QUALCOMM INC (NASDAQ:QCOM) – A Strong Dividend Stock with Solid Fundamentals

By Mill Chart

Last update: May 29, 2025

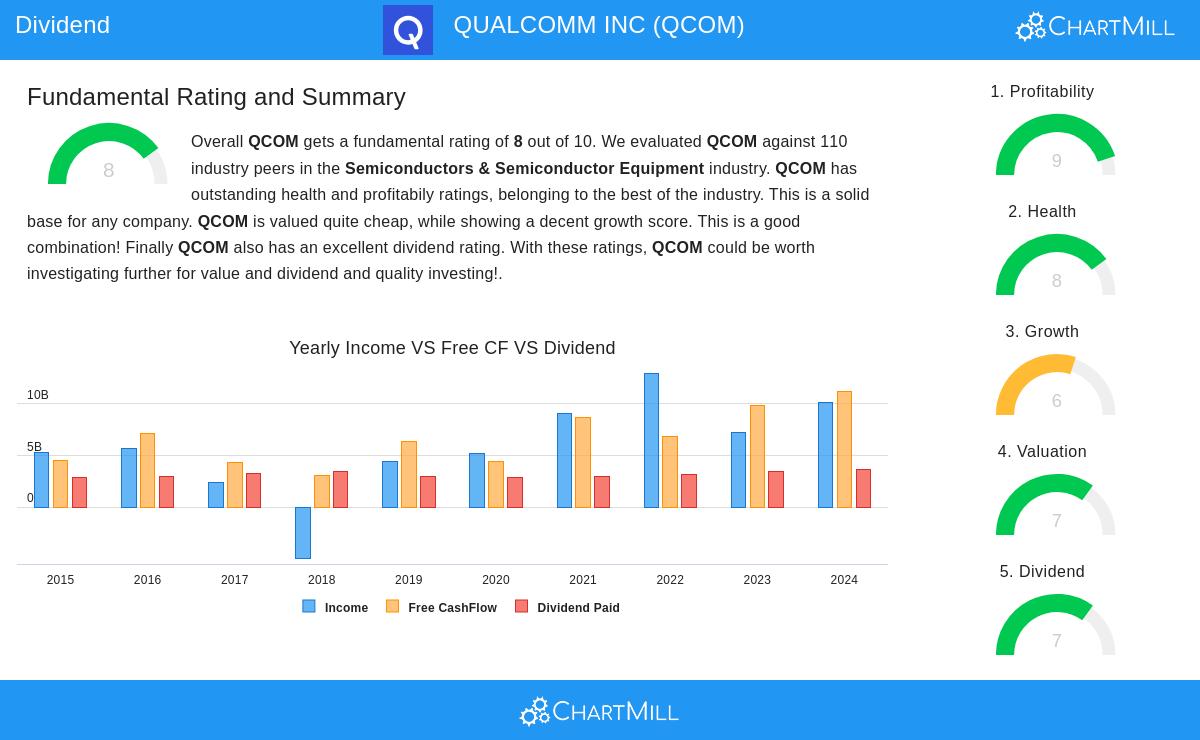

QUALCOMM INC (NASDAQ:QCOM) was identified as a top dividend stock by our screening process, which looks for companies with strong dividend ratings while maintaining solid profitability and financial health. QCOM stands out as a reliable choice for income-focused investors, backed by consistent payouts and a stable financial position.

Key Dividend Strengths

- Attractive Dividend Yield: QCOM offers a 2.35% yield, slightly below the industry average of 2.61%, but still competitive compared to the S&P 500’s 2.40%. Importantly, it pays more than 89% of its semiconductor peers.

- Reliable Track Record: The company has paid dividends for at least 10 years without reductions, signaling stability.

- Sustainable Payout Ratio: Only 34.21% of earnings are allocated to dividends, leaving ample room for reinvestment and future growth.

- Moderate Dividend Growth: While not explosive, QCOM’s dividend has grown at an annualized rate of 5.69%, supported by earnings growth.

Profitability and Financial Health

- High Profitability Rating (9/10): QCOM excels in margins, with a 26.11% profit margin and 27.64% operating margin, outperforming most industry peers.

- Strong Financial Health (8/10): The company maintains a solid balance sheet, with a low debt-to-FCF ratio (1.25) and a manageable debt-to-equity ratio (0.48).

- Earnings Growth: Over the past year, EPS grew by 24.23%, and revenue increased by 16.15%, reinforcing dividend sustainability.

Valuation

- Reasonable Valuation: QCOM trades at a P/E of 13.09, cheaper than 88% of its industry peers, and has a forward P/E of 12.13, indicating potential upside.

For a deeper dive into QCOM’s fundamentals, review the full fundamental report here.

Our Best Dividend Stocks screener provides more high-quality dividend ideas, updated daily.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.

171.05

-2.6 (-1.5%)

Find more stocks in the Stock Screener

QCOM Latest News and Analysis

17 hours ago - By: Chartmill