PDD HOLDINGS INC (NASDAQ:PDD) stands out as an undervalued stock with solid fundamentals, making it a potential candidate for value investors. The company’s strong financial health, profitability, and growth metrics, combined with an attractive valuation, suggest it may be trading below its intrinsic value.

Key Strengths

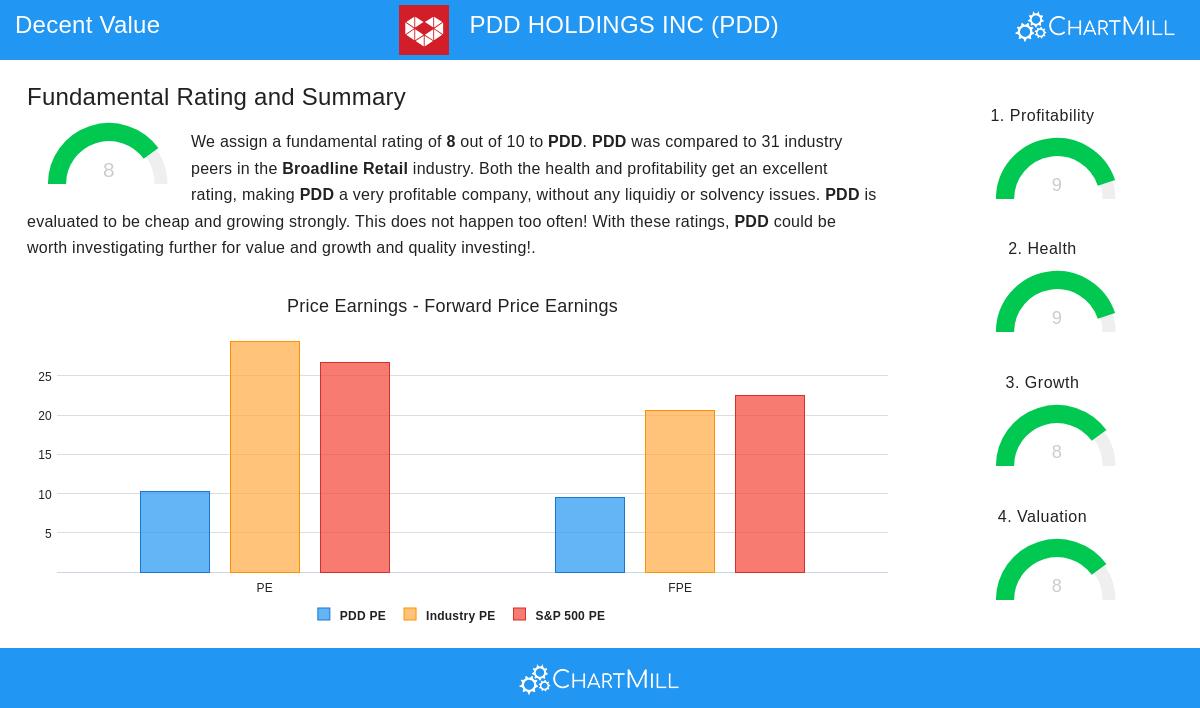

Valuation (Score: 8/10)

- PDD trades at a Price/Earnings (P/E) ratio of 10.24, significantly below the S&P 500 average of 26.68.

- Its Price/Forward Earnings ratio of 9.47 is also lower than the industry average, indicating a reasonable valuation.

- The stock is cheaper than 87% of its peers in the Broadline Retail sector based on P/E.

Financial Health (Score: 9/10)

- PDD has no outstanding debt, strengthening its balance sheet.

- A Current Ratio of 2.21 and Quick Ratio of 2.21 highlight strong liquidity.

- The company’s Altman-Z score of 6.31 suggests low bankruptcy risk, outperforming 90% of industry peers.

Profitability (Score: 9/10)

- Return on Assets (ROA) of 22.26% and Return on Equity (ROE) of 35.89% are among the best in the industry.

- Operating Margin of 27.53% and Profit Margin of 28.55% demonstrate efficient operations.

- The company has been profitable in 4 of the past 5 years with consistent positive cash flows.

Growth (Score: 8/10)

- Revenue growth of 59% YoY and EPS growth of 78.54% YoY reflect strong business momentum.

- Over the past five years, revenue has grown at an average annual rate of 67.20%.

- Analysts expect 13.52% annual revenue growth in the coming years.

Why PDD Fits Value Investing Criteria

PDD combines low valuation multiples with high profitability and financial stability, a rare mix that aligns with value investing principles. While past growth has been exceptional, even moderated future expectations still suggest solid expansion potential.

For a deeper look, review the full fundamental analysis of PDD.

Our Decent Value screener lists more stocks with strong valuations and fundamentals.

Disclaimer

This is not investing advice! The article highlights observations at the time of writing, but you should always conduct your own analysis before making investment decisions.