Just when it seemed like the markets had become immune to presidential outbursts, Donald Trump reminded investors who’s still got the loudest bullhorn in the room.

With new tariff threats flying left and right, U.S. stocks pulled back on Friday after a record-setting week. The drama? Canada, the EU, Mexico - no one was safe.

Meanwhile, the Nasdaq tried to shake off the noise, Nvidia kept flexing its $4 trillion muscle, and Levi Strauss proved that denim never dies.

Wall Street Pauses as Trump Reignites the Tariff Torch

Friday’s pullback wasn’t exactly a market meltdown, but it was a reality check. The Dow Jones dropped 0.7%, and the Nasdaq slipped 0.2%, putting the brakes on a week that had delivered fresh highs for both the S&P 500 and Nasdaq Composite.

At the center of the market’s unease was President Trump’s tariff tirade. After threatening a 35% import tax on Canadian goods, he warned other partners, including the EU (30%) and Mexico (30%), to brace for similar hikes, effective August 1st.

In his usual unfiltered fashion on Truth Social, Trump made it clear: retaliate, and I’ll double it.

UBS strategist Ulrike Hoffmann-Burchardi predicts that the average U.S. tariff rate could climb to 15% by year’s end, potentially cooling the economy without triggering a recession. Still, Citigroup isn't so optimistic, forecasting pressure on equity markets over the next year due to “overly rosy earnings expectations.”

What does this all mean for investors? A cloud of uncertainty and inflation risks, two things the market absolutely hates. The 10-year Treasury yield shot up 7 basis points to 4.42%, a sign that traders are scaling back hopes for any near-term Fed rate cuts.

Nvidia’s Moonshot Continues, While Levi Rewrites the Denim Playbook

If there's one company that refuses to follow market gravity, it’s Nvidia (NVDA | +0.50%). The chip titan closed the week with a $4.03 trillion valuation, having briefly broken the $4 trillion ceiling for the first time in history earlier in the week. In a sea of uncertainty, Nvidia remains the market’s North Star.

Also defying the mood was Levi Strauss (LEVI | +11.25%), which crushed Q2 expectations and raised its full-year guidance.

Revenue is now expected to grow 1–2% in 2025, a reversal from earlier forecasts of a decline. EPS was guided to $1.25–1.30, beating the previous range.

According to CFO Harmit Singh, even with a $25–30 million tariff hit, growth in women's wear and new categories is cushioning the blow.

Bloomberg’s Mary Ross Gilbert noted that Levi’s appeal among millennials and Gen Z is proving to be a game-changer. Turns out, vintage jeans might just be the perfect inflation hedge.

Crypto Surge Powers Related Stocks, AMC and Drones Fly Higher

The crypto crowd had another reason to pop champagne. Bitcoin soared to a new peak of $118,848, dragging up names like MicroStrategy (MSTR | +3.04%) and MARA Holdings (MARA | +0.74%).

With “Crypto Week” on deck in Congress and the Genius Act (focused on stablecoins) on the table, speculators are betting the hype will only grow.

Elsewhere, AMC Entertainment (AMC | +11.00%) surged after Wedbush upgraded the stock to “Outperform” and raised its price target from $3 to $4. The move marks a rare bit of bullishness for the meme stock favorite, which has been battered by declining foot traffic and heavy debt.

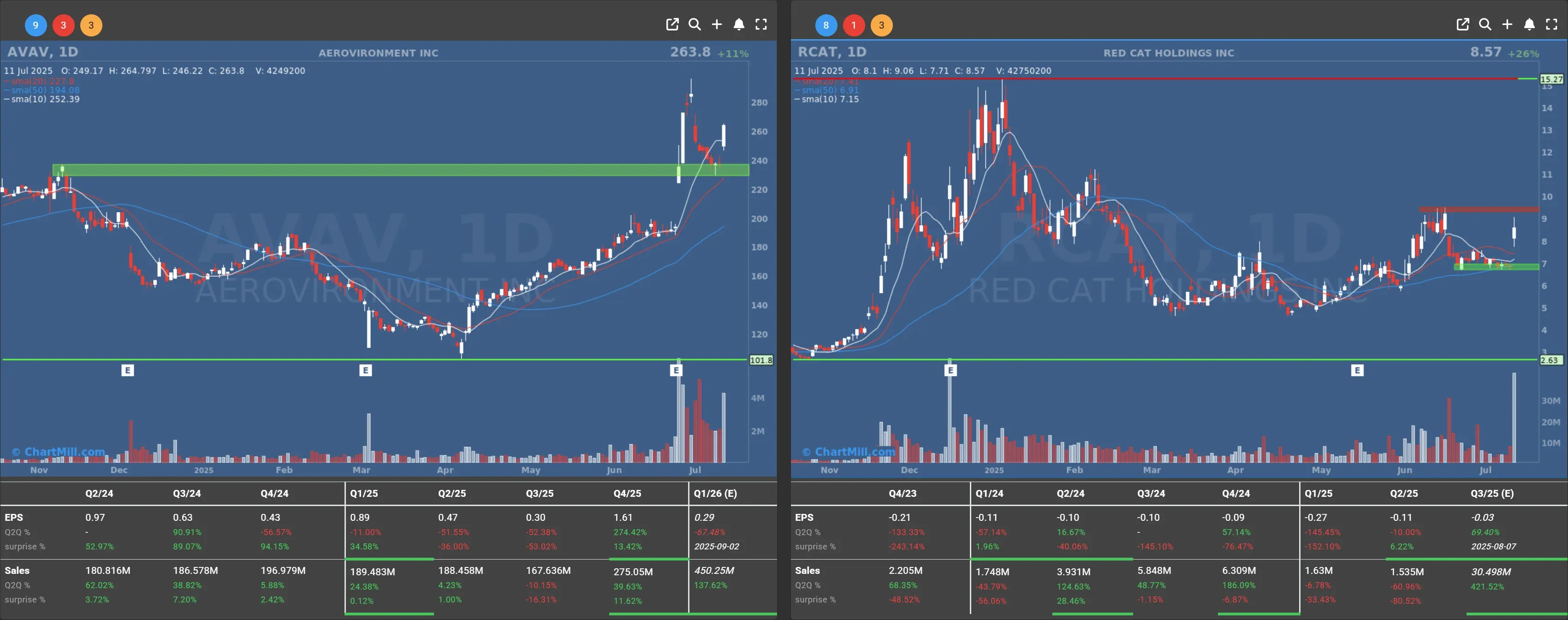

On the defense side, Red Cat Holdings (RCAT | +26.40%) exploded higher after Defense Secretary Pete Hegseth announced the removal of regulatory barriers on drone deployment.

AeroVironment (AVAV | +11.04%), a key supplier of unmanned systems, also climbed sharply as investors sniffed out a fresh wave of Pentagon spending.

One notable declining stock was Dave Inc (DAVE | -11.88%), which has dropped more than 27% since its peak on July 8. Last Friday's closing price is now testing the rising 50-day average. It seems that investors are getting a bit scared and some are choosing to take their profits off the table.

Coming Attractions: Inflation Data and Bank Earnings

This past Friday may have been relatively quiet on the macro front, but don’t expect that to last. Next week, U.S. inflation data will headline the calendar, and Tuesday marks the unofficial start of earnings season as major banks report.

Expectations are cautiously optimistic, analysts are looking for higher revenues and earnings, but with valuations already stretched, disappointment could be punished hard.

HSBC, in fact, just downgraded JPMorgan (JPM | -0.46%), Goldman Sachs (GS | -0.59%), and Bank of America (BAC | -0.51%), warning that the mega banks shouldn’t be priced like tech darlings.

As for crude oil, WTI jumped 2.8% to close at $68.45, while gold crept higher. The euro/dollar pair dipped slightly to 1.1689.

Final Take

This market may still be levitating on tech optimism and crypto euphoria, but the undercurrent is turning choppier. Tariff fears are back, and the timing couldn’t be worse, with earnings season kicking off and inflation data on the horizon.

I’ll be watching whether investors start to price in the risk of a global trade war 2.0, or whether the usual Teflon rally kicks back in by midweek.

One thing’s for sure: this is no time to get complacent.

Until tomorrow.

Kristoff - ChartMill

Next to read: Market Monitor Trends & Breadth Analysis, July 14