The investment philosophy developed by Peter Lynch has long served as a guide for investors seeking to build wealth through a disciplined, long-term approach. Central to this methodology is the concept of "Growth at a Reasonable Price," or GARP, which focuses on identifying companies that exhibit solid growth trajectories but trade at valuations that do not overstate their future prospects. This strategy avoids the extremes of pure growth investing, which can often carry excessive risk, and deep value investing, which might involve companies with stagnant prospects. Instead, it aims to find businesses growing at a sustainable pace, financed conservatively, and generating strong returns for shareholders, all available at a price that provides a margin of safety.

A Candidate for the Lynch Approach

TORM PLC-A (NASDAQ:TRMD) operates a fleet of product tankers, transporting refined petroleum products across the globe. The company’s profile, a vital but unglamorous player in the energy logistics chain, fits well with Lynch's preference for understandable businesses operating in essential industries. The initial screen based on Lynch's criteria identified TRMD as a potential candidate, and a deeper look at the specific financial metrics reveals why it aligns with the GARP philosophy.

Valuation and Growth Compensation

A cornerstone of the Lynch strategy is the PEG ratio, which adjusts the common Price-to-Earnings (P/E) ratio for a company's growth rate. A PEG ratio at or below 1.0 suggests the market may be undervaluing the company's growth prospects.

- PEG Ratio: TRMD's PEG ratio, based on its past five-year earnings growth, is a remarkably low 0.28.

- P/E Ratio: The company's standard P/E ratio sits at 6.48, which is significantly lower than both the industry average and the broader S&P 500.

This combination indicates that the stock is priced very conservatively relative to its historical growth, a key signal for value-conscious growth investors. The low PEG ratio directly addresses Lynch's requirement for a reasonable price, ensuring investors are not overpaying for future earnings potential.

Profitability and Financial Health

Lynch emphasized investing in companies that are not only growing but are also fundamentally sound and profitable. He used metrics like Return on Equity (ROE) and debt levels to assess a company's strength and efficiency.

- Return on Equity (ROE): TRMD's ROE of 15.62% meets Lynch's threshold of 15%, indicating that management is effectively generating profits from shareholder equity.

- Debt/Equity Ratio: The company's Debt/Equity ratio of 0.46 falls comfortably below the screen's limit of 0.6, reflecting a conservative balance sheet that is not overly reliant on borrowing.

- Current Ratio: At 2.57, the Current Ratio shows TRMD has more than enough short-term assets to cover its short-term liabilities, signaling strong financial health and liquidity.

These metrics paint a picture of a profitable company with a solid balance sheet, reducing the risk profile for long-term investors.

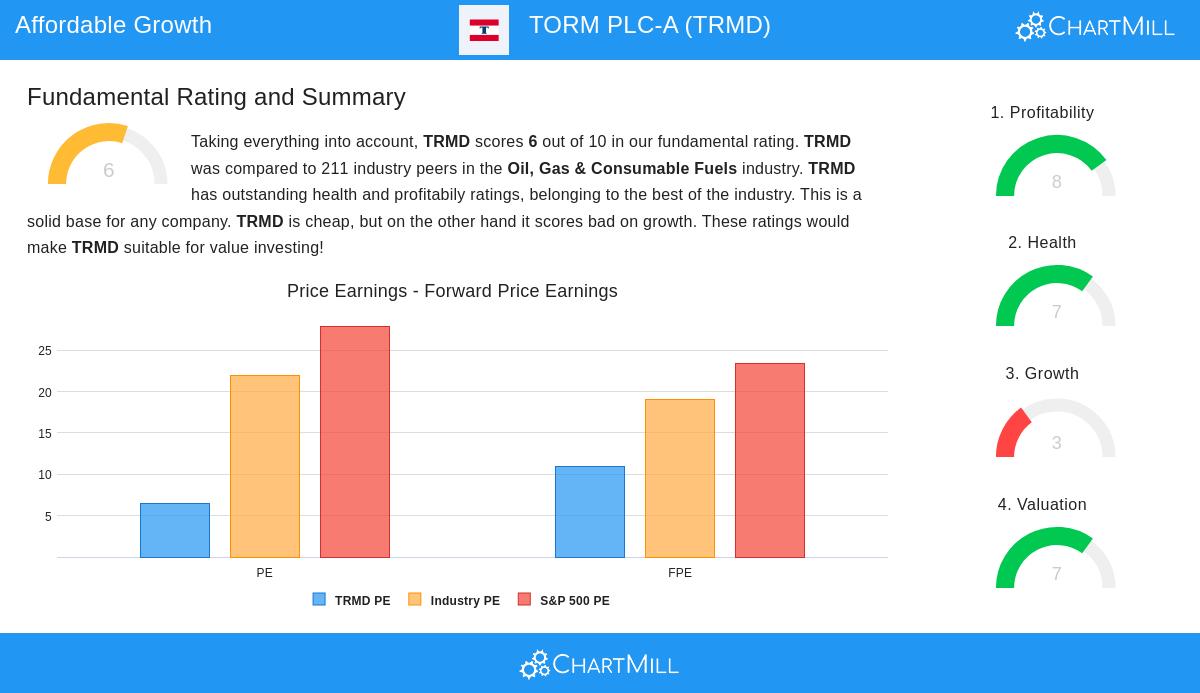

Fundamental Analysis Overview

A detailed fundamental analysis of TORM PLC-A awards it an overall rating of 6 out of 10. The report highlights several key strengths that align with the Lynch framework. The company receives outstanding scores for both profitability and financial health, placing it among the top performers in its industry. Its profit margins are strong and have shown improvement, while its liquidity position is excellent. The primary area of concern lies in its growth outlook; after a period of very strong historical growth, both revenue and earnings are expected to contract in the near term. However, this is largely reflected in its exceptionally cheap valuation, making it a potentially interesting proposition for value investors willing to look through a cyclical downturn.

Conclusion

For investors guided by the principles of Peter Lynch, TORM PLC-A presents a strong case. It demonstrates the characteristics Lynch prized: a straightforward business model, a strong historical growth rate in earnings, superior profitability, and a firm balance sheet. Most importantly, these qualities are available at a valuation that appears to offer a significant margin of safety, as evidenced by its minuscule PEG ratio. While future growth projections are muted, the company's fundamental health provides a buffer, making it a stock worthy of further research for those building a long-term, diversified portfolio.

For investors interested in discovering other companies that fit this disciplined strategy, you can find more results by using the Peter Lynch Stock Screener.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. The content presented is based on data believed to be reliable but is not guaranteed as to accuracy or completeness. Investors should conduct their own independent research and consult with a qualified financial advisor before making any investment decisions.