SHERWIN-WILLIAMS CO/THE (NYSE:SHW) was identified by our Caviar Cruise screen as a potential candidate for quality investors. The company, a leader in paint and coatings, demonstrates strong profitability, efficient capital allocation, and consistent growth—key traits sought by long-term investors. Below, we examine why SHW fits the criteria for a quality investment.

Strong Profitability and Efficient Capital Use

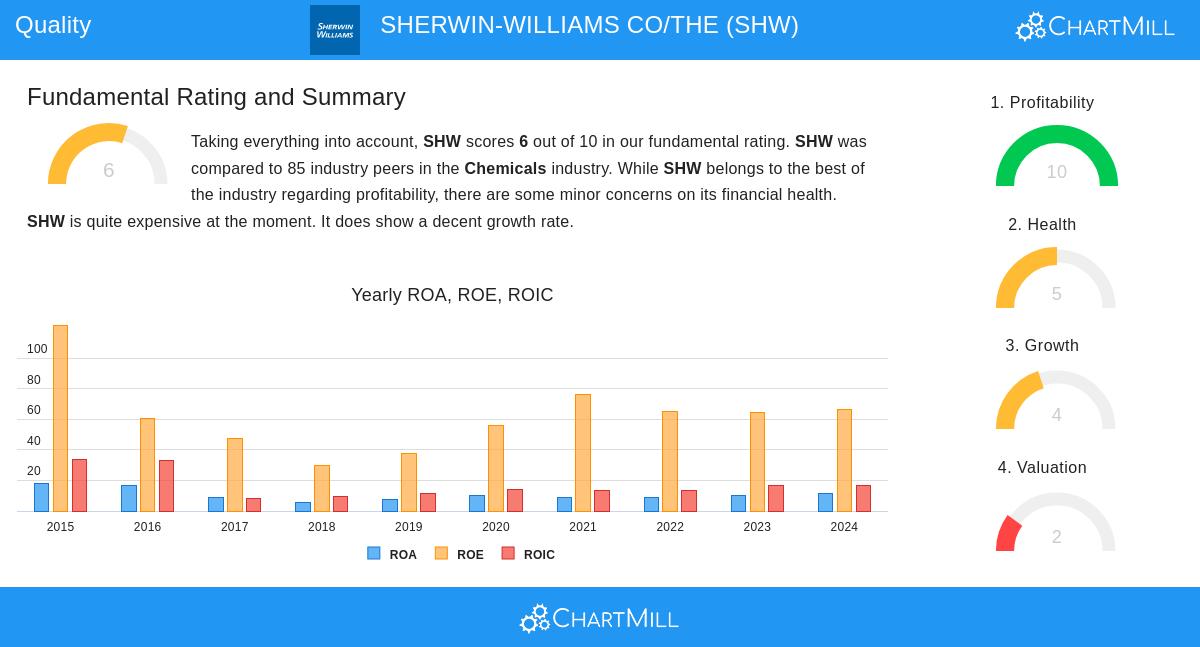

- High ROIC (Ex Cash & Goodwill): SHW’s return on invested capital stands at 40.91%, well above the 15% threshold for quality stocks. This indicates the company generates substantial profits from its capital investments.

- Improving Margins: Both operating and profit margins have expanded over the past five years, reflecting pricing power and cost management.

- Consistent Earnings Growth: EBIT has grown at a 9.18% annual rate over the last five years, outpacing revenue growth, which suggests improving operational efficiency.

Financial Health and Cash Flow Strength

- Manageable Debt Levels: SHW’s debt-to-free cash flow ratio is 4.95, meaning it could repay its debt in under five years using current cash flows—a sign of financial stability.

- High Profit Quality: The company converts nearly 101% of net income into free cash flow, indicating reliable earnings with minimal accounting adjustments.

Growth Prospects

- Steady Revenue Expansion: While past revenue growth has been modest at 4.12%, analysts expect continued growth, supporting the case for long-term durability.

- Dividend Growth: Though the yield is low at 0.89%, SHW has increased its dividend for over a decade, with an annual growth rate of 13.53%.

Valuation Considerations

SHW trades at a premium, with a P/E ratio of 31.37, above industry and S&P 500 averages. However, its high profitability and strong fundamentals may justify the valuation for quality-focused investors.

Our Caviar Cruise screener lists more quality stocks meeting these criteria. For a deeper look, review the full fundamental analysis of SHW.

Disclaimer

This is not investing advice. Always conduct your own research before making investment decisions.