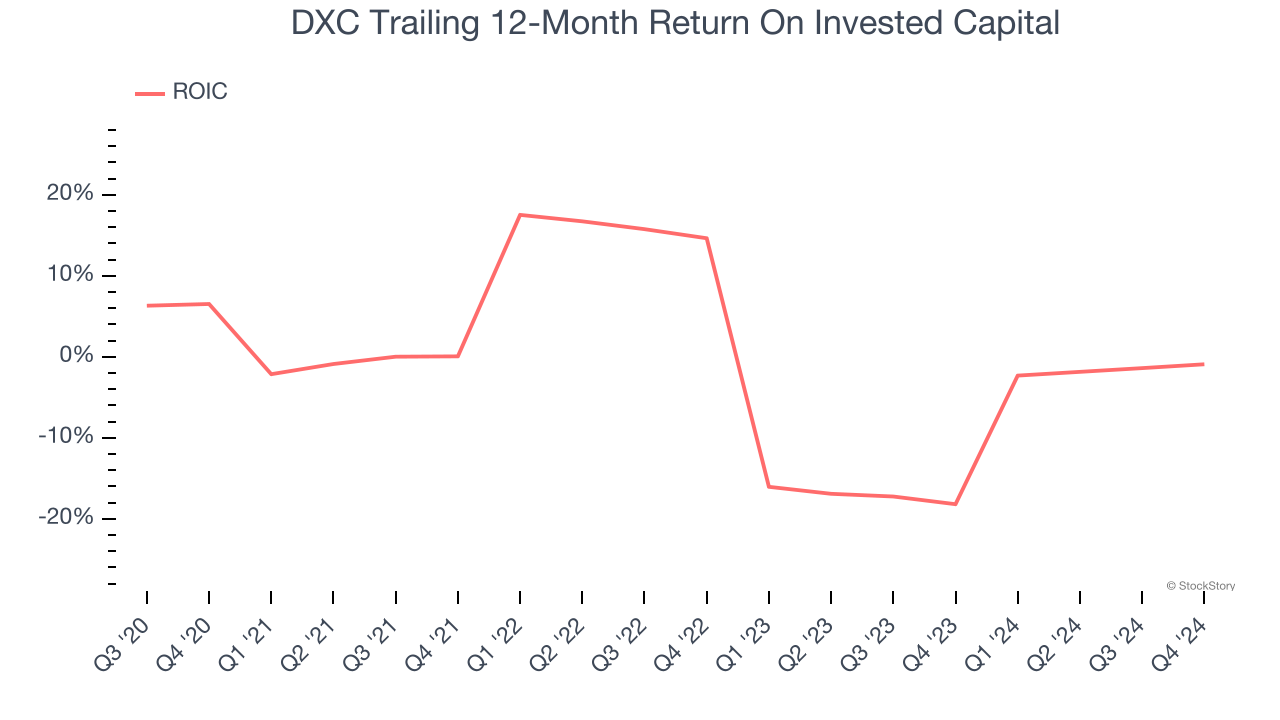

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, DXC’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of DXC, we’ll be cheering from the sidelines. After the recent drawdown, the stock trades at 5.1× forward price-to-earnings (or $16.38 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. Let us point you toward one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than DXC

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.

25.18

+0.48 (+1.94%)

1014.94

+4.13 (+0.41%)

15.76

+0.27 (+1.74%)

Find more stocks in the Stock Screener

HPQ Latest News and Analysis

9 days ago - ChartmillMarket Monitor News May 30 (Nvidia UP - HP, Best Buy DOWN)

9 days ago - ChartmillMarket Monitor News May 30 (Nvidia UP - HP, Best Buy DOWN)While AI titans like Nvidia propelled optimism, tariff-related headwinds pulled down stalwarts like HP and Best Buy.

9 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.

9 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.Wondering what's happening in today's session for the S&P500 index? Stay informed with the top movers within the S&P500 index on Thursday.

9 days ago - ChartmillThese S&P500 stocks have an unusual volume in today's session

9 days ago - ChartmillThese S&P500 stocks have an unusual volume in today's sessionDiscover the S&P500 stocks that are experiencing unusual trading volume in today's session. Find out more about these stocks below.

9 days ago - ChartmillStay informed with the top movers within the S&P500 index on Thursday.

9 days ago - ChartmillStay informed with the top movers within the S&P500 index on Thursday.Curious about the top performers within the S&P500 index in the middle of the day on Thursday? Dive into the list of today's session's top gainers and losers for a comprehensive overview.

9 days ago - ChartmillGapping S&P500 stocks in Thursday's session

9 days ago - ChartmillGapping S&P500 stocks in Thursday's sessionLet's have a look at what is happening on the US markets on Thursday. Below you can find the S&P500 gap up and gap down stocks in today's session.

9 days ago - ChartmillWondering what's happening in today's S&P500 pre-market session?

9 days ago - ChartmillWondering what's happening in today's S&P500 pre-market session?The US market is yet to commence its session on Thursday, but let's get a preview of the pre-market session and explore the top S&P500 gainers and losers driving the early market movements.

10 days ago - ChartmillGet insights into the top gainers and losers of Wednesday's after-hours session.

10 days ago - ChartmillGet insights into the top gainers and losers of Wednesday's after-hours session.Let's have a look at what is happening on the US markets after the closing bell on Wednesday. Below you can find the top gainers and losers in today's after hours session.