Investors looking for growth chances at fair prices often consider methods that find companies with good expansion prospects without high costs. The "Affordable Growth" method looks for stocks showing strong growth numbers, good earnings, and sound finances while being priced at levels that may not show their full prospects. This process tries to find companies set for future gains without the high prices usually linked to fast-growing firms, mixing chance with risk control through basic strength.

Universal Technical Institute (NYSE:UTI) appears as a option matching this method, providing technical and trade education at its locations. The company's recent results and financial numbers imply it matches the affordable growth standards, especially because of its operational focus in a field with consistent need for trained workers.

Growth Path

Universal Technical Institute shows interesting growth traits that are the center of its investment draw. The company has shown notable increases in both income and profits, backed by rising student numbers and course options.

- Earnings Per Share (EPS) rose by 128% over the last year, with a typical yearly growth rate of 28.35% over recent years.

- Income went up by 14.56% in the last year, keeping a typical yearly growth of 17.19% in the past.

- Future guesses predict ongoing growth, with EPS likely to increase by 11.29% each year and income by 10.53%, showing continued speed.

These growth numbers are important for the affordable growth method, as they show the company's capacity to grow its activities and earnings over time, giving a base for possible stock gains.

Price Evaluation

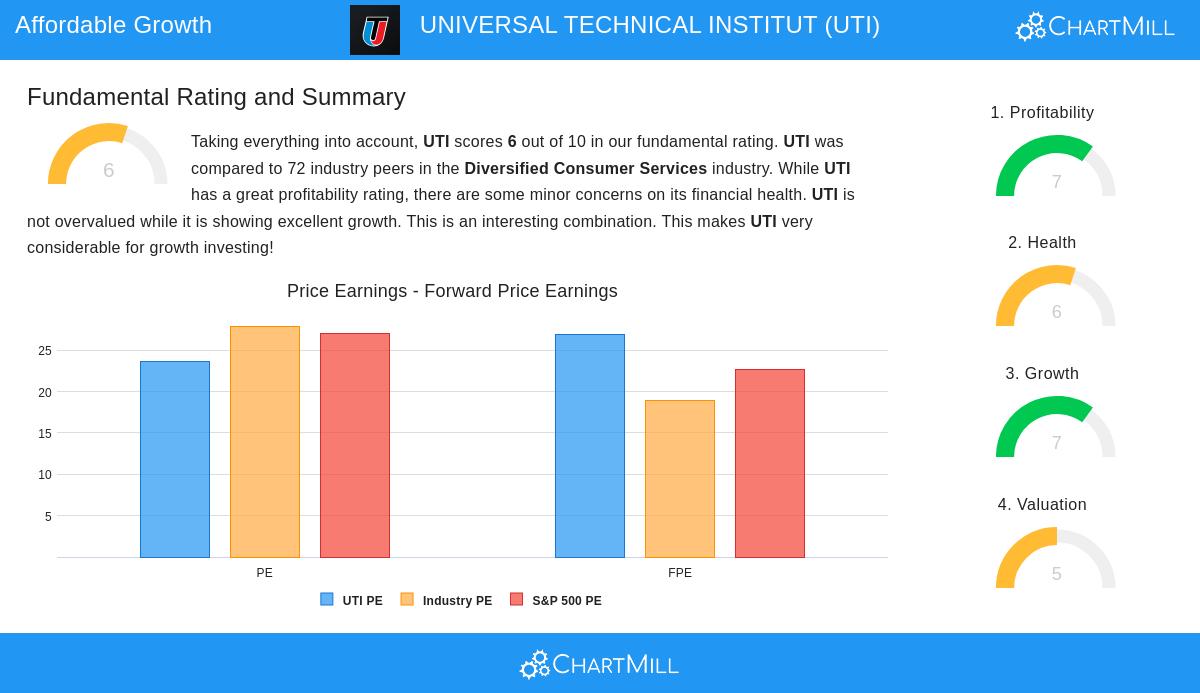

Even with its good growth, Universal Technical Institute is priced at levels that stay fair compared to its field and the wider market. This mix of growth and cost is key to prevent paying too much for future prospects.

- The Price/Earnings (P/E) ratio of 23.62 is a bit under the field average and similar to the S&P 500, implying no major overpricing.

- Enterprise Value to EBITDA and Price/Free Cash Flow ratios are positive, with the company costing less than about 71% of field rivals.

- A small PEG Ratio, which changes the P/E for growth, implies the stock might be underrated given its profit growth rate.

Price is a main part of the affordable growth method, making sure that investors are not too open to high multiples that might increase fall risk during market drops.

Earnings and Money Strength

The company's earnings and money safety give more backing for its label as an affordable growth option. Good returns and effective operations highlight its capacity to use growth chances.

- Return on Equity (ROE) of 20.57% and Return on Invested Capital (ROIC) of 10.86% do better than most field rivals, showing good management and money use.

- Profit Margins have displayed gains, with a present profit margin of 7.79% and operating margin of 10.44%, both above field averages.

- Money health is sufficient, with a good Altman-Z score of 3.68 showing low failure risk and a workable debt situation, but cash ratios are typical.

These points are vital for the method, as they lower the risk tied to growth investing by confirming the company has the operational power and money toughness to handle difficulties.

Summary

Universal Technical Institute stands as an interesting case for investors focused on affordable growth stocks. Its mix of good past and expected growth, fair price, and acceptable earnings and health numbers matches well with a method looking for balanced contact with expansion chances. While all investments have risk, the company's basics imply it is set well inside its field.

For readers focused on finding like investment chances, more outcomes from the Affordable Growth screen are available here.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Readers should conduct their own research and consult with a financial advisor before making investment decisions.