The investment philosophy popularized by legendary fund manager Peter Lynch emphasizes identifying companies with strong growth potential that are trading at reasonable valuations, often described as a growth at a reasonable price (GARP) approach. This strategy focuses on firms demonstrating consistent earnings expansion, solid financial health, and profitability, while ensuring their stock prices have not outpaced their growth prospects. The methodology avoids speculative high-flyers in favor of businesses with sustainable, understandable operations that can deliver returns over a long-term investment period.

Meeting the Lynch Criteria

Boot Barn Holdings Inc (NYSE:BOOT) appears as a candidate for review under this framework. The company operates a chain of retail stores specializing in western and work-related footwear, apparel, and accessories, a clear business model that fits with Lynch's principle of investing in what you know. The screen identified the stock based on several quantitative filters derived from Lynch's strategy.

- Sustainable Earnings Growth: A key part of the Lynch approach is finding companies with solid, but not hyper-inflated, earnings growth. BOOT reports a 5-year earnings per share (EPS) growth rate of 28.69%, which comfortably exceeds the screen's minimum threshold of 15%. More importantly, this growth falls below the 30% ceiling Lynch suggested, as extremely high growth is often unsustainable. This indicates a company expanding at a healthy, maintainable pace.

- Reasonable Valuation via PEG Ratio: To avoid overpaying for growth, Lynch favored the PEG ratio (Price/Earnings to Growth). A PEG ratio at or below 1.0 suggests the stock may be reasonably priced relative to its earnings growth. BOOT's PEG ratio of 0.95 meets this important test, indicating that its share price has not disconnected from its actual growth trajectory.

- Strong Profitability and Financial Health: The screen also filters for high profitability and a sturdy balance sheet.

- BOOT's Return on Equity (ROE) of 17.26% surpasses the 15% minimum, signaling efficient use of shareholder capital.

- The company reports a Debt/Equity ratio of 0.0, far exceeding the screen's requirement of being below 0.6 and fitting with Lynch's personal preference for minimal debt. This signifies a low-risk financial structure.

- A Current Ratio of 2.35 indicates more than sufficient liquidity to cover short-term obligations, fulfilling another health check.

Fundamental Analysis Overview

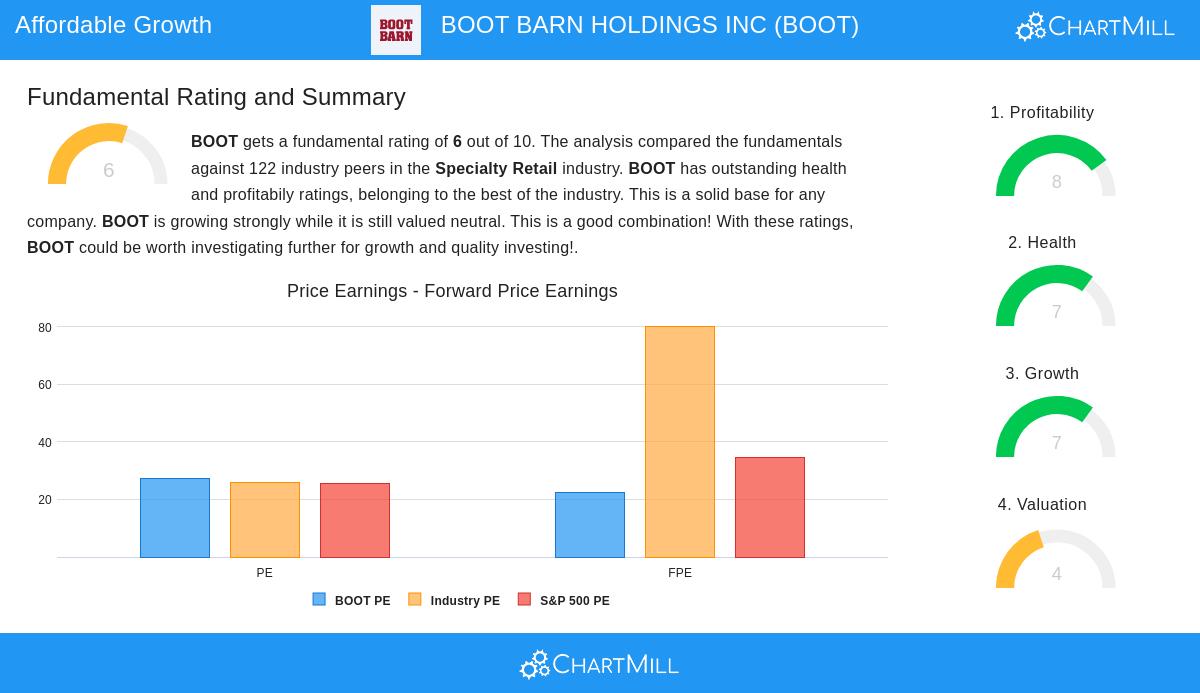

A closer look into the company's fundamentals supports the initial screening results. The full fundamental report gives BOOT a solid rating of 6 out of 10, comparing favorably within the competitive Specialty Retail industry. The analysis points out two particularly strong areas: profitability and financial health. The company earns good marks for its profit margins and returns on assets and invested capital. Its balance sheet is considered very healthy, with no solvency concerns and strong liquidity. While its valuation is not considered deeply cheap, it is viewed as acceptable, especially when its growth and high profitability are considered.

A Classic Lynch Profile

Boot Barn represents several qualitative aspects Lynch valued. It operates in a niche, understandable market, western and workwear, that may be overlooked by Wall Street in favor of more glamorous sectors. Its nationwide store presence and e-commerce platforms provide a tangible business that consumers can interact with directly. The combination of strong historical growth, a reasonable valuation measured by the PEG ratio, a clean balance sheet with no debt, and high profitability creates a profile that long-term GARP investors may find interesting.

For investors interested in exploring other companies that pass this disciplined investment screen, you can find the current list of qualifying stocks via the Peter Lynch Strategy screener.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation to buy or sell any security, or an offer to solicit any transaction. All investments involve risk, including the possible loss of principal. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.