WALMART INC (NYSE:WMT) – A Quality Stock with Strong Fundamentals

By Mill Chart

Last update: May 13, 2025

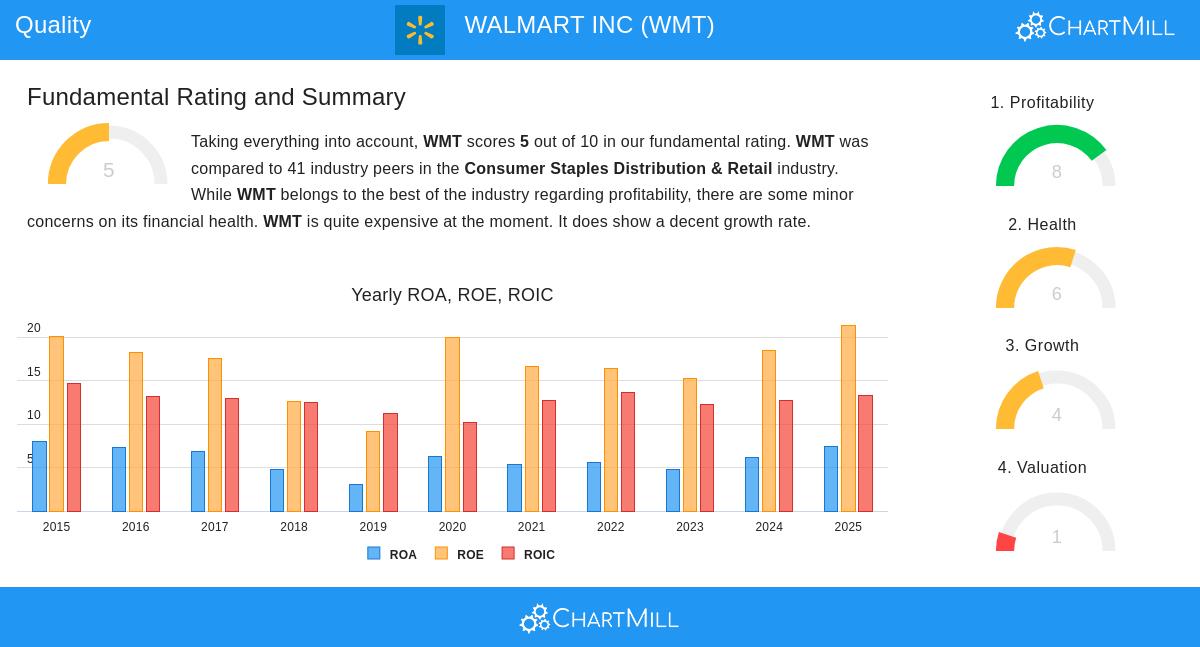

WALMART INC (NYSE:WMT) stands out as a potential candidate for quality investors, meeting key criteria in profitability, financial health, and operational efficiency. The company’s fundamentals reflect stability and consistent growth, making it a noteworthy pick for long-term investors.

Why WMT Fits the Quality Investing Criteria

- Strong Profitability: Walmart’s Return on Invested Capital (ROIC) of 17.12% (excluding cash and goodwill) is well above the 15% threshold for quality stocks, indicating efficient use of capital. The company also maintains solid margins, with an operating margin of 4.31%, outperforming 82.93% of its industry peers.

- Healthy Debt Management: The Debt-to-Free Cash Flow ratio of 3.62 suggests Walmart can repay its debt in under four years using current cash flows, a sign of financial discipline.

- Consistent Growth: While revenue growth has been modest (4.08% 5Y CAGR), EBIT growth (6.45% 5Y CAGR) outpaces sales growth, reflecting improving operational efficiency.

- High Profit Quality: Walmart converts 110.16% of net income into free cash flow (5Y average), indicating strong earnings quality and cash generation.

- Stable Dividend: The company has paid dividends for over a decade without cuts, supported by a sustainable payout ratio of 34.41%.

Valuation Considerations

Walmart’s current valuation is on the higher side, with a P/E ratio of 38.55, above both industry and S&P 500 averages. However, its strong profitability and defensive business model may justify the premium for quality-focused investors.

Fundamental Analysis Summary

Walmart scores 5/10 in our fundamental analysis, with strengths in profitability and financial health offset by a rich valuation. The company ranks highly in ROIC and margins but faces minor liquidity concerns due to lower current and quick ratios.

For more quality stock ideas, explore our Caviar Cruise screener.

Disclaimer

This is not investing advice. Always conduct your own research before making investment decisions.

100.51

-0.42 (-0.42%)

Find more stocks in the Stock Screener

WMT Latest News and Analysis