Market Monitor News July 07 BMO (Tripadvisor, Datadog UP - Alibaba DOWN)

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Jul 7, 2025

If the shortened trading day on July 3 was meant to be quiet, nobody told the market. A surprisingly strong U.S. jobs report and some sizzling corporate stories pushed the major indexes to new highs, just in time for the fireworks.

Markets Celebrate an Early Independence Day

In what felt more like a victory lap than a cautious pre-holiday session, the S&P 500 closed up 0.83%, the Dow Jones gained 0.77%, and the tech-heavy Nasdaq led the charge with a 1.02% gain.

A half-day session ahead of the July 4th break? Sure. But traders still came out swinging.

Since bottoming out in early April, the S&P 500 has now gained over 25%, pushing it into fresh record territory. That's no small feat in a market that’s been digesting trade drama, sticky inflation, and election-year jitters.

Jobs Data Smashes Expectations – But Not Rate Cut Hopes

The big headline? The U.S. economy added 147,000 jobs in June, far surpassing the consensus estimate of 106,000. Unemployment ticked down to 4.1%. Add to that upward revisions for May and April, and the picture of a resilient labor market becomes crystal clear.

This kind of labor market strength normally dampens hopes for a Fed rate cut… but markets barely flinched. Sure, the probability of a July rate cut is now basically off the table, but investors are still betting on a September cut, with about a 75% chance priced in, according to fed funds futures.

The 10-year Treasury yield nudged up 5 basis points to 4.34%, and the dollar firmed modestly. In short: the data says “not yet,” but the market still thinks “soon.”

Sector Buzz: From Cloud Kings to Sneaker Stocks

Tripadvisor (TRIP | +16.74%) Let’s talk fireworks. Tripadvisor absolutely exploded higher after activist fund Starboard Value disclosed a 9% stake in the company.

The move, revealed through an SEC filing, sent a clear signal that Starboard sees serious upside in the travel platform, likely tied to strategic overhauls. Expect pressure on management and possible asset sales or spin-offs.

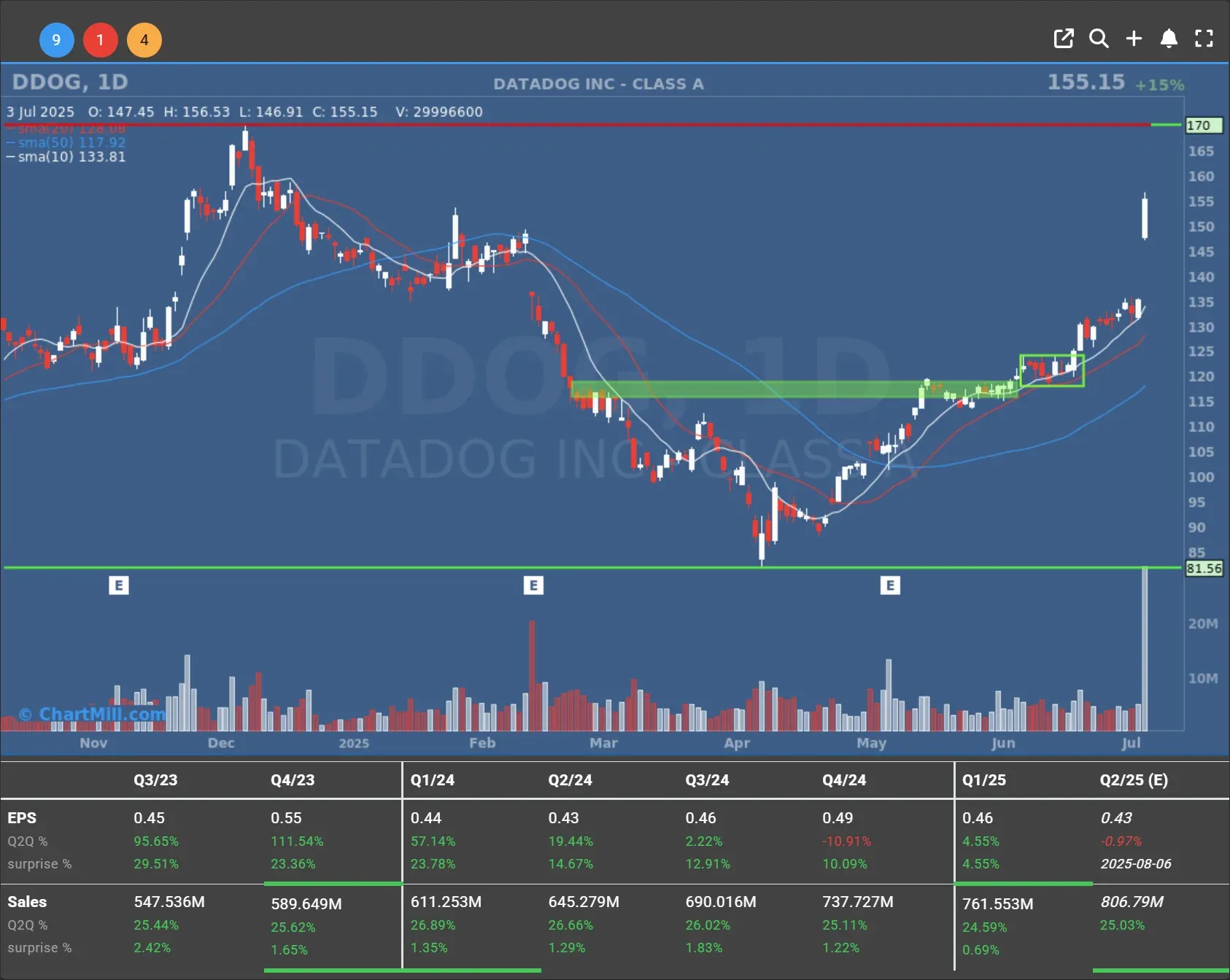

Datadog (DDOG | +14.92%) was another rocketship, riding a 15% surge on news it’s joining the S&P 500 on July 9, replacing Juniper Networks.

Passive fund inflows, anyone? Index inclusion tends to create a short-term boost, and this one didn’t disappoint.

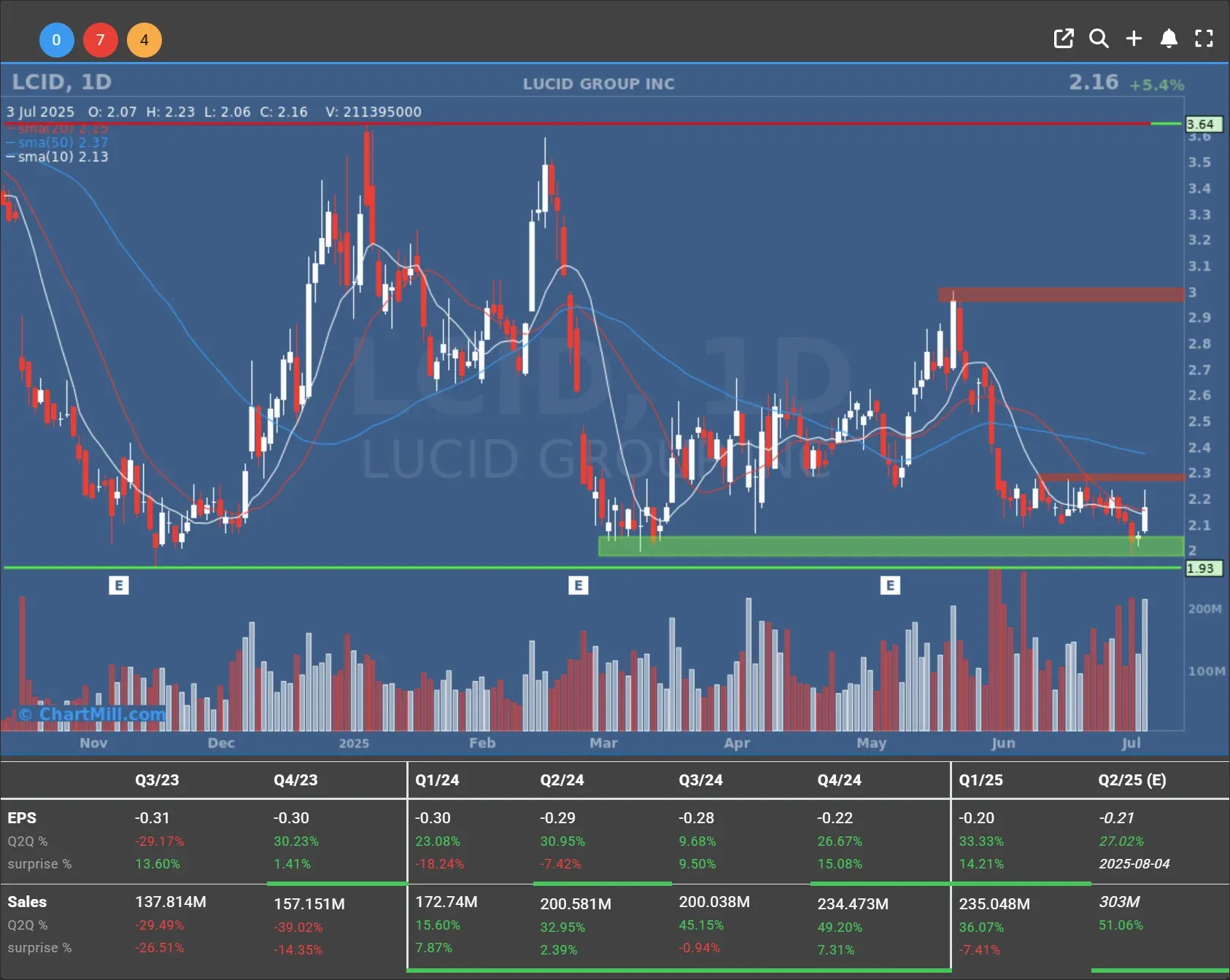

Electric vehicle maker Lucid Group (LCID| +5.4%) showed some rare spark after reporting a record second quarter in terms of deliveries. Nearly 50% more cars were delivered in the first half of 2025 compared to a year ago, an encouraging sign for a company often under scrutiny for its production pace.

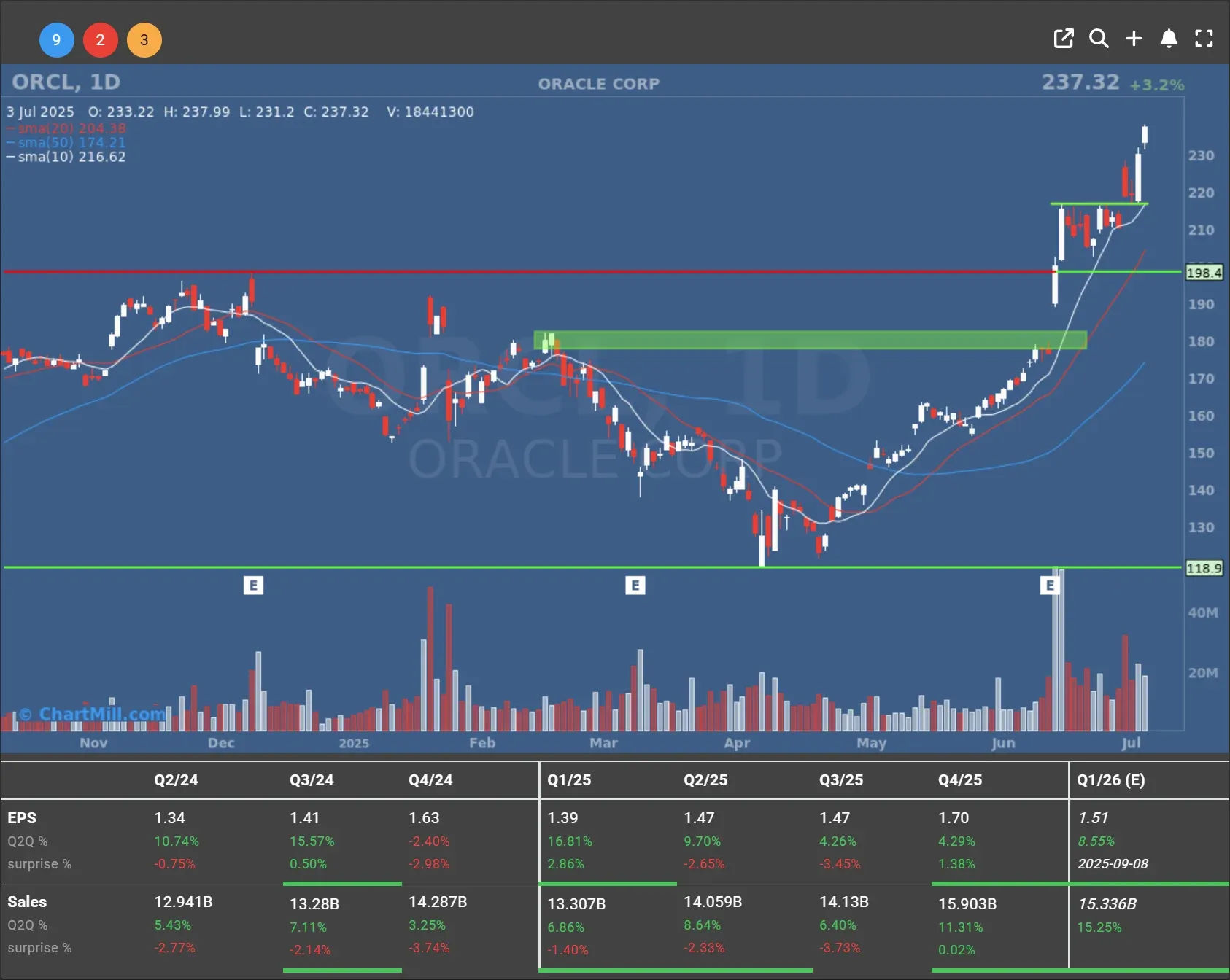

The tech veteran Oracle (ORCL | +3.19%) is on a roll. It jumped another 3% as word got out it will expand its massive Stargate data center project in partnership with OpenAI. Combined with a freshly inked cloud services deal projected to generate $30 billion annually by 2028, investors are finally warming up to Oracle’s AI pivot.

Chinese tech giant Alibaba (BABA | -1.82%) slid 1.8% after announcing a $1.5 billion bond issuance in Hong Kong. Proceeds will help fund its cloud infrastructure. A necessary move? Probably. Market-friendly? Not so much, at least short-term.

ReNew Energy Global Plc (RNW | +10.84%) Announces the Receipt of a Final Non-Binding Offer from Masdar, CPP Investments, ADIA and Sumant Sinha

Macro Watch: Services Wobble, Trade Gap Widens

Economic data beyond jobs was a bit mixed. Weekly jobless claims fell slightly, a welcome sign. But the U.S. services sector showed conflicting signals, S&P Global reported a slowdown, while ISM data suggested growth returned.

Meanwhile, the trade deficit widened sharply in May, driven by falling exports. Not great, but not unexpected given global economic softness.

And in the background, Washington buzzed as the House prepared to vote on Trump’s “Big Beautiful Bill”, a sweeping tax and spending package central to his re-election campaign. How markets react to that in the coming weeks will be key.

Elon Musk Launches ‘America Party’ After Budget Bill Fallout

Just a day after President Donald Trump signed his massive $3.4 trillion “One Big Beautiful Bill Act” into law, Elon Musk added fuel to the political fire. The Tesla (TSLA | -0.1%) CEO announced the official founding of the “America Party” on his platform X, claiming it would restore “freedom” to Americans.

Musk cited an online poll where 65% of respondents favored him starting a new political movement.

The announcement follows a very public feud between Musk and Trump, sparked by the budget bill’s controversial elimination of the $7,500 federal tax credit for electric vehicle purchases, an obvious blow to companies like Tesla.

Musk had already resigned from his government advisory role at the Department of Government Efficiency (DOGE) in protest over the bill’s priorities, accusing the legislation of propping up “industries of the past” while punishing future-facing sectors.

In typical Musk fashion, he didn’t mince words. He slammed the bill as “insane,” promised to boost his political spending, and threatened to target any lawmakers who supported it. With the Congressional Budget Office projecting the bill will balloon the federal deficit by $3.4 trillion over the next decade, expect this to be a persistent political and market narrative.

Whether the “America Party” becomes a real electoral force or just another Musk media moment remains to be seen, but it certainly adds a new wrinkle to an already unpredictable election year.

Final Thoughts: July Off to a Strong Start, But Will It Last?

With the first week of July in the books and the market riding high, the next key driver will be earnings season. Investors will be watching margins, outlooks, and currency headwinds closely, especially given the euro’s recent strength.

For now, sentiment is buoyant, momentum is strong, and volatility remains low. But let’s not get too comfortable. The market may be pricing in a soft landing, but a single earnings shock or inflation print could challenge that view in a heartbeat.

I’ll be watching.

Kristoff - Co-Founder ChartMill

Next to read: Market Monitor Trends & Breadth Analysis, July 07

235

-0.81 (-0.34%)

18.16

+0.83 (+4.79%)

61.5

+0.05 (+0.08%)

106.64

+2.81 (+2.71%)

137.49

-5.26 (-3.68%)

2.33

+0.05 (+2.19%)

Find more stocks in the Stock Screener

ORCL Latest News and Analysis

3 days ago - ChartmillMarket Monitor News July 08 BMO (Rocket Lab, WNS UP - Tesla, Royal Gold DOWN)

3 days ago - ChartmillMarket Monitor News July 08 BMO (Rocket Lab, WNS UP - Tesla, Royal Gold DOWN)Tariffs, Tesla Trouble & Tech on the Rocks - Monday’s Market Mood Swing

3 days ago - ChartmillWhat's going on in today's session: S&P500 gap up and gap down stocks

3 days ago - ChartmillWhat's going on in today's session: S&P500 gap up and gap down stocksSeeking insights into today's market movers? Discover the S&P500 gap up and gap down stocks in today's session on Monday. Stay informed about the latest market trends.

4 days ago - ChartmillMarket Monitor News July 07 BMO (Tripadvisor, Datadog UP - Alibaba DOWN)

4 days ago - ChartmillMarket Monitor News July 07 BMO (Tripadvisor, Datadog UP - Alibaba DOWN)Wall Street Flexes Muscle Before Holiday Break

7 days ago - ChartmillTop S&P500 movers in Thursday's session

7 days ago - ChartmillTop S&P500 movers in Thursday's sessionJoin us in exploring the top gainers and losers within the S&P500 index in the middle of the day on Thursday as we examine the latest happenings in today's session.

10 days ago - ChartmillMarket Monitor News July 01 BMO (Hewlett Packard Enterprise, SunRun UP - Enphase Energy DOWN)

10 days ago - ChartmillMarket Monitor News July 01 BMO (Hewlett Packard Enterprise, SunRun UP - Enphase Energy DOWN)Wall Street Keeps Climbing as Deals, AI Drama, and Trade Winds Stir Up the Market

10 days ago - ChartmillStay informed with the top movers within the S&P500 index on Monday.

10 days ago - ChartmillStay informed with the top movers within the S&P500 index on Monday.Uncover the latest developments among S&P500 stocks in today's session. Stay tuned to the S&P500 index's top gainers and losers on Monday.

10 days ago - ChartmillIn today's session, there are S&P500 stocks with remarkable trading volume.

10 days ago - ChartmillIn today's session, there are S&P500 stocks with remarkable trading volume.Let's take a look at the S&P500 stocks that are experiencing unusual volume in today's session.

10 days ago - ChartmillThese S&P500 stocks are moving in today's session

10 days ago - ChartmillThese S&P500 stocks are moving in today's sessionLet's delve into the developments on the US markets in the middle of the day on Monday. Below, you'll find the top gainers and losers within the S&P500 index during today's session.