Value investing, a strategy established by Benjamin Graham and made well-known by Warren Buffett, aims to find stocks selling for less than their inherent value. This method focuses on buying securities that seem priced too low based on fundamental measures, with the belief that their market price will in time show their actual worth. A systematic value investor searches for businesses with good financial condition, acceptable profitability, and possibility for growth, all while making sure the stock is priced well compared to these basics. The aim is to discover chances where the market has missed quality, offering a safety buffer for investors.

SSR MINING INC (NASDAQ:SSRM) appears as a possibility matching this value-focused structure. As a gold mining business with activities in the United States, Türkiye, Canada, and Argentina, it works in the production and discovery of precious metals. The company's varied collection of assets and concentration on gold, silver, and other metals place it in a field frequently affected by commodity cycles and broader economic elements. For value investors, these businesses can offer possibilities when their prices do not completely represent inherent qualities or what may come.

Valuation Metrics

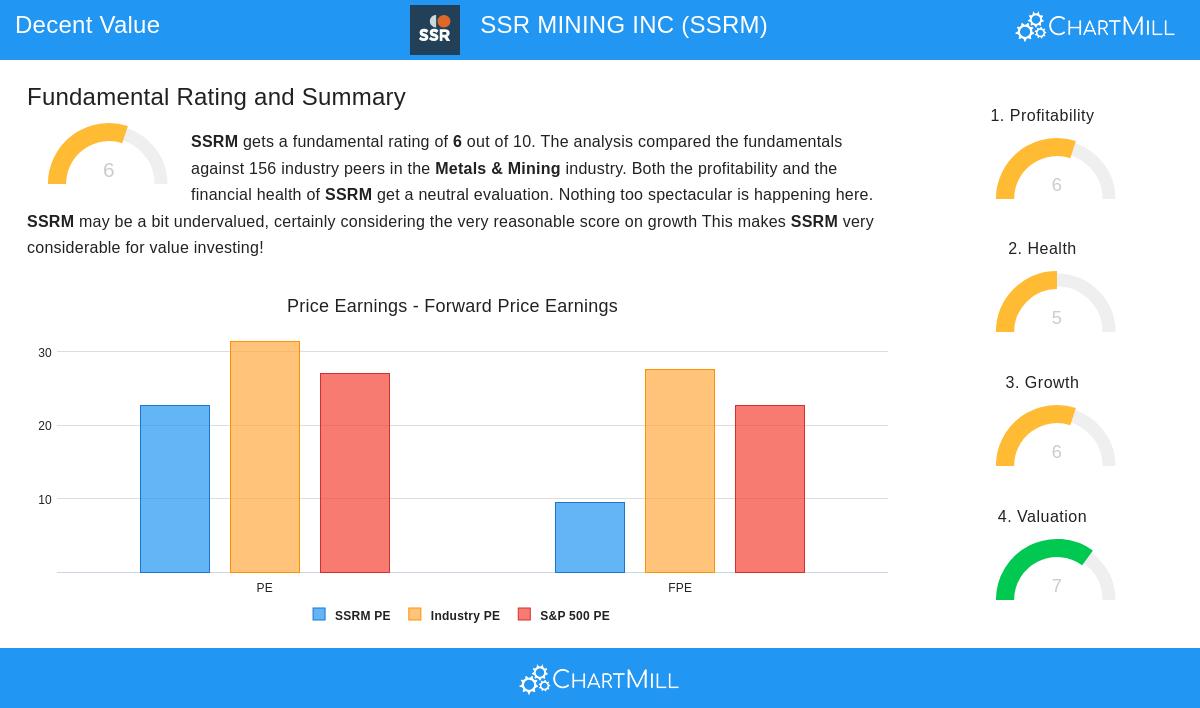

A core idea of value investing is finding stocks where the market price is less than basic measures. SSR Mining’s valuation picture indicates it could be priced too low:

- The forward price-to-earnings (P/E) ratio is at 9.52, significantly under the industry average of 27.65 and the S&P 500 average of 22.69, showing an acceptable earnings multiple.

- The enterprise value to EBITDA ratio is positive, with the company less expensive than 75% of others in its industry.

- A low PEG ratio, which changes the P/E for growth, indicates a price that may not completely account for estimated future earnings increase.

These measures are vital for value investors, as they assist in determining if a stock is valued below its inherent value, supplying that needed safety buffer.

Financial Health

Financial steadiness is another foundation of value investing, lowering the chance of capital loss. SSR Mining shows a varied but generally acceptable condition:

- The company keeps a low debt-to-equity ratio of 0.03, superior to 69.23% of industry rivals, indicating a careful method to borrowing.

- A current ratio of 2.39 shows good short-term cash availability, with enough assets to meet responsibilities.

- However, an Altman-Z score in the trouble area gives a warning, although a good debt-to-free-cash-flow ratio of 2.22 helps lessen worries about paying debts.

For value methods, good financial condition makes sure the business can survive economic declines and steer clear of value traps—cases where obvious low cost hides basic problems.

Profitability and Efficiency

Profitability numbers give investors confidence that a business can produce gains on capital used. SSR Mining displays ability here:

- Return on equity (ROE) of 5.06% and return on assets (ROA) of 2.85% both put the company in the better half of its industry.

- Operating margin of 23.13% and gross margin of 43.19% do better than 75% and 82% of others, in that order, emphasizing efficient activities.

- These numbers, while not outstanding, show a skilled management group and operational competence, main points for value investors who emphasize lasting earnings ability.

Growth Outlook

While value investing frequently concentrates on present measures, growth forecasts can improve the investment argument. SSR Mining plans solid forward movement:

- Earnings per share (EPS) are predicted to increase by 104.86% each year in the near future, a speed that greatly exceeds past results.

- Revenue is estimated to rise by 24.45% on average, hinting at growing activities and market position.

- This expected speed-up in growth, if it happens, might cause a new look at the stock’s market price, matching it more nearly with inherent value.

Growth is especially significant in value investing because it can start the price change that investors look for, turning a low-priced case into a gainful one.

Conclusion

SSR Mining Inc. offers a strong case for value-focused investors, joining acceptable valuation, sufficient financial condition, satisfactory profitability, and good growth estimates. Its low forward P/E and solid margin results indicate the market may not be completely valuing its earnings possibility or operational competence. While some dangers, like the Altman-Z score, deserve notice, the general basic view matches the rules of value investing—looking for good businesses obtainable for less than their inherent value.

For investors curious about finding similar possibilities, more outcomes from the "Decent Value" screen are available here. You can also examine the detailed fundamental analysis report for SSR Mining for a more detailed look into its measures.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consider their financial situation and risk tolerance before making any investment decisions.