TAT TECHNOLOGIES LTD (NASDAQ:TATT) has been identified as a high-growth momentum stock that aligns with Mark Minervini’s Trend Template criteria. The company, which provides services and products to the aerospace and defense industries, demonstrates strong technical and fundamental characteristics that make it a compelling candidate for growth-focused investors.

Technical Strength: Meeting Minervini’s Trend Template

Minervini’s Trend Template is designed to identify stocks in strong uptrends with favorable risk/reward setups. TATT meets these criteria:

- Price Above Key Moving Averages:

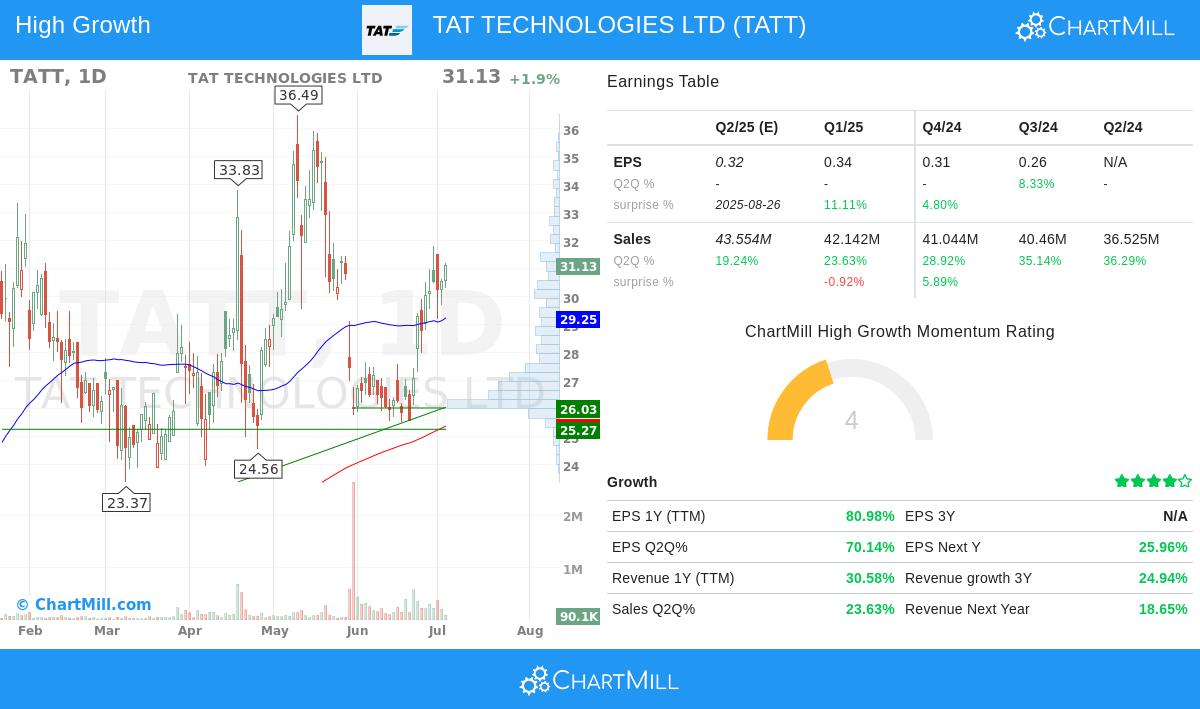

- Current price ($31.13) is above the 50-day ($29.25), 150-day ($27.62), and 200-day ($25.39) moving averages.

- The 50-day MA is above both the 150-day and 200-day MAs, confirming bullish momentum.

- Upward-Trending Moving Averages:

- The 150-day and 200-day MAs are rising, indicating sustained upward momentum.

- Strong Relative Strength:

- TATT’s relative strength (CRS) is 93.91, meaning it outperforms nearly 94% of all stocks.

- Price Near 52-Week High:

- The stock is within 15% of its 52-week high ($36.49), a sign of strong momentum.

Fundamental Growth Drivers

Beyond technical strength, TATT exhibits accelerating earnings and revenue growth, key factors for high-growth investors:

- Earnings Growth:

- EPS (TTM) grew 81% YoY, with recent quarterly growth of 70%.

- Full-year EPS growth surged 93.6% in the latest fiscal year.

- Revenue Expansion:

- Revenue (TTM) increased 30.6% YoY, with recent quarterly sales up 23.6%.

- Analysts have raised next-year EPS estimates by 8.26% over the past three months.

- Improving Profit Margins:

- Quarterly profit margins expanded from 7.08% to 9.05% over the past year.

Technical Analysis Summary

According to ChartMill’s technical report, TATT scores a perfect 10 on technical health, supported by:

- Strong short-term uptrend.

- Outperformance vs. 93% of stocks over the past year.

- Trading near the upper end of its recent range ($25.52 - $31.82).

While the setup rating is currently 3 (indicating volatility), the stock’s technical strength suggests potential for further upside upon consolidation.

Our High Growth Momentum + Trend Template screener lists more high-growth momentum stocks and is updated daily.

Disclaimer

This is not investing advice. The article highlights observations at the time of writing, but you should conduct your own analysis before making investment decisions.