Enterprise Value and the EV/EBITDA-ratio explained

Enterprise Value (EV) is a metric used in fundamental analysis to determine the value of a company. It is a useful ratio when comparing companies that have different levels of debt and present value, two aspects that enterprise value takes due account of, unlike some other valuation ratios. Indeed, all short-term and long-term debt as well as all cash and cash equivalents are included in the calculation.

In this article

- Enterprise Value Components

- How is EV calculated?

- Why EV matters...

- EV/EBITDA

- What is considered a good EV/EBITDA ratio?

- EV/EBITDA in ChartMill

- How is Enterprise Value different from Market Capitalization?

- What are the limitations in using Enterprise Value?

Enterprise Value Components

Market capitalization

Market capitalization, just like enterprise value (EV), can be used as a measure of the value of the company. Within the concept of the E.V. it is merely one component. It is calculated by multiplying the number of shares outstanding by the current share price. In itself, it is a useful ratio for comparing the size of firms with that of other firms in the same industry.

Financial debt

Many firms are required to rely on so-called "debt capital" to finance their assets. Usually these are banks that extend credit to the firm. They may also be bondholders who have lent money to the firm over a period of time. Banks and bondholders have one thing in common, they receive "interest" on the amount of money they provide to the firm. The term interest-bearing debt is used for this purpose. Financial debt is divided into two categories, short-term and long-term debt. Short-term means that the debts are repaid in less than 1 year, for long-term debts it is more than 1 year.

Cash and cash equivalents

This is the total amount of cash but also all investment instruments that behave like cash in the sense that they can be sold or converted into cash at their face value within a short period of time, usually within a time frame of less than three months. These include government bonds, money market funds, negotiable securities, certificates of deposit...etc.

How is EV calculated?

The formula to calculate Enterprise Value is as follows:

*net debt = financial debt - cash and cash equivalents

Normally the EV will be greater than the market capitalization because it not only looks at the market value of the shares but also considers net debt.

How big that difference is depends largely on how much debt a company carries. A high debt ratio means a high(er) EV value.

Likewise, that means that companies with little or no debt and lots of cash on the balance sheet have an enterprise value that comes out lower than the market capitalization. This is because in such cases net debt is negative. One speaks of a positive "net cash position" in such cases.

Why EV matters...

Enterprise value is an important ratio because it is a measure of the total value of a company. This results in a better valuation picture because it also reflects the effects of debt on the value of the company. Furthermore, EV is useful for comparison between companies because it captures the relationship between the value and size of the company.

EV/EBITDA

One of the most common ratios for which EV is used is undoubtedly the EV/EBITDA ratio.

EBITDA stands for "Earnings Before Interest, Taxes, Depreciation and Amortization." It reflects operating income before the effects of interest, taxes and depreciation/amortization. As a result, it purely measures operating performance, making it possible to compare companies in different industries.

In the beginning of the article, we already explained how EV is arrived at. The EBITDA is obtained using the following formula:

EBITDA = Net Income + Interest Expense + Taxes + Depreciation + Amortization

In ChartMill, the EBITDA figure is available on the profile page of a company, under the menu 'financials', and then 'Income Statement'. So you don't have to calculate the EBITDA yourself. Those who do wish to do so can obtain all the necessary figures through the company's published financial statements (10-K) or quarterly results (10-Q).

By dividing EV by EBITDA you get a ratio that reflects the relationship between the value of the company and its operating profit (which is not affected by interest, nor by depreciation or taxes).

An EV/EBITDA of 11, for example, means that the investor, including net debt, must pay 11 times the firm's EBITDA per share.

What is considered a good EV/EBITDA ratio?

The ratio strongly varies by industry, as shown in the table below. It is important not to focus solely on the ratio itself but to compare the figure especially with industry peers.

S&P 500 EV/EBITDA multiple in the United States from 2014 to 2021, by sector

As a general guideline, an EV/EBITDA of less than 10 is considered above average by analysts. For your information: The average EV/EBITDA for the S&P500 has ranged between 11 and 16 in recent years, reaching 17.12 in December 2021.

EV/EBITDA in ChartMill

The EV/EBITDA ratio is available by default in ChartMill, there are several options to make it visible.

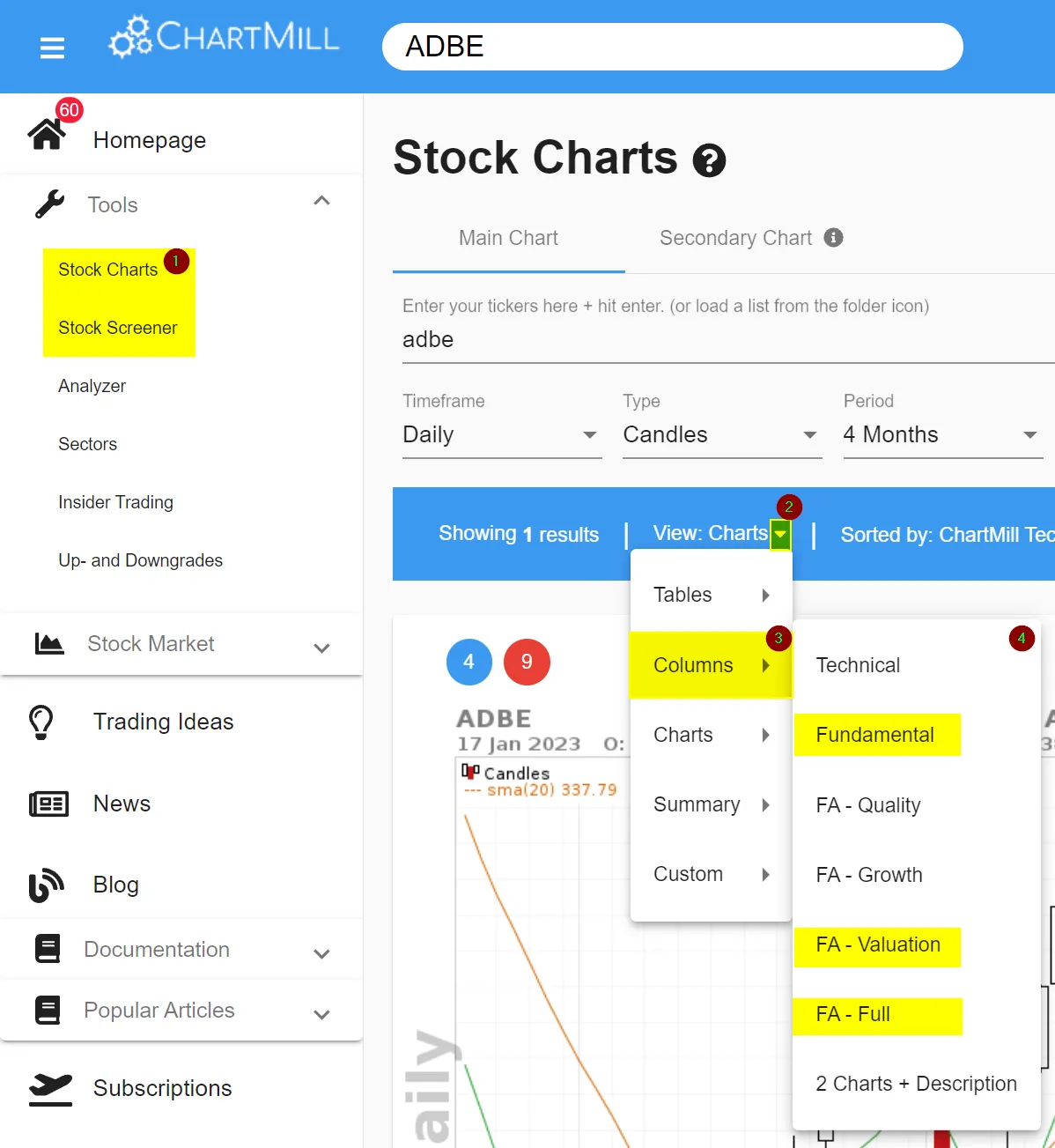

OPTION I

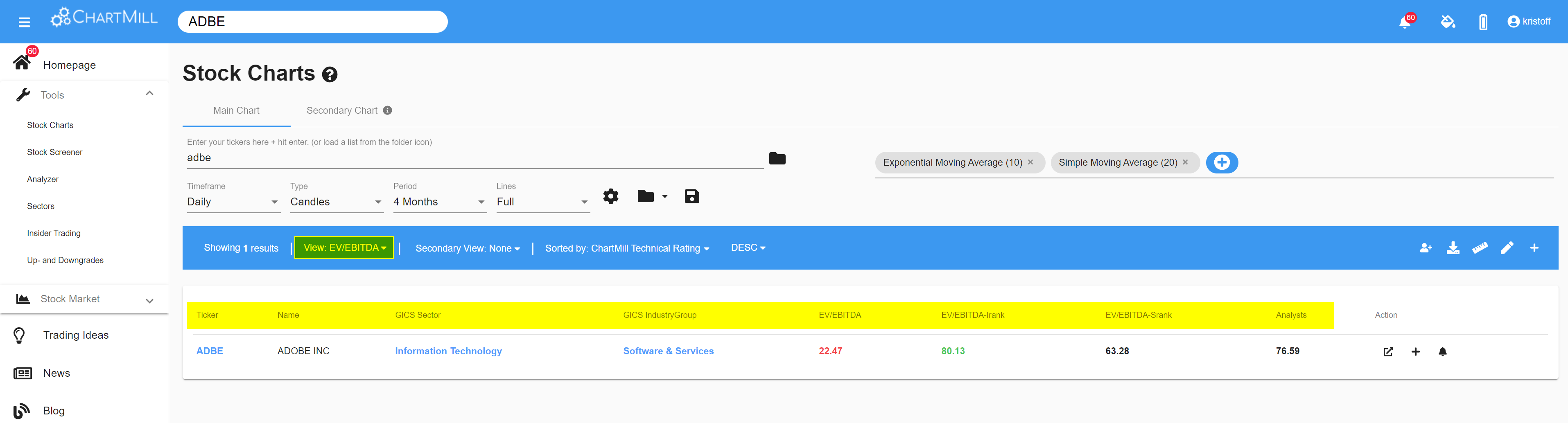

- In the main menu, choose 'Stock Charts' or 'Stock Screener'.

- Click on the inverted triangle in the blue horizontal bar

- Select 'Columns'

- The EV/EBITDA becomes visible in the views 'Fundamental', 'FA-Valuation' and 'FA-Full'

OPTION II

The EV/EBITDA ratio is also listed in the FA analysis report on the profile page under the fundamental analysis tab.

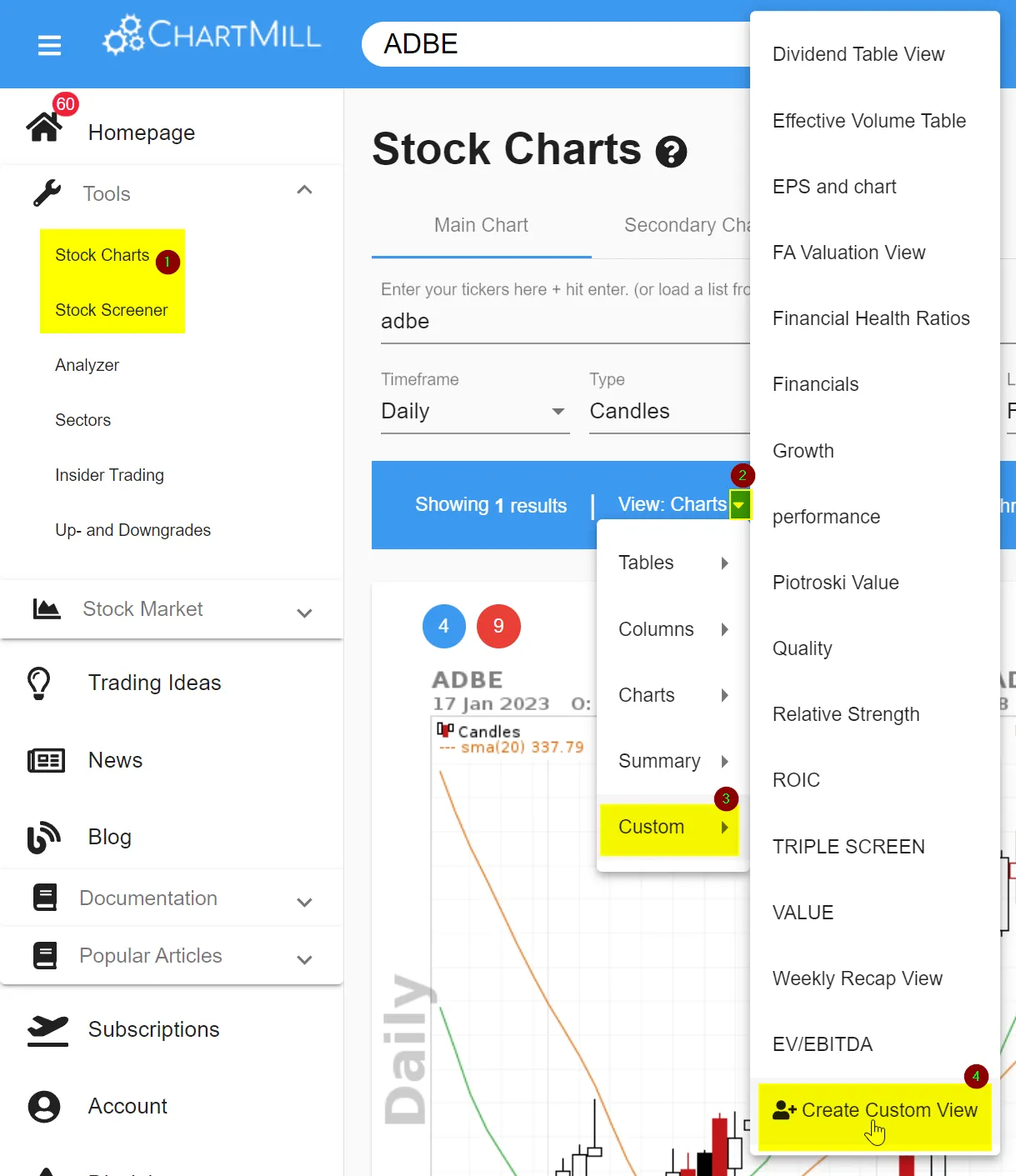

OPTION III

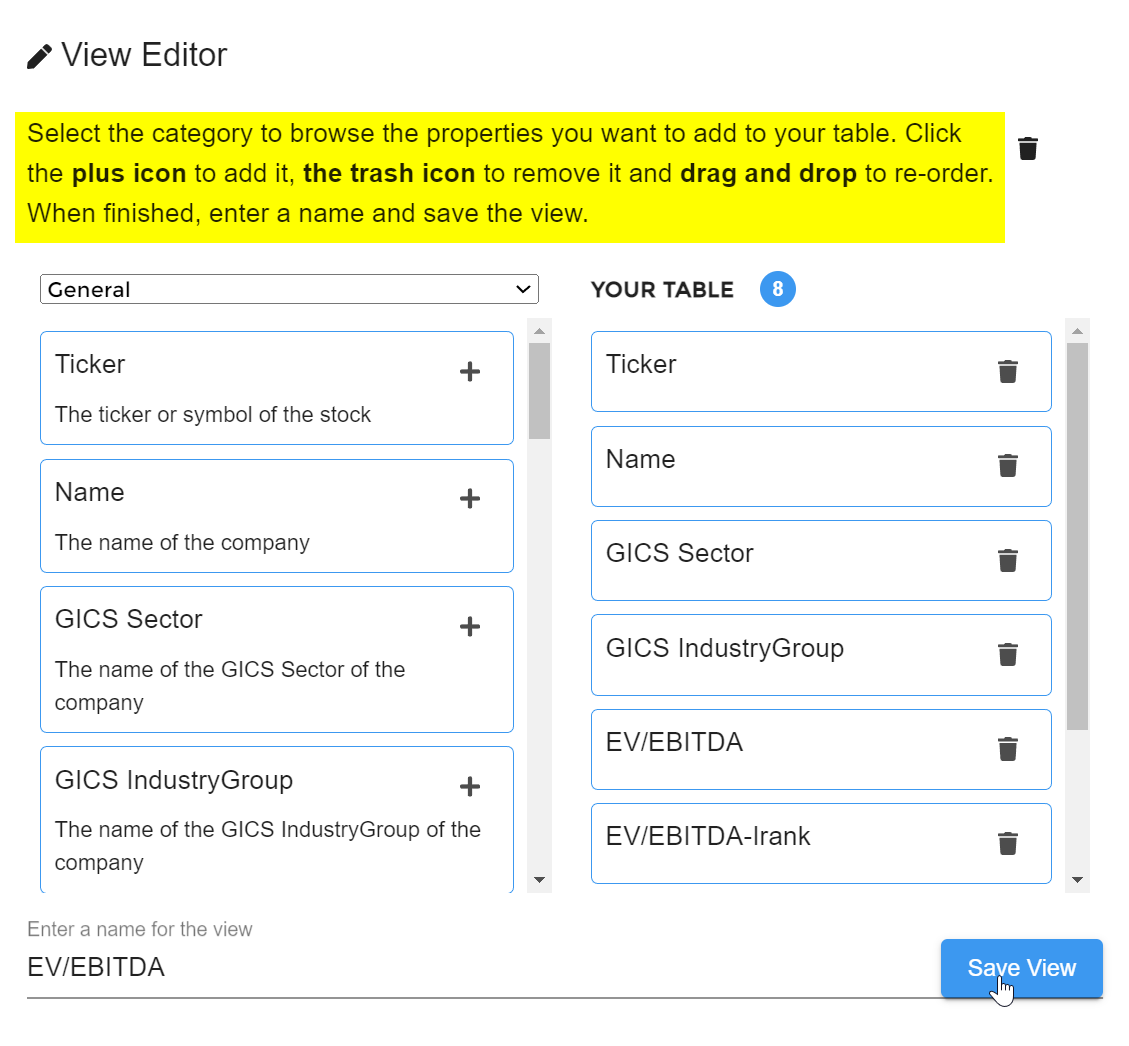

Finally, you can also create your own custom screen in which you can display the EV/EBITDA, along with other components. In the example below, you can see how that works for the creation of an FA custom table view.

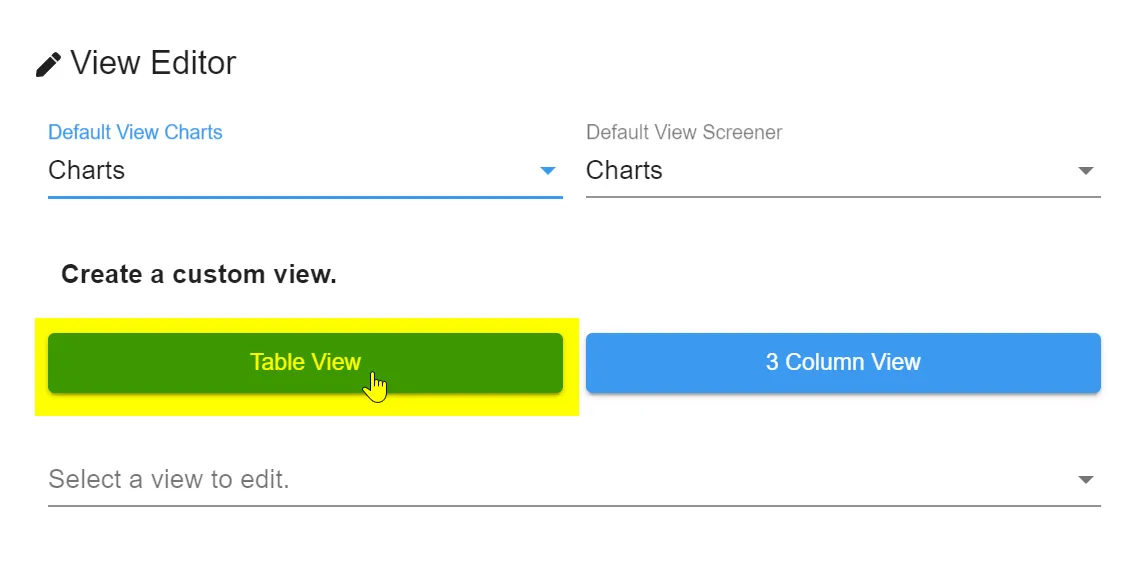

In the next screen, click on "Table View.

Then select the desired components:

Once saved, you can access your personal view at any time by opening the drop down menu (View) in the blue horizontal bar, on both the 'Stock Charts' and 'Stock Screener' pages.

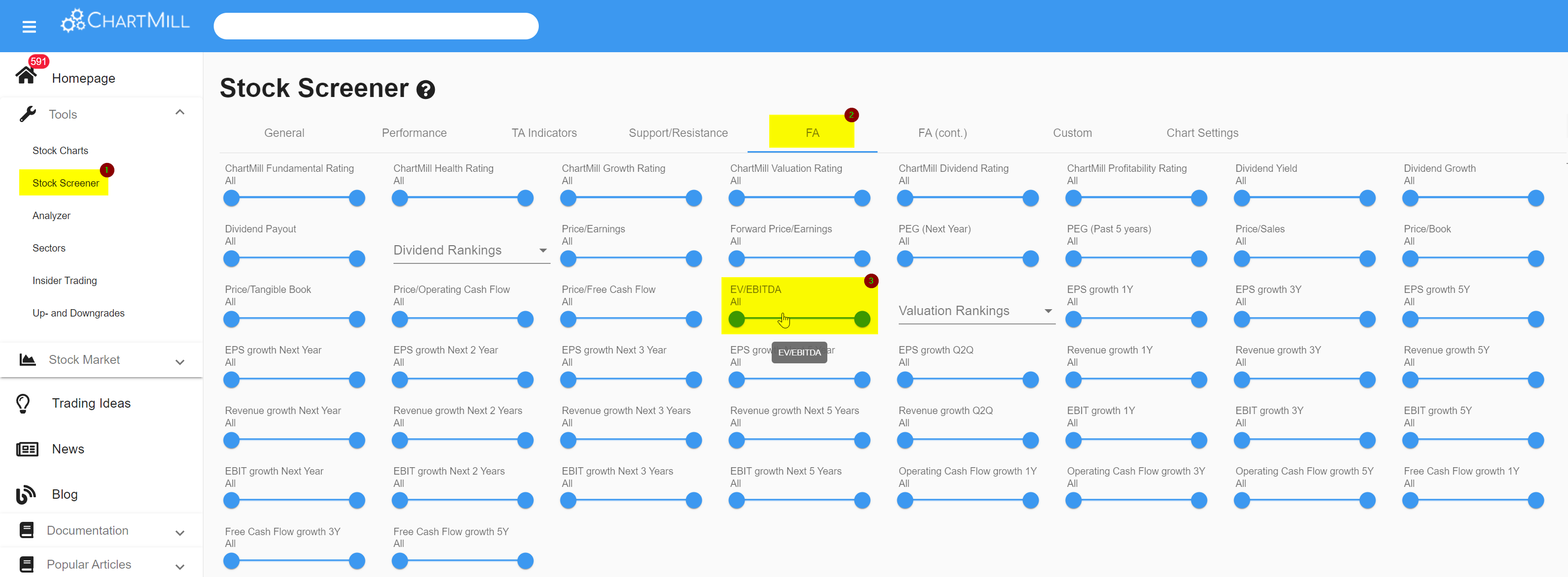

OPTION IV

Finally, ChartMill also offers the ability to filter stocks based on the EV/EBITDA ratio. To do this, on the stock screener page, select the fundamental tab where you can configure the ratio.

How is Enterprise Value different from Market Capitalization?

Enterprise value (EV) and market capitalization (MK) are two different measures used to determine the value of a company.

- Market capitalization is the value of a company calculated by multiplying the number of shares outstanding by the current share price. It indicates how much money investors would have to pay to buy the entire company.

- Enterprise value is a broader measure that represents the value of a company by combining the market value of its equity (share capital and reserves) with its debt minus its present value. It is a measure that takes into account more than just the value of equity. EV is considered the (theoretical) acquisition price of the company. It corresponds to the amount it would cost to buy each share of common and preferred stock + outstanding debt.

In summary, market capitalization reflects the value of the company to shareholders, while enterprise value reflects the value of the company to both shareholders and creditors.

What are the limitations in using Enterprise Value?

This is mainly reflected when comparing companies with vastly different capital structures. Two companies with the same market capitalization but vastly different debt levels or varying cash reserves would automatically result in the company with the least debt having a better EV.

However, EV does not take into account how that debt is used. If debt capital is used efficiently and leads to high returns, that higher debt ratio would not automatically have to be negative.

Moreover, capital-intensive companies need much more debt anyway yet would show a worse EV compared to other less capital-intensive sectors. While that debt, just because of the capital-intensive nature of the business, is necessary to generate revenue.

Some other Valuation Ratios

Fundamental Valuation Filters

In this article we will discuss the fundamental filters related to the valuation of a stock. Read more...