In the world of long-term investing, few strategies have shown the steady success of Peter Lynch’s method, which centers on finding companies with good growth prospects trading at sensible prices. Lynch, who famously led the Magellan Fund to outstanding returns, stressed investing in businesses that are financially sound, profitable, and easy to grasp, often those not widely followed on Wall Street. His approach mixes parts of growth and value investing, looking for firms with lasting earnings growth, strong balance sheets, and appealing prices compared to their growth potential, all while steering clear of high debt or extreme growth rates.

Meeting the Lynch Criteria

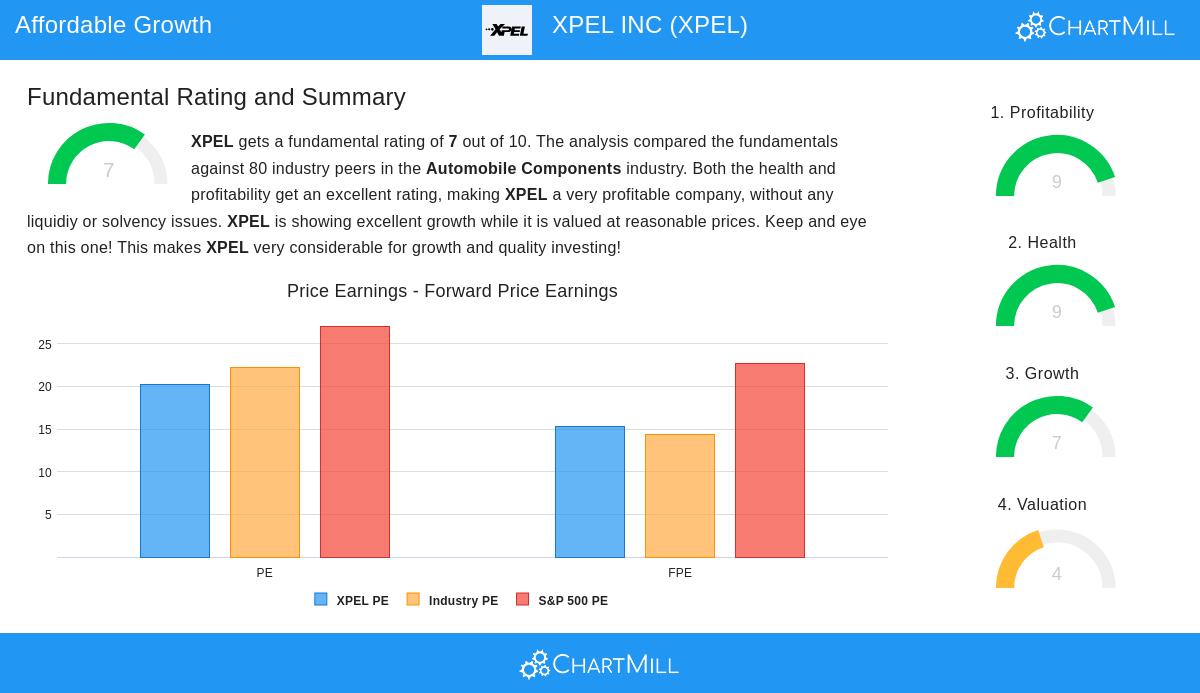

XPEL INC (NASDAQ:XPEL) stands out as a strong candidate based on important measures that match Lynch’s strategy. The company, which makes and sells automotive protection films and window tints, works in a specialized but growing market. Its financial picture shows several traits Lynch liked:

- Earnings Growth: XPEL’s EPS has increased at an average yearly rate of 26.4% over the last five years, clearly above Lynch’s 15% target and inside his chosen steady range (under 30%). This shows the company has grown profitably without depending on unsound hyper-growth.

- Valuation Relative to Growth: With a PEG ratio of 0.77, well under Lynch’s ideal limit of 1, XPEL seems fairly priced compared to its past earnings growth. This measure, key to Lynch’s method, helps find companies that are not overpriced for their growth path.

- Financial Health: The company keeps a solid balance sheet, shown by a debt-to-equity ratio close to zero and a current ratio of 4.42, greatly passing Lynch’s lowest need of 1. These numbers point to good liquidity and little financial risk, matching Lynch’s liking for companies that can handle economic slumps.

- Profitability: XPEL’s return on equity (ROE) is 19.03%, exceeding Lynch’s 15% standard. This shows effective use of shareholder money, a feature Lynch saw as vital for long-term compounding.

These measures together describe a company that has grown steadily and profitably while keeping a careful financial setup, a profile Lynch often linked with lasting investment chances.

Fundamental Strengths and Considerations

A closer view of XPEL’s basics supports its fit with a growth-at-a-reasonable-price (GARP) outlook. The company does very well in profitability, with top-tier margins and returns on invested capital, pointing to operational effectiveness and competitive strengths. Its solvency and liquidity are excellent, with very little debt and plenty of short-term assets, lowering bankruptcy risk and offering room for future investments or growth.

Still, investors should be aware of some details. While past growth has been good, recent EPS momentum has weakened a bit, and valuation measures like P/E and EV/EBITDA are not very low compared to some industry rivals. That noted, the company’s projected forward earnings growth of almost 30% might support its current price, especially alongside its high-quality financial foundation.

For a detailed look at XPEL’s fundamental profile, readers can see the full fundamental analysis report.

Industry Position and Outlook

XPEL works in the automobile components sector, offering products like paint protection films and window tints that serve both consumer and commercial markets. The company’s move into architectural glass solutions and hydrophobic coatings broadens its revenue sources and reaches into nearby growth fields. As automotive customization and aftermarket services become more popular, XPEL’s specialized products may keep appealing to a wide customer group. Its low institutional ownership, a trait Lynch liked, implies the company might still be missed by bigger investors, possibly allowing for greater market notice.

Conclusion

XPEL offers a notable case for using Peter Lynch’s investment ideas in today’s markets. Its mix of historical growth, fair valuation, financial soundness, and profitability fits well with the GARP method, making it a candidate deserving more study for long-term investors. While no investment is free of risk, XPEL’s core measures suggest a business made for lasting growth instead of speculative buzz.

For readers wanting to look into other companies that fit Peter Lynch’s criteria, more screening results can be found here.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Readers should conduct their own research and consult with a qualified financial advisor before making investment decisions.