Market Monitor News May 28 (Tesla, Nvidia UP - PDD Holdings, Trump Media DOWN)

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: May 28, 2025

Wall Street Rallies on Tariff Truce and Consumer Optimism

Positive Sentiment Returns After Long Weekend

After a long Memorial Day weekend, U.S. markets reopened Tuesday, May 27, 2025, with strong gains.

Investors welcomed news of a temporary pause in planned U.S. tariffs on European imports, coupled with an unexpected rise in consumer confidence. The Dow Jones surged 1.8%, the S&P 500 advanced 2.0%, and the Nasdaq soared 2.5%, all bolstered by falling Treasury yields and bullish investor sentiment.

EU Tariff Delay Sparks Relief

President Donald Trump announced via Truth Social that the 50% import tariffs threatened against the European Union would be postponed until July 9, following constructive talks with EU Commission President Ursula von der Leyen.

Trump noted that Brussels was eager to arrange new negotiations, boosting investor confidence in a diplomatic resolution.

"Both China and the EU will thrive if they open their markets," Trump commented, referencing similar earlier tariff rollbacks with China that had previously lifted the Dow Jones nearly 3%.

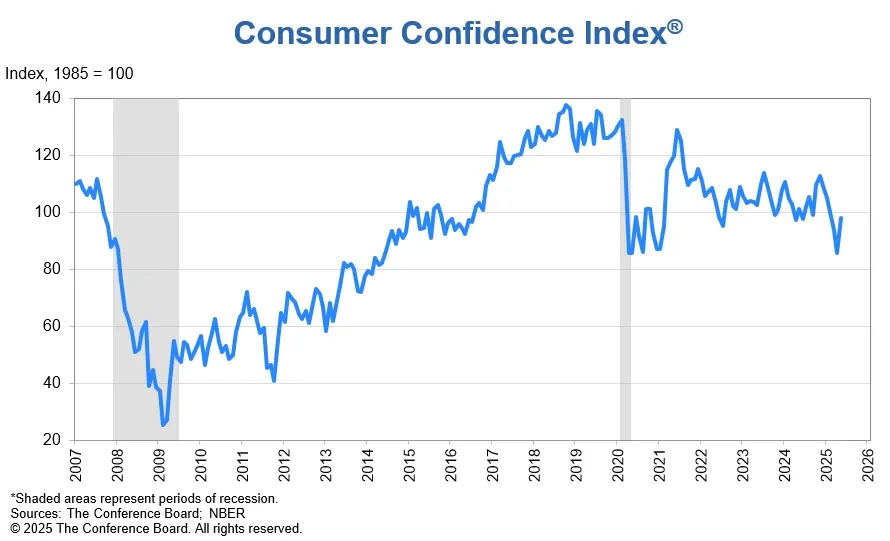

Consumer Confidence Surges Unexpectedly

Economic optimism got another boost as the Conference Board's consumer confidence index jumped 12.3 points to 98 in May, its first rise in five months and well above expectations.

Consumers showed increased optimism after the announcement of a pause on global tariff implementations, hinting that political headlines are closely influencing sentiment.

Falling Yields Aid Market Momentum

Long-term interest rates cooled notably. The 10-year Treasury yield dropped 7 basis points to 4.44%, while the 30-year yield declined 10 basis points to 4.94%.

Lower yields provided tailwinds for equities, especially growth and tech stocks.

Big Tech Leads the Charge

Tesla (TSLA | +6.94%)

Despite a steep 46% drop in April vehicle sales in Europe, Tesla rebounded strongly. CEO Elon Musk reassured investors over the weekend, stating he would refocus on Tesla, X (formerly Twitter), and xAI, alongside the upcoming Starship launch.

His renewed commitment helped lift the stock sharply higher.

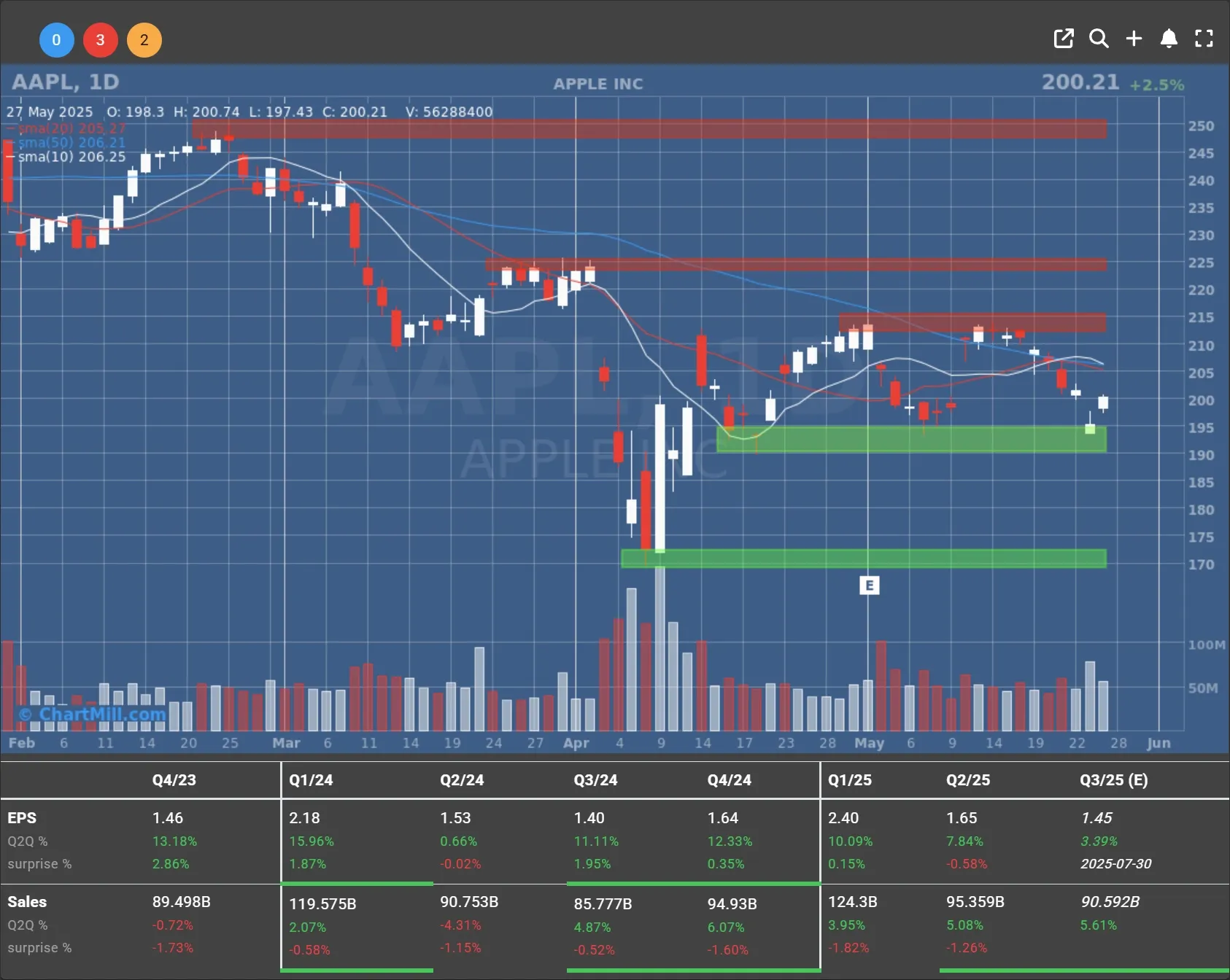

Apple (AAPL | +2.53%)

Apple recovered following a 3% dip last week after Trump floated the idea of a 25% tariff on iPhones not produced in the U.S. The president later clarified that similar measures would apply to other smartphone makers like Samsung, in the name of fairness.

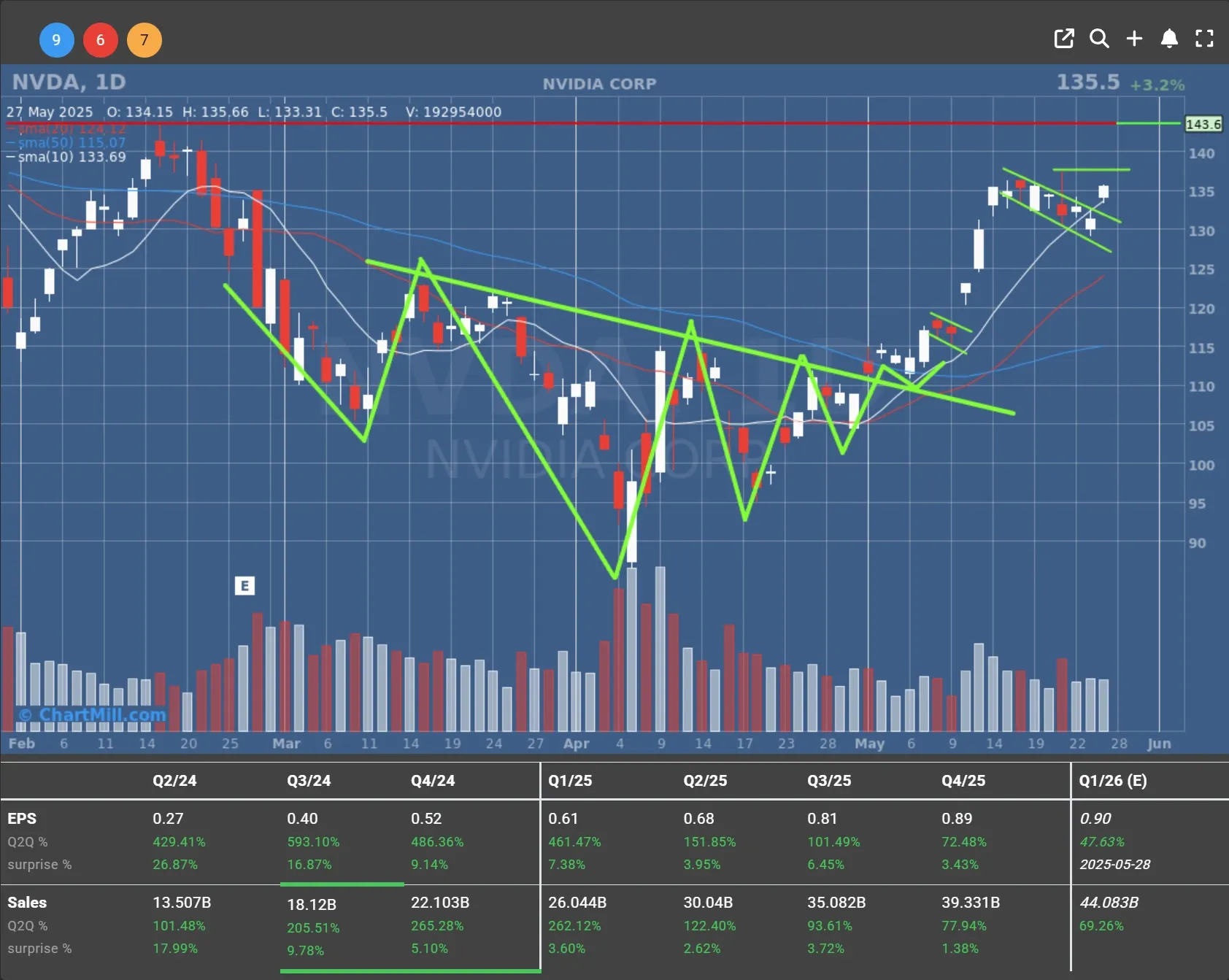

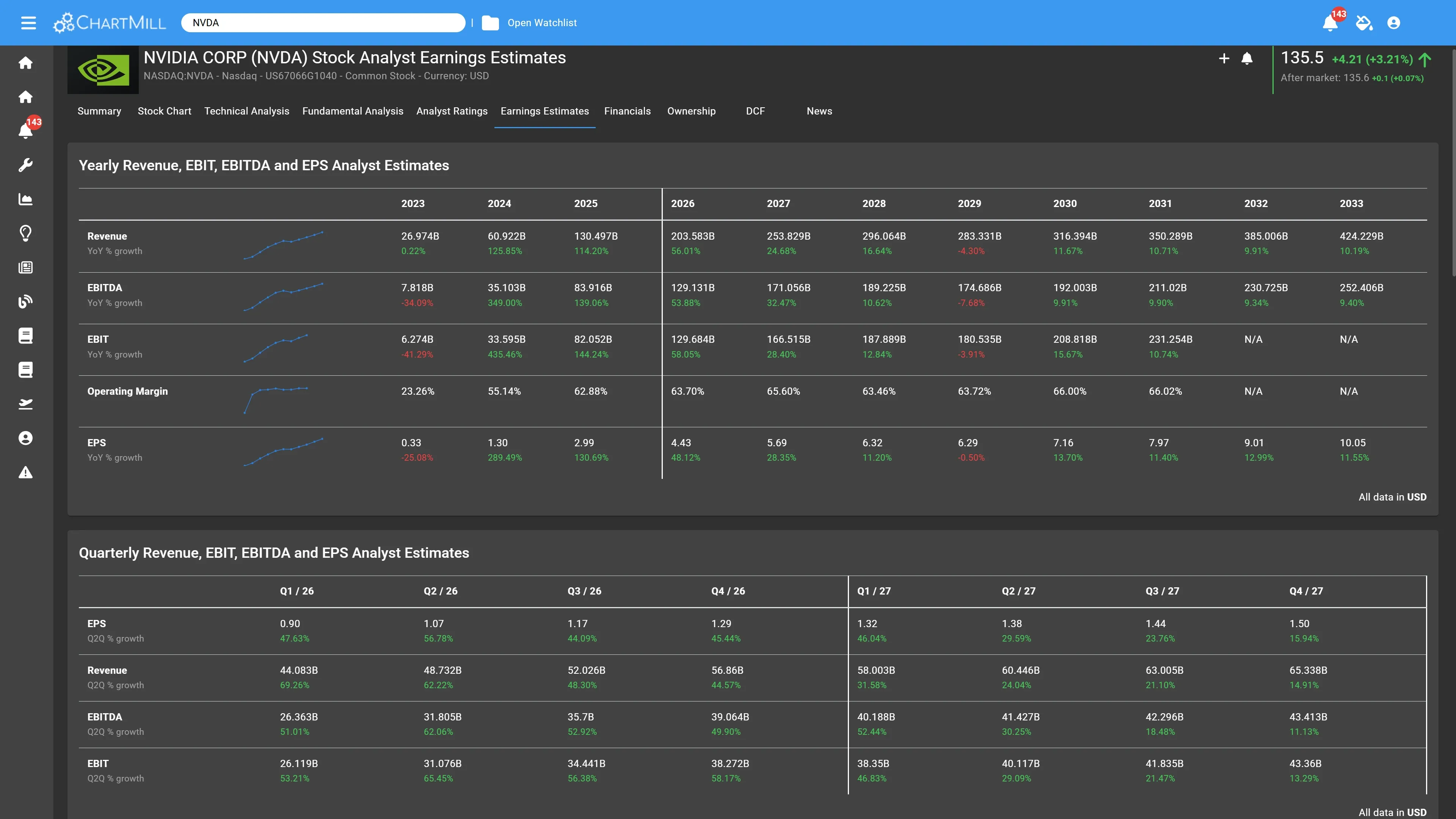

Nvidia (NVDA | +3.21%)

Investors piled into Nvidia ahead of its Q1 earnings report due Wednesday. Analysts expect 66% year-over-year revenue growth, driven by soaring demand from AI-focused hyperscalers such as Microsoft, Amazon, and Google.

While the company faces export restrictions to China, its core business remains robust, and Wall Street is looking for signs of continued dominance in the AI space.

Corporate Movers: Winners and Losers

Salesforce (CRM | +1.49%) announced a $8 billion acquisition, of data software provider Informatica (INFA | +6.08%) aiming to boost its in-house AI capabilities.

U.S. Steel (X | +1.98%) continued its upward trajectory following last week's 21% gain after Trump supported its $14 billion acquisition by Japan’s Nippon Steel.

Chinese e-commerce player PDD Holdings (PDD | -13.64%), owner of Temu and Pinduoduo, missed revenue expectations despite a 10% YoY gain.

Heavy platform investments hurt short-term profitability, prompting a sell-off.

Trump Media & Technology Group (DJT | -10.38%) tumbled after announcing plans to raise $2.5 billion to invest in Bitcoin and other cryptocurrencies. Investors reacted skeptically to the high-risk capital allocation strategy.

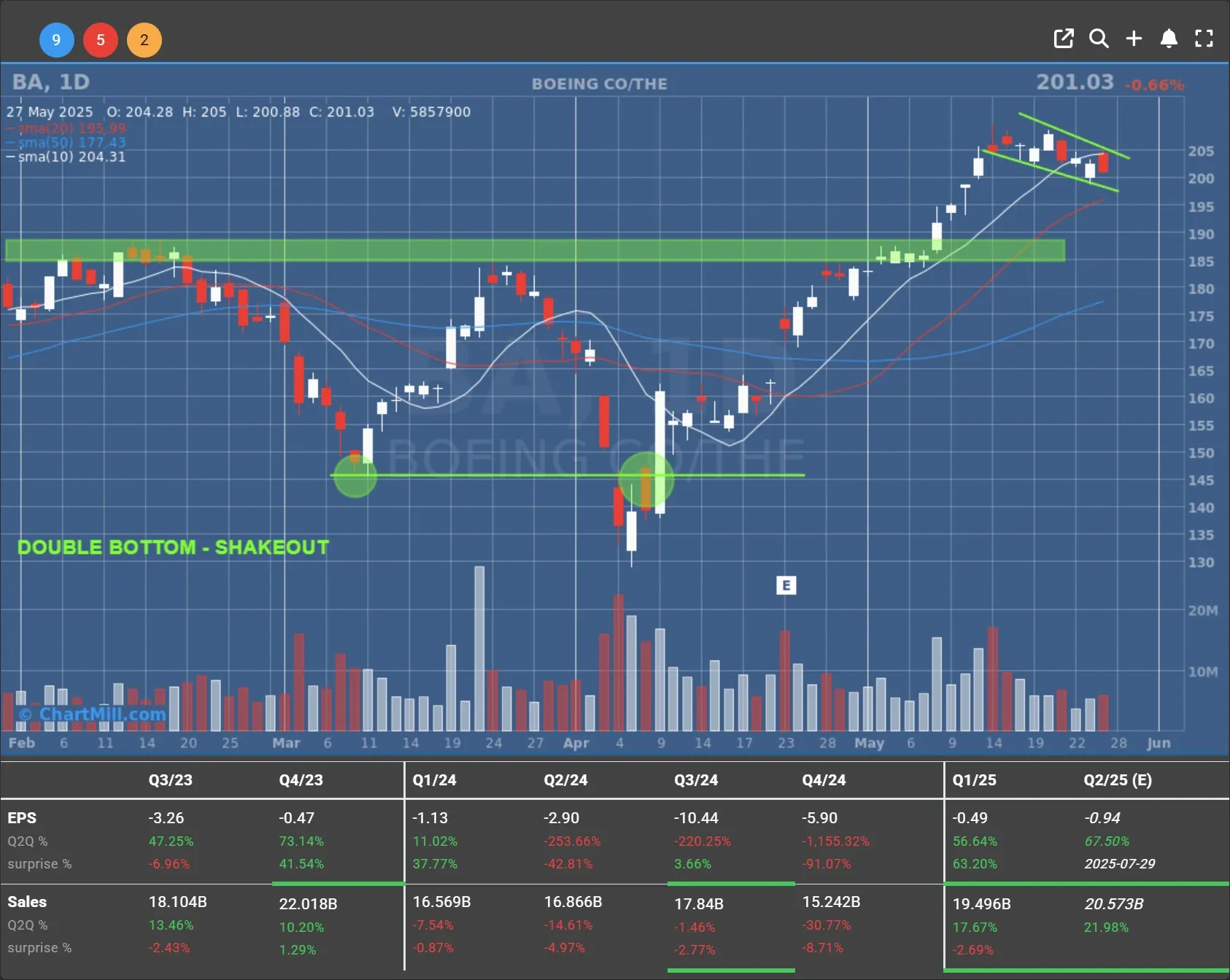

Boeing (BA | -0.66%) slipped slightly despite reaching a tentative $1.1 billion settlement with the U.S. Department of Justice related to the 737 MAX crashes.

Economic Data Mixed, But Markets Focus on Positives

-

Durable goods orders fell 6.3% in April, marking a reversal after four months of growth but still beating forecasts of a steeper 7.8% decline.

-

Housing price growth slowed, adding to signs of a cooling economy. However, investors shrugged off the mixed data, focusing instead on policy developments and improving sentiment indicators.

Commodities and Currencies

-

WTI Crude Oil dipped 1.1% to $60.84 per barrel.

-

Bitcoin hovered near record highs around $110,000.

-

EUR/USD weakened slightly to 1.1328 from 1.1380 on Monday.

Looking Ahead: Eyes on Nvidia

All eyes now turn to Nvidia’s earnings release Wednesday evening. Analysts expect stellar growth but will be watching for any signs of pressure from export restrictions and sustainability of AI-driven demand.

With tech leading the market rebound, Nvidia's report could set the tone for the rest of the week.

Next to read: Market Monitor Trends & Breadth, May 28

201.5

+0.47 (+0.23%)

53.34

+0.3 (+0.57%)

24.29

+0.37 (+1.55%)

276.03

-1.16 (-0.42%)

200.42

+0.21 (+0.1%)

134.81

-0.69 (-0.51%)

356.9

-5.99 (-1.65%)

97.88

-5.1 (-4.95%)

21.49

-1.56 (-6.77%)

Find more stocks in the Stock Screener

BA Latest News and Analysis

21 hours ago - ChartmillMarket Monitor News May 28 (Tesla, Nvidia UP - PDD Holdings, Trump Media DOWN)

21 hours ago - ChartmillMarket Monitor News May 28 (Tesla, Nvidia UP - PDD Holdings, Trump Media DOWN)Wall Street Rallies on Tariff Truce and Consumer Optimism

14 days ago - ChartmillMarket Monitor News May 15 ( eToro, Oklo UP - Grail, American Eagle Outfitters DOWN)

14 days ago - ChartmillMarket Monitor News May 15 ( eToro, Oklo UP - Grail, American Eagle Outfitters DOWN)Wall Street pauses after weeks of gains. Nvidia leads tech rally, eToro soars on IPO, and Boeing lands record order amid Trump’s Middle East tour.

20 days ago - ChartmillMarket Monitor May 9 (Boeing, MicroStrategy UP - Match Group DOWN)

20 days ago - ChartmillMarket Monitor May 9 (Boeing, MicroStrategy UP - Match Group DOWN)U.S. Markets Rise on Trade Deal Hopes and Boeing Boost