QUALCOMM INC (NASDAQ:QCOM) - A Strong Candidate for Long-Term Growth Investors

By Mill Chart

Last update: May 14, 2025

QUALCOMM INC (NASDAQ:QCOM) stands out as a compelling pick for investors seeking growth at a reasonable price (GARP). The company, a leader in wireless technology, meets key criteria from Peter Lynch’s investment strategy, balancing solid growth, profitability, and a reasonable valuation.

Growth and Valuation

- EPS Growth: Over the past five years, QCOM has delivered an average annual EPS growth of 23.5%, well above the 15% threshold Lynch favors.

- PEG Ratio: At 0.77, the PEG ratio (factoring in past growth) suggests the stock is undervalued relative to its earnings trajectory.

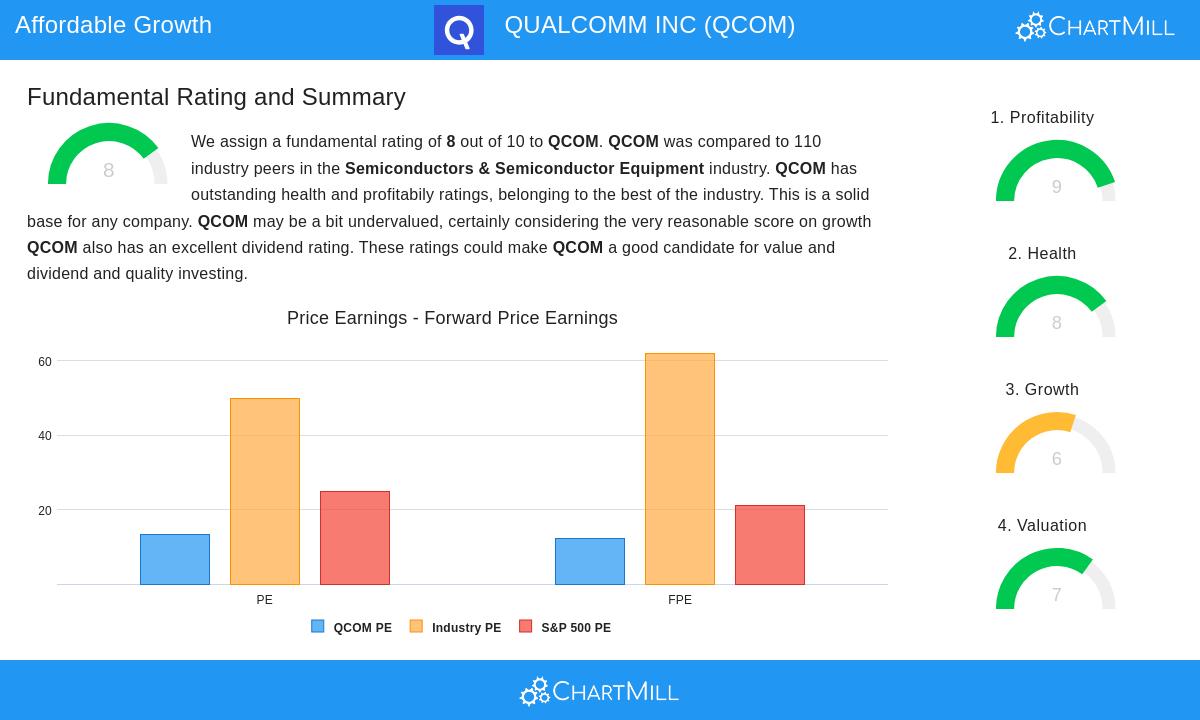

- Reasonable P/E: With a P/E of 13.4, QCOM trades below both the industry average and the S&P 500, offering an attractive entry point.

Financial Health

- Strong Profitability: QCOM’s return on equity (ROE) of 39.8% highlights efficient use of shareholder capital.

- Low Debt: A debt-to-equity ratio of 0.48 indicates a conservative balance sheet, aligning with Lynch’s preference for financially stable companies.

- Liquidity: A current ratio of 2.73 ensures the company can comfortably meet short-term obligations.

Dividend Appeal

QCOM also offers a 2.45% dividend yield, with a sustainable payout ratio of 34% and a track record of consistent payouts for over a decade.

For a deeper look, review the full fundamental analysis of QCOM.

Our Peter Lynch Strategy screener lists more stocks fitting this strategy and is updated daily.

Disclaimer

This is not investing advice. Always conduct your own research before making investment decisions.

176.31

+3.33 (+1.93%)

Find more stocks in the Stock Screener

QCOM Latest News and Analysis