Zeta (NYSE:ZETA) Exceeds Q1 Expectations, Provides Encouraging Quarterly Revenue Guidance

Provided By StockStory

Last update: May 1, 2025

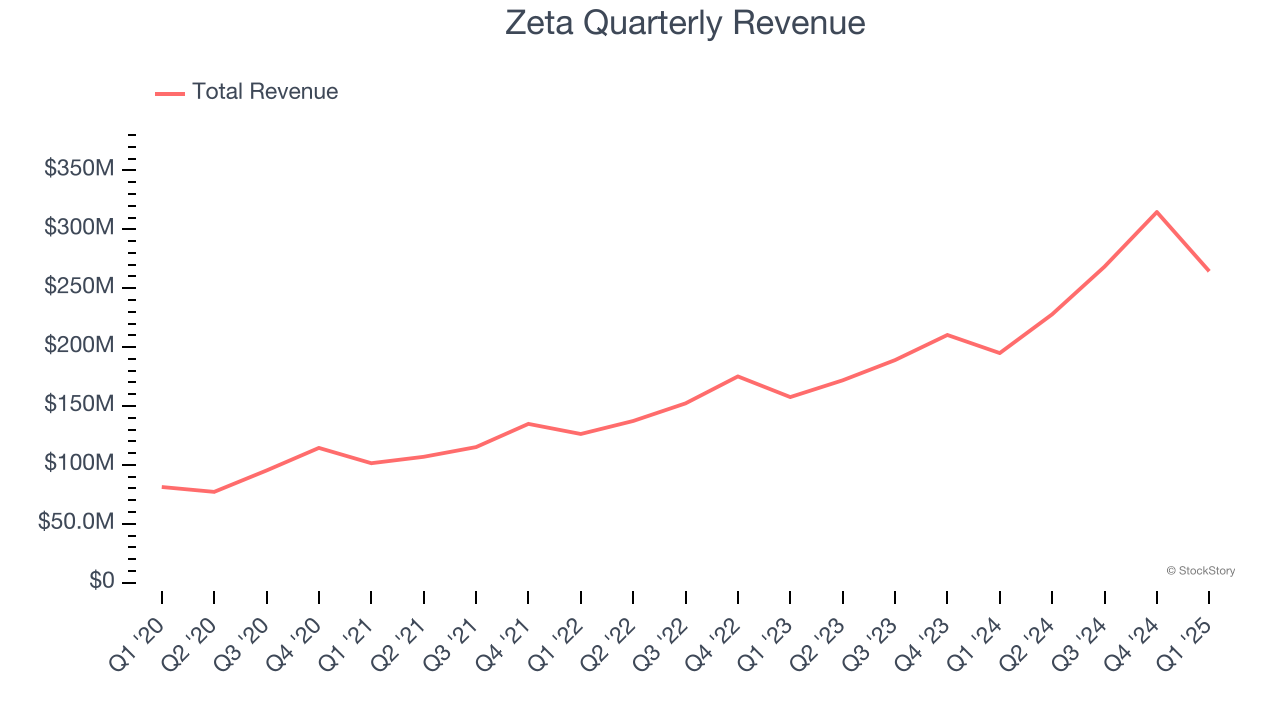

Advertising and marketing company Zeta Global (NYSE:ZETA) reported Q1 CY2025 results exceeding the market’s revenue expectations, with sales up 35.6% year on year to $264.4 million. Guidance for next quarter’s revenue was better than expected at $296.5 million at the midpoint, 1.7% above analysts’ estimates. Its GAAP loss of $0.10 per share was in line with analysts’ consensus estimates.

Is now the time to buy Zeta? Find out by accessing our full research report, it’s free.

Zeta (ZETA) Q1 CY2025 Highlights:

- Revenue: $264.4 million vs analyst estimates of $254.1 million (35.6% year-on-year growth, 4.1% beat)

- EPS (GAAP): -$0.10 vs analyst estimates of -$0.09 (in line)

- Adjusted EBITDA: $46.71 million vs analyst estimates of $44.42 million (17.7% margin, 5.2% beat)

- The company slightly lifted its revenue guidance for the full year to $1.24 billion at the midpoint from $1.24 billion

- EBITDA guidance for the full year is $258.5 million at the midpoint, above analyst estimates of $256.1 million

- Operating Margin: -6.1%, up from -18.4% in the same quarter last year

- Free Cash Flow Margin: 10.7%, similar to the previous quarter

- Market Capitalization: $3.10 billion

Company Overview

Co-founded by former Apple CEO John Sculley, Zeta Global (NYSE:ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Zeta’s 30.6% annualized revenue growth over the last three years was impressive. Its growth beat the average software company and shows its offerings resonate with customers.

This quarter, Zeta reported wonderful year-on-year revenue growth of 35.6%, and its $264.4 million of revenue exceeded Wall Street’s estimates by 4.1%. Company management is currently guiding for a 30.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 19.1% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is noteworthy and implies the market sees success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Zeta is extremely efficient at acquiring new customers, and its CAC payback period checked in at 5.3 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Zeta more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Zeta’s Q1 Results

We enjoyed seeing Zeta beat analysts’ EBITDA expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The market seemed to be hoping for more, and the stock traded down 4.8% to $12.89 immediately after reporting.

Is Zeta an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

NASDAQ:AAPL (5/7/2025, 3:50:03 PM)

195.42

-3.09 (-1.56%)

NASDAQ:NVDA (5/7/2025, 3:50:03 PM)

115.557

+2.02 (+1.78%)

NASDAQ:AMD (5/7/2025, 3:50:03 PM)

99.37

+0.75 (+0.76%)

NYSE:ZETA (5/7/2025, 3:50:03 PM)

13.185

+0.08 (+0.57%)

Find more stocks in the Stock Screener

AAPL Latest News and Analysis

2 hours ago - ChartmillCurious about the most active S&P500 stocks in today's session?

2 hours ago - ChartmillCurious about the most active S&P500 stocks in today's session?Explore the S&P500 index on Wednesday and find out which stocks are the most active in today's session. Stay updated with the stocks that are capturing market interest.

a day ago - ChartmillLooking for the most active stocks in the S&P500 index on Tuesday?

a day ago - ChartmillLooking for the most active stocks in the S&P500 index on Tuesday?Stay informed about the most active S&P500 stocks in today's session as we take a closer look at what's happening on the US markets on Tuesday. Discover the stocks that are generating the highest trading volume and driving market activity.

2 days ago - ChartmillMarket Monitor May 6 ( Skechers UP - Berkshire DOWN)

2 days ago - ChartmillMarket Monitor May 6 ( Skechers UP - Berkshire DOWN)Wall Street Slips as Buffett’s Departure and Trade Uncertainty Weigh on Markets

2 days ago - ChartmillThese S&P500 stocks are the most active in today's session

2 days ago - ChartmillThese S&P500 stocks are the most active in today's sessionExplore the S&P500 index on Monday and find out which stocks are the most active in today's session. Stay updated with the stocks that are capturing market interest.

3 days ago - ChartmillMarket Monitor May 5 ( Meta UP - Apple DOWN)

3 days ago - ChartmillMarket Monitor May 5 ( Meta UP - Apple DOWN)Wall Street rallies for 9th straight session on strong US jobs data and trade optimism; Apple stumbles, Buffett announces retirement.

5 days ago - ChartmillFriday's session: top gainers and losers in the S&P500 index

5 days ago - ChartmillFriday's session: top gainers and losers in the S&P500 indexStay updated with the movement of S&P500 stocks in today's session. Discover which S&P500 stocks are making waves on Friday.

5 days ago - ChartmillFriday's session: most active stock in the S&P500 index

5 days ago - ChartmillFriday's session: most active stock in the S&P500 indexLooking for the most active stocks in the S&P500 index on Friday? Dive into today's session and discover the stocks that are dominating the trading activity and setting the pace for the market.

5 days ago - ChartmillStay informed with the top movers within the S&P500 index on Friday.

5 days ago - ChartmillStay informed with the top movers within the S&P500 index on Friday.Let's have a look at the top S&P500 gainers and losers in the middle of the day of today's session.

5 days ago - ChartmillWhich S&P500 stocks are gapping on Friday?

5 days ago - ChartmillWhich S&P500 stocks are gapping on Friday?Looking for the S&P500 stocks that are experiencing notable gaps on Friday? Find out which stocks are gapping up and gapping down in the S&P500 index during today's session.

5 days ago - ChartmillWhich S&P500 stocks are moving before the opening bell on Friday?

5 days ago - ChartmillWhich S&P500 stocks are moving before the opening bell on Friday?Before the opening bell on Friday, let's take a glimpse of the US markets and explore the S&P500 top gainers and losers in today's pre-market session.

5 days ago - ChartmillApple Beats Expectations, But China Sales Weigh On Stock

5 days ago - ChartmillApple Beats Expectations, But China Sales Weigh On StockApple beat Q2 estimates, but China sales and soft guidance dragged the stock. AI, buybacks, and India production are key themes.

6 days ago - ChartmillMovers and shakers in today's after-hours session for S&P500 stocks?

6 days ago - ChartmillMovers and shakers in today's after-hours session for S&P500 stocks?Wondering what's happening in today's after-hours session with S&P500 stocks? Stay tuned for the latest updates on movers and shakers.