PDD HOLDINGS INC (NASDAQ:PDD) stands out as an undervalued stock with strong fundamentals, making it an interesting candidate for value investors. The company, which operates e-commerce platforms like Pinduoduo and Temu, combines solid growth with attractive profitability and financial health—all while trading at a reasonable valuation.

Key Strengths

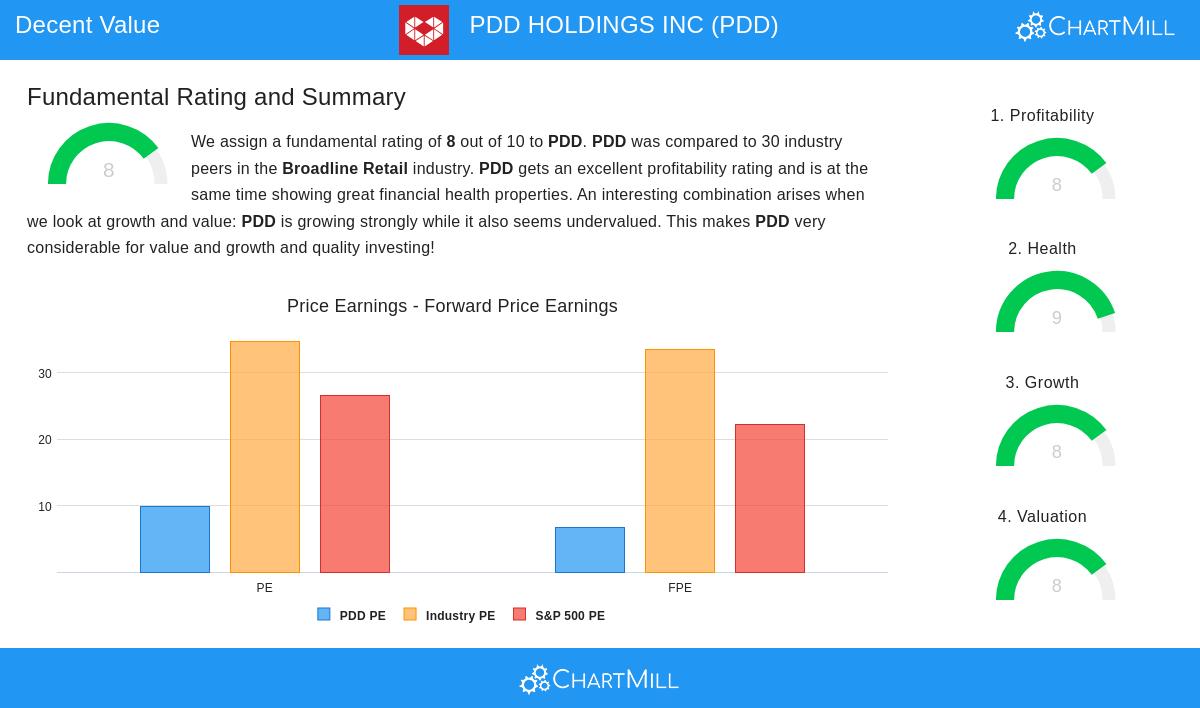

Valuation (Rating: 8/10)

- PDD trades at a Price/Earnings (P/E) ratio of 9.84, significantly below both the industry average (34.80) and the S&P 500 (26.55).

- Its Forward P/E of 6.65 suggests further upside potential, with 86.67% of its peers priced higher.

- The Enterprise Value to EBITDA ratio is also favorable, placing PDD in the top 10% of its sector for affordability.

Financial Health (Rating: 9/10)

- The company has no debt, a rare strength that enhances its financial stability.

- Strong liquidity metrics, including a Current Ratio of 2.27 and a Quick Ratio of 2.27, indicate ample ability to meet short-term obligations.

- An Altman-Z score of 5.54 signals low bankruptcy risk, outperforming 86.67% of competitors.

Profitability (Rating: 8/10)

- PDD boasts an impressive Return on Invested Capital (ROIC) of 24.85%, well above its cost of capital.

- Profit Margins (24.63%) and Operating Margins (24.47%) rank among the best in the broadline retail sector.

- Consistent cash flow generation over the past five years reinforces its earnings quality.

Growth (Rating: 8/10)

- Revenue surged 35.67% YoY, with a 5-year average growth rate of 67.20%.

- Earnings Per Share (EPS) expanded by 106.51% annually over the same period.

- While future growth is expected to moderate, estimates still project 11.12% annual revenue growth and 8.84% EPS growth.

Why PDD Fits a Value Strategy

PDD’s combination of low valuation, strong profitability, and healthy balance sheet makes it a compelling pick for value investors. The stock’s growth trajectory further supports the case for long-term appreciation.

For a deeper dive, review the full fundamental analysis report for PDD.

Our Decent Value screener highlights more stocks with similar characteristics, updated daily.

Disclaimer

This is not investment advice. The observations here are based on available data at the time of writing. Always conduct your own research before making investment decisions.