Investors looking for undervalued opportunities often use value investing strategies, which center on finding stocks trading for less than their intrinsic worth. This method highlights strong fundamentals, profitability, financial stability, and reasonable growth, along with appealing valuations. One way to find these opportunities is with screening tools that assess stocks using composite scores in these important areas. Allison Transmission Holdings (NYSE:ALSN) recently appeared in a screen made to point out companies with good core metrics and lower prices.

Valuation Metrics

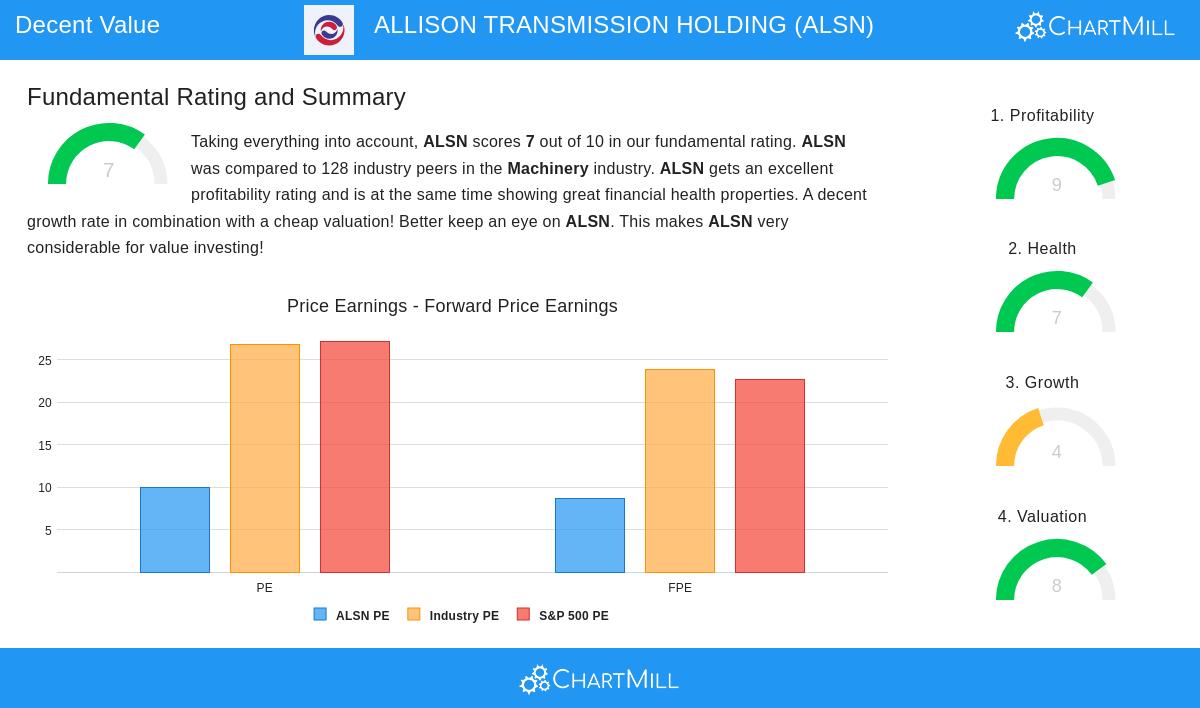

Allison Transmission’s valuation metrics are notable. The stock seems deeply undervalued compared to its industry and the wider market, a main point for value investors seeking a safety margin.

- P/E Ratio: At 9.92, it is much lower than the industry average of 26.77 and the S&P 500’s 27.20, showing a less expensive entry point.

- Forward P/E: 8.67 is better than the industry’s 23.87 and the S&P’s 22.70, indicating ongoing value.

- Price-to-Free-Cash-Flow and EV/EBITDA: Both ratios put ALSN in the least expensive part of its sector, doing better than over 90% of similar companies.

These numbers are important in value investing, as they help find stocks where the market price might not show the company’s earnings potential or asset value fully, possibly providing protection from paying too much.

Profitability Strength

Strong, steady profitability is a sign of a good value investment, lowering the chance that a low valuation comes from operational problems. Allison Transmission does very well here, with a Profitability Rating of 9/10.

- Margins: An operating margin of 31.72% is best in its industry, while a profit margin of 23.81% is higher than 99% of sector peers.

- Returns: ROE of 43.47% and ROA of 14.08% are very high, showing efficient use of equity and assets.

- Consistency: The company has reported positive earnings and operating cash flow for five straight years.

This level of profitability backs the idea that the stock’s low valuation is not due to bad performance but could be a market mistake.

Financial Health

A solid balance sheet offers strength, another key part of value investing. Allison Transmission has a Health Rating of 7/10, with clear advantages in liquidity and controlled, though existing, debt.

- Liquidity: Current and quick ratios of 3.36 and 2.64 show good short-term financial flexibility, doing better than most industry rivals.

- Debt Management: Although the debt-to-equity ratio is high at 1.37, the debt-to-free-cash-flow ratio of 3.67 is manageable, demonstrating ability to handle debts.

This financial steadiness lowers potential loss risk, which matters for investors who might hold during times of market unpredictability.

Growth Prospects

While growth is less important than valuation and safety in strict value investing, steady growth helps the argument for price increases. ALSN’s Growth Rating of 4/10 shows modest but consistent advancement.

- Historical Growth: EPS has increased at an 11.10% yearly rate over recent years, with revenue rising 3.63% per year.

- Future Expectations: Analysts forecast EPS growth of 6.32% and revenue growth of 3.34% each year, suggesting steadiness instead of drop.

For value investors, this reliable growth helps make sure intrinsic value could rise over time, closing the difference with market price.

Investment Considerations

Although the fundamental view is mostly positive, investors should be aware of areas needing watch. The dividend, while increasing and steady, has a yield under the S&P 500 average, and future EPS growth is predicted to decrease a bit. Also, the company’s high debt compared to equity deserves attention, though it is now backed by strong cash flow.

Value investors frequently accept these flaws when valuations are low and key strengths are clear, as with Allison Transmission. The company’s industry role, as a top maker of commercial vehicle transmissions with a worldwide presence, adds a degree of operational quality to the numerical attraction.

For those wanting to see the full fundamental assessment, more information is in the complete report.

Exploring Similar Opportunities

Allison Transmission was found using a screen for reasonable value stocks, those with high valuation scores and good fundamentals. Investors searching for similar options can review other possibilities through this predefined screen.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consider their financial situation and risk tolerance before making investment decisions.