PILGRIM'S PRIDE CORP (NASDAQ:PPC) was identified by our stock screener as a decent value stock. The company shows strong profitability and reasonable financial health while trading at an attractive valuation. Below, we examine why PPC may appeal to value investors.

Valuation

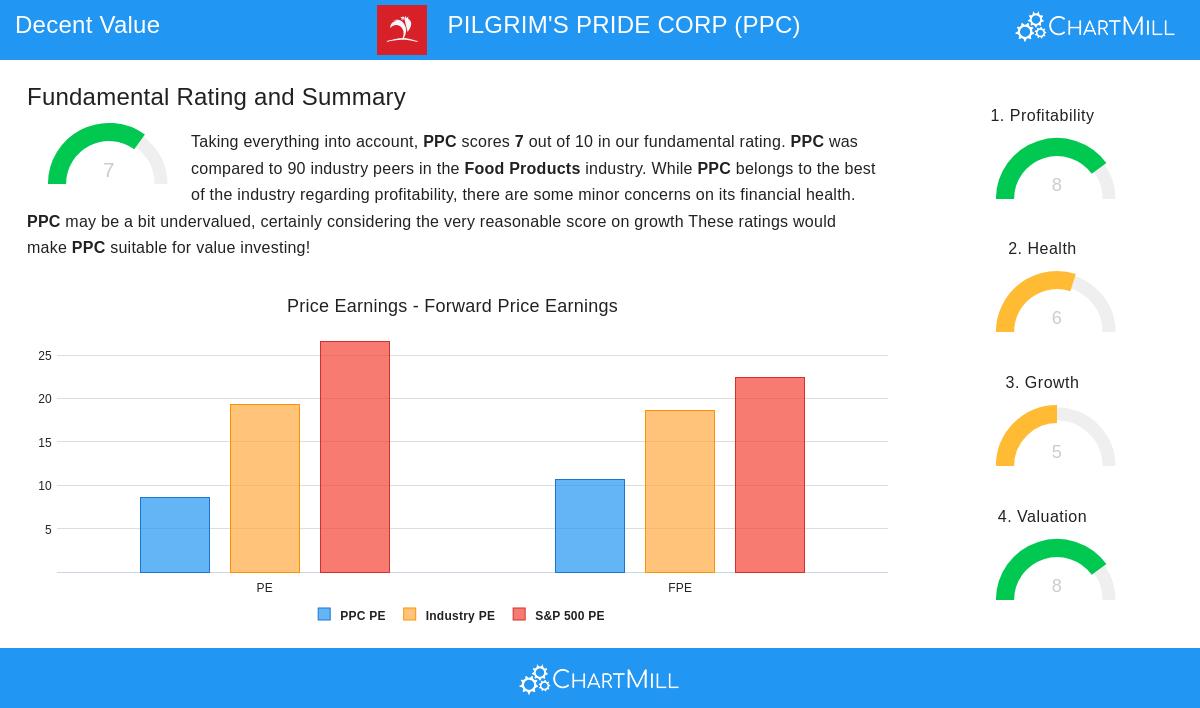

PPC stands out with a Valuation Rating of 8/10, indicating it trades at a discount compared to peers. Key highlights:

- P/E Ratio: At 8.59, PPC is cheaper than 91% of its industry peers. The S&P 500 average P/E is 26.60, making PPC notably undervalued.

- Forward P/E: 10.67, still well below the industry and broader market averages.

- Enterprise Value/EBITDA & Price/FCF: Both ratios suggest PPC is priced lower than most competitors, reinforcing its value appeal.

Profitability

With a Profitability Rating of 8/10, PPC demonstrates strong earnings power:

- Return on Equity (ROE): 38.56%, outperforming 97.78% of industry peers.

- Return on Invested Capital (ROIC): 20.80%, well above the industry average.

- Operating Margin: 9.77%, better than 73% of competitors, with improving trends in recent years.

Financial Health

PPC’s Health Rating of 6/10 reflects a stable but slightly leveraged position:

- Debt/Equity: 1.02, higher than 75% of peers, but manageable given strong cash flow coverage.

- Altman-Z Score: 3.50, indicating low bankruptcy risk and better than 74% of the industry.

- Free Cash Flow: Sufficient to cover debt obligations comfortably.

Growth

While growth prospects are mixed, PPC has a solid historical track record:

- Past EPS Growth: 150.42% over the past year and 27.16% annually over five years.

- Revenue Growth: 9.40% annual growth over the past years, though future estimates suggest slower expansion.

Dividend

PPC offers a high 12.95% dividend yield, significantly above the industry (4.58%) and S&P 500 (2.36%) averages. However, its short dividend history (less than three years) warrants caution.

Our Decent Value Stocks screener lists more stocks with similar characteristics. For a deeper dive, review the full fundamental report on PPC.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.