COMCAST CORP-CLASS A (NASDAQ:CMCSA) showing some interesting technicals. Here's why.

By Mill Chart

Last update: Sep 18, 2023

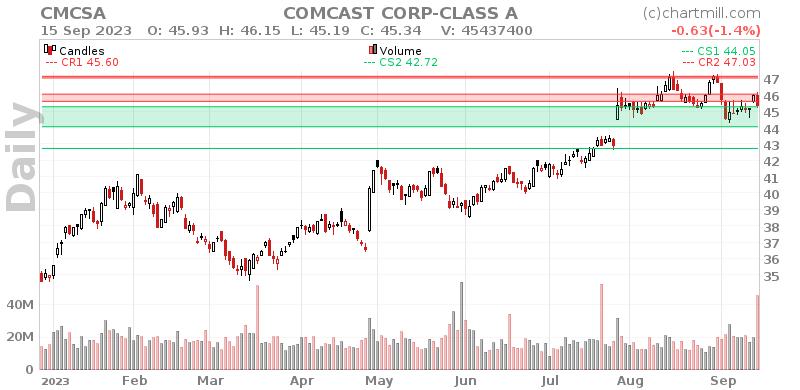

Our stock screener has flagged COMCAST CORP-CLASS A (NASDAQ:CMCSA) as a potential breakout candidate. This occurs when the stock shows signs of consolidation after a notable upward trend. While we can't predict the actual breakout, it's worth monitoring NASDAQ:CMCSA for potential movement.

Technical analysis of NASDAQ:CMCSA

ChartMill utilizes a proprietary algorithm to assign a Technical Rating to every stock. This rating, ranging from 0 to 10, is computed daily by analyzing a variety of technical indicators and properties.

We assign a technical rating of 8 out of 10 to CMCSA. In the last year, CMCSA was one of the better performers, but we do observe some doubts in the very recent evolution.

- The long term trend is positive and the short term trend is neutral. The long term trend may just continue or reversal may be around the corner!

- When comparing the yearly performance of all stocks, we notice that CMCSA is one of the better performing stocks in the market, outperforming 89% of all stocks. On top of that, CMCSA also shows a nice and consistent pattern of rising prices.

- CMCSA is part of the Media industry. There are 98 other stocks in this industry. CMCSA outperforms 91% of them.

- CMCSA is currently trading near its 52 week high, which is a good sign. The S&P500 Index is trading in the upper part of its 52 week range, but not near new highs, so CMCSA is leading the market.

- In the last month CMCSA has a been trading in the 44.25 - 47.30 range, which is quite wide. It is currently trading in the middle of this range where prices have been consolidating recently, this may present a good entry opportunity, but some resistance may be present above.

Our latest full technical report of CMCSA contains the most current technical analsysis.

Looking at the Setup

ChartMill also assign a Setup Rating to every stock. With this score it is determined to what extend the stock has been trading in a range in the recent days and weeks. This score also ranges from 0 to 10 and is updated daily. The setup score evaluates various short term technical indicators. NASDAQ:CMCSA scores a 8 out of 10:

CMCSA has an excellent technical rating and also presents a decent setup pattern. Prices have been consolidating lately. There is a support zone below the current price at 45.27, a Stop Loss order could be placed below this zone.

Trading breakout setups.

A breakout could materialize when the stock breaks out to new highs above the current consolidation zone. One could wait for this to happen and buy when this happens. A stop loss could be placed below the consolidation zone.

Please note that this article should not be construed as trading advice. The information provided is solely based on automated technical analysis and serves to highlight technical observations. It is important to conduct your own analysis and make trading decisions based on your own judgment and responsibility.

More breakout setups can be found in our Breakout screener.

Keep in mind

This article should in no way be interpreted as advice in any way. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.

28.37

+0.16 (+0.57%)

Find more stocks in the Stock Screener

CMCSA Latest News and Analysis