AI Momentum, Tariff Tensions, and Earnings Shake the Market

Wall Street Edges Higher Amid Volatility

On Thursday, May 29, 2025, U.S. markets ended modestly higher as investors digested strong earnings from Nvidia and grappled with renewed uncertainty around Trump’s tariff policies.

The Dow Jones gained 0.3%, while the S&P 500 and Nasdaq (COMPX) both closed up 0.4%.

Sentiment fluctuated sharply throughout the session, as early optimism faded amid ongoing legal drama surrounding import tariffs imposed under the Trump administration.

A lower court’s ruling against these tariffs was temporarily suspended by an appeals court late Thursday, reintroducing policy risk for multinational companies.

Nvidia Shines Bright with AI-Powered Growth

Nvidia (NVDA | +3.25%) delivered exceptional earnings, driving its stock up by as much as 6% intraday before settling at +3.3%, closing at $139.19.

Despite export restrictions on the H20 chip causing an $8 billion revenue loss, Nvidia’s AI chip demand remains relentless. Analysts believe Nvidia remains the premier play on the AI megatrend.

“Nvidia is the best way to invest in the best theme: AI,” - Rick Schafer of Oppenheimer.

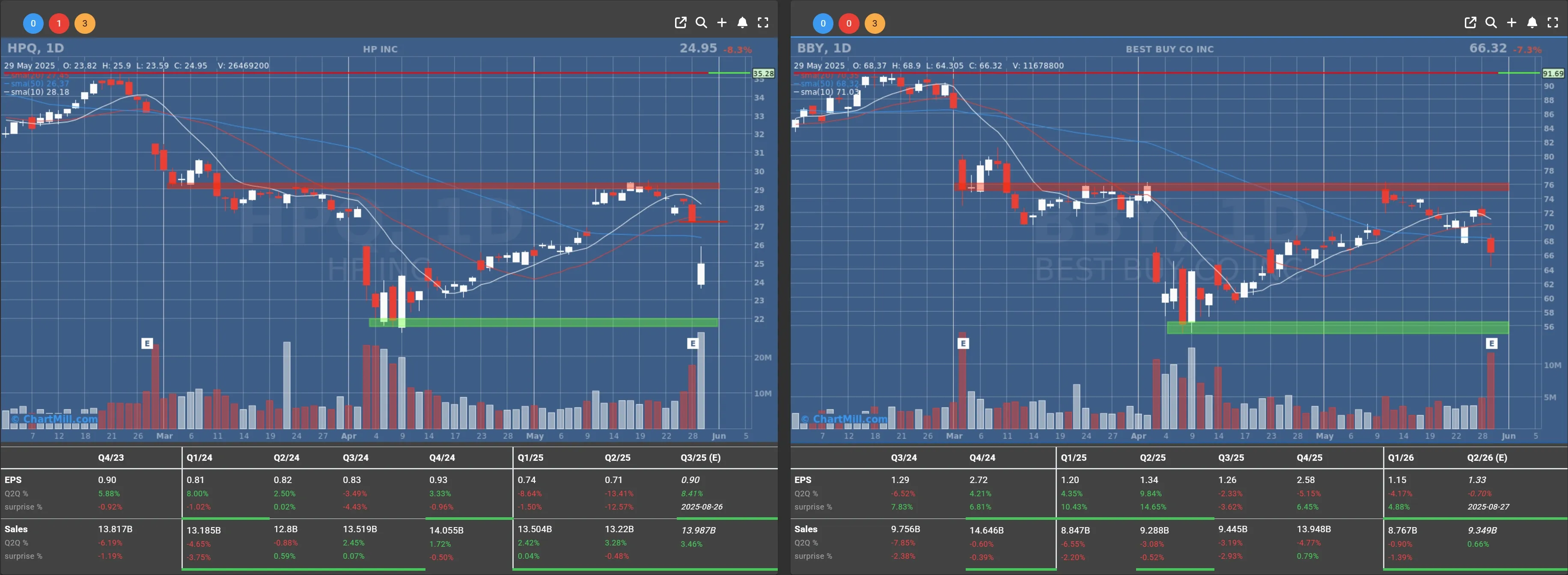

HP and Best Buy Plunge on Tariff Fallout

Not all companies fared well. HP Inc. and Best Buy suffered steep losses as tariffs weighed heavily on their Q1 earnings and outlook.

HP Inc. (HPQ | -8.27%)

The PC maker reported weaker-than-expected results and issued a downbeat forecast. CEO Enrique Lores blamed increasing costs and declining demand due to the unpredictable economic environment shaped by tariff battles.

“Tariffs have hit harder and broader than we expected. We’ll need to raise prices and reduce China-based production,” - Enrique Lores CEO.

Best Buy (BBY | -7.27%)

The electronics retailer also cut its guidance following a drop in revenue and earnings. CFO Matt Bilunas revised comparable sales forecasts down to a range of -1% to +1%, citing consistent consumer behavior and unrelenting tariff costs.

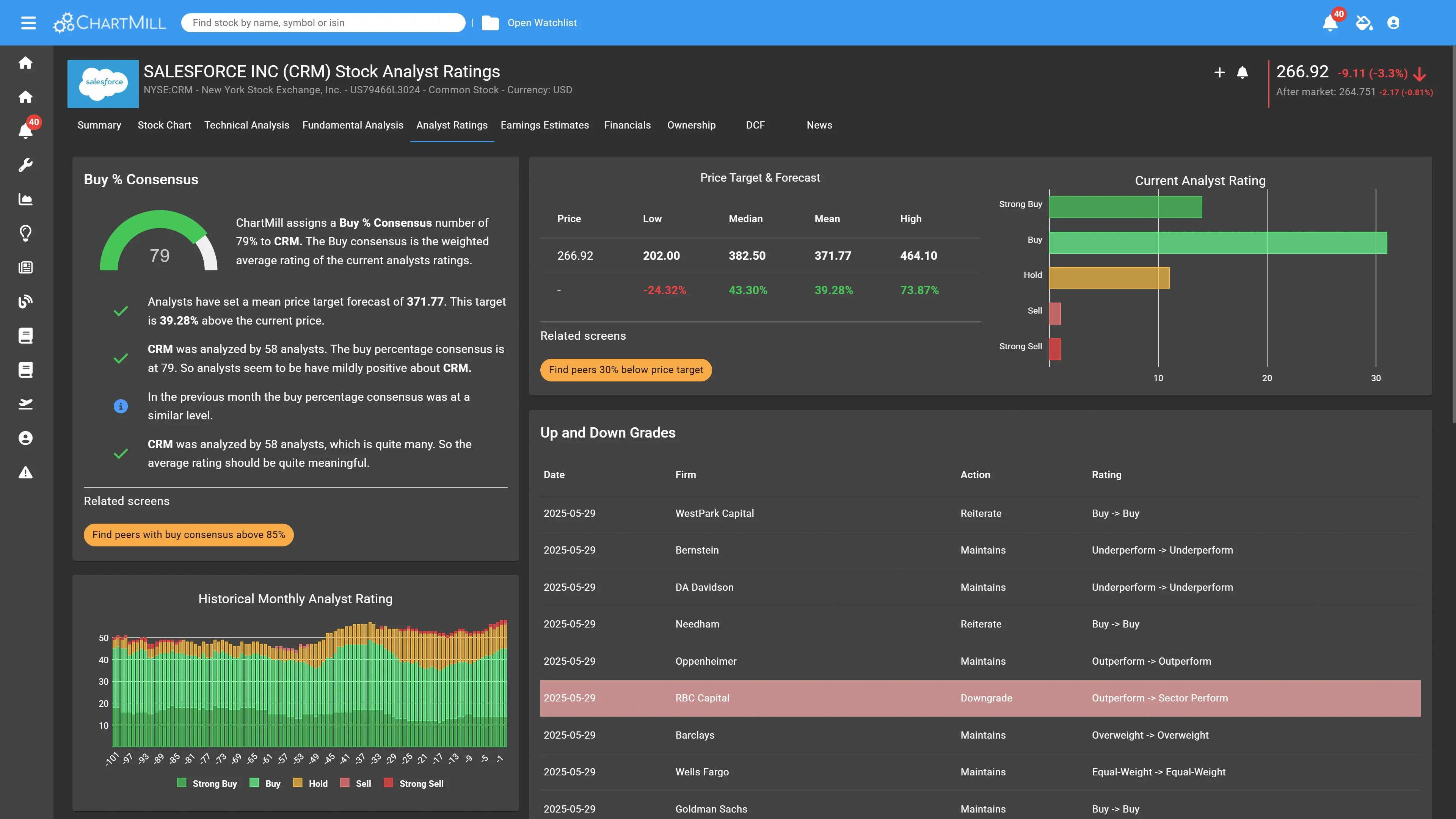

Salesforce (CRM) Stumbles Despite Solid Earnings

Salesforce (CRM | -3.30%) slid over 3% despite reporting slightly better-than-expected quarterly revenue and issuing a positive full-year outlook.

While revenue beat consensus and guidance improved, concerns emerged around the planned acquisition of Informatica (INFA). RBC downgraded the stock, warning that such deals may distract from Salesforce’s core operations.

“Salesforce should double down on core CRM growth rather than branching out into complex data management solutions,” - RBC Capital.

Dell Technologies (DELL) Rises on AI Server Demand

In after-hours trading, Dell Technologies (DELL | -0.12%) surged on the back of raised full-year earnings guidance. The company cited booming demand for AI-enabled servers, particularly those powered by Nvidia chips.

-

Revised EPS Forecast: $9.40 (up from $9.30)

-

Q2 Revenue Outlook: $28.5B–$29.5B (vs. $25.05B expected)

Tech Stocks Show Divergence: Broadcom, Micron, AMD Flat

While Nvidia (NVDA) led the charge, other semiconductor giants had mixed results:

All trimmed early gains, failing to mirror Nvidia’s momentum. Concerns about future export regulations and macroeconomic slowdown continue to limit enthusiasm across the broader chip sector.

Tesla (TSLA) Hits a Roadblock

Tesla (TSLA | 0.43%) ended flat despite early gains. The stock dipped midday after CEO Elon Musk confirmed his departure from DOGE, the U.S. government’s Department of Government Efficiency.

Investors questioned whether the controversial public image of Musk may have long-term brand implications.

Tariff Drama: Legal and Political Uncertainty Deepens

The ongoing Trump tariff saga re-emerged as a key market driver. A lower court had deemed the tariffs unconstitutional, citing lack of a national emergency. However, an appeals court stayed the decision, allowing the tariffs to remain in place—for now.

“This battle could go all the way to the Supreme Court,” - Derek Halpenny of MUFG Bank.

Markets remain on edge as tariff policy uncertainty threatens global trade flows and corporate margins alike.

Macroeconomic Signals: Mixed Indicators Raise Eyebrows

The U.S. economy sent conflicting signals:

-

Initial jobless claims rose, indicating some labor market softening.

-

Oil inventories fell sharply, hinting at robust energy demand.

-

Pending home sales (April): Fell significantly, indicating possible real estate slowdown.

-

Q1 GDP: Contracted 0.2%, slightly better than expected but still in negative territory.

-

USD/EUR: The dollar dropped 1.3% to 1.1381, reacting to the GDP miss.

Powell Meets Trump: Fed Independence Reaffirmed

Federal Reserve Chairman Jerome Powell met with President Donald Trump on Thursday. According to a Fed statement, Powell emphasized that all monetary policy decisions remain independent and data-driven, free from political influence.

“Rate decisions will always be based on objective, non-political analysis,” Powell told the president.

Trump has repeatedly criticized Powell for not cutting interest rates fast enough, calling him "slow" and "always late."

Powell reiterated the Fed's mission to act based on economic conditions, not political pressure.

Conclusion: AI Leads, Tariffs Weigh, and Uncertainty Persists

May 29, 2025, was a day of divergence and disruption.

While AI titans like Nvidia propelled optimism, tariff-related headwinds pulled down stalwarts like HP and Best Buy.

Meanwhile, broader macroeconomic data and judicial developments added to investor caution.

The market remains at a crossroads: poised between innovation-driven growth and policy-induced drag. Investors must tread carefully in the face of competing narratives that could tip sentiment swiftly.

Next to read: Market Monitor Trends & Breadth, May 30