In value investing, the search for undervalued stocks often involves finding companies whose market price does not fully reflect their intrinsic worth, based on fundamental metrics. This approach, started by Benjamin Graham and famously used by Warren Buffett, focuses on buying securities that seem underpriced by some form of fundamental analysis. One way to find such opportunities is by using screening tools that assess stocks based on key fundamental ratings, including valuation, health, profitability, and growth. A stock that scores well across these areas, especially with a good valuation rating, may be an attractive option for value-focused investors looking for a margin of safety and long-term appreciation potential.

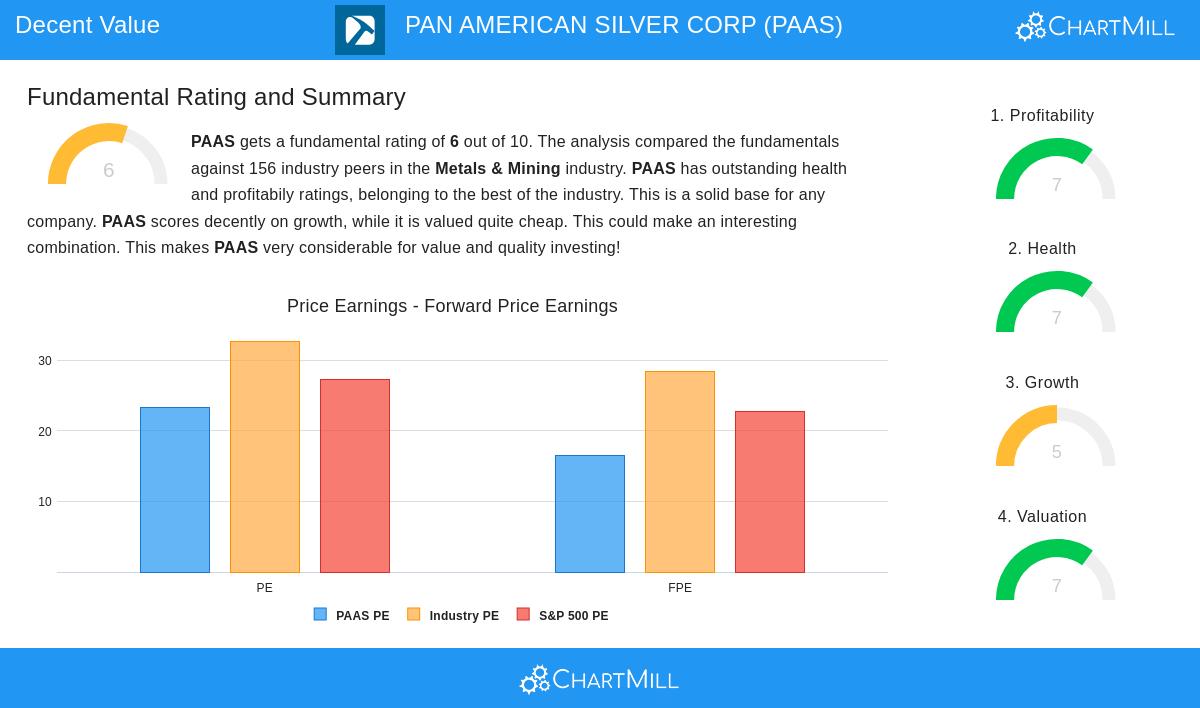

PAN AMERICAN SILVER CORP (NYSE:PAAS), a notable company in the metals and mining industry, has been found through a "Decent Value" screen that focuses on good valuation along with acceptable fundamentals in health, profitability, and growth. This screening method fits with value investing principles, as it looks for companies that are not only priced well but also show financial stability and operational strength, lowering the risk of value traps and raising the chance of price convergence with intrinsic value over time.

Valuation Metrics

The valuation rating for PAAS is 7 out of 10, suggesting it may be undervalued compared to its peers and broader market indices. Key points from the fundamental analysis report include:

- A Price/Earnings (P/E) ratio of 23.25, which is lower than 76.28% of industry competitors, even though it is above the historical value investing ideal, pointing to relative undervaluation in its sector.

- A forward P/E ratio of 16.45, under the S&P 500 average of 22.70, indicating reasonable expectations for future earnings.

- Positive metrics such as Enterprise Value to EBITDA and Price/Free Cash Flow ratios that show the stock is priced lower than many industry peers, supporting the idea that it offers good value.

For value investors, these valuation metrics are important because they help find differences between market price and intrinsic value. A lower P/E ratio, along with strong profitability and health, can point to a possible opportunity where the market has not fully recognized the company's worth, providing a cushion or margin of safety.

Financial Health

PAAS shows a health rating of 7, reflecting a strong financial position that reduces risk—a key factor for value investors who focus on capital preservation. Highlights include:

- A good Altman-Z score of 4.50, showing financial stability and a low risk of bankruptcy, doing better than 67.31% of the industry.

- Healthy liquidity ratios, with a Current Ratio of 3.05 and Quick Ratio of 2.11, suggesting sufficient ability to meet short-term obligations.

- A manageable Debt to Equity ratio of 0.15, which is similar to industry averages and supports a sustainable capital structure.

Financial health is critical in value investing, as it ensures the company can endure economic downturns and avoid the problems of overleveraging or insolvency. A good health rating, like that of PAAS, gives confidence that the company has the strength to handle market cycles while possibly realizing value over time.

Profitability Strength

With a profitability rating of 7, PAAS displays strong operational efficiency and earnings power, which are needed to justify its valuation and support long-term growth. Notable aspects include:

- A Return on Equity (ROE) of 10.53%, doing better than 80.13% of industry peers, showing effective use of shareholder capital.

- A Profit Margin of 16.76%, ranking in the top part of the industry, which points to efficient cost management and pricing power.

- Consistent positive operating cash flow over the past five years, highlighting the company's ability to generate cash from core operations.

Profitability is a key part of value investing because it confirms the company's ability to create value and sustain dividends or reinvestment. High margins and returns suggest that PAAS is not only inexpensive but also fundamentally sound, lowering the risk that its low valuation is due to poor performance rather than market neglect.

Growth Considerations

PAAS has a growth rating of 5, pointing to moderate but stable growth prospects, which adds to its value profile without depending on too much optimism. Key details include:

- Strong past growth, with Revenue rising by 21.09% over the last year and 15.85% on average over five years, showing good historical performance.

- A large one-year EPS growth of 1588.89%, though this is from a low base, reflecting possible recovery or operational improvements.

- Future estimates point to modest EPS growth but a small decrease in Revenue, indicating that growth may be stabilizing rather than speeding up.

For value investors, sustainable growth is important as it supports the idea that intrinsic value will rise over time, leading to price appreciation. While PAAS's growth is not rapid, its consistency and profitability make it a sensible choice for those looking for undervalued stocks with reliable fundamentals.

Conclusion

PAN AMERICAN SILVER CORP makes a strong case for value investors, with good valuation metrics, strong financial health, solid profitability, and reasonable growth. These traits fit well with the principles of value investing, as they suggest a company that is possibly undervalued by the market yet fundamentally healthy, offering a margin of safety and long-term potential. Investors should think about these factors in the context of their own research and risk tolerance.

For those interested in finding similar investment opportunities, more results from the "Decent Value" screen can be found here.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own due diligence and consult with a financial advisor before making any investment decisions.