Peter Lynch’s investment strategy, described in One Up on Wall Street, centers on finding companies with stable growth at fair prices, commonly known as the Growth at a Reasonable Price (GARP) method. The approach highlights solid fundamentals, profitability, and financial stability while steering clear of inflated valuations or high debt levels. Stocks that fit Lynch’s standards usually show consistent earnings growth, high returns on equity, low debt, and valuations that match their growth potential.

One company that matches these traits is NetEase Inc-Adr (NASDAQ:NTES), a Chinese tech firm active in gaming, education, music streaming, and online retail. Here, we look at why NTES aligns with Lynch’s investment model.

Key Criteria and How NTES Stacks Up

-

Stable Earnings Growth (EPS 5Y Growth: 17.51%)

Lynch preferred firms with steady, moderate earnings growth—usually between 15% and 30%. NetEase’s five-year EPS growth of 17.51% fits this range, showing reliable progress without overextension. The company’s varied income sources, especially in gaming and music streaming, support this consistency. -

Fair Valuation (PEG Ratio: 0.96)

The PEG ratio (Price/Earnings to Growth) adjusts the P/E ratio for growth, with a figure below 1 suggesting the stock is undervalued. NTES’s PEG of 0.96 means its growth potential isn’t fully priced in—a key trait Lynch looked for. -

High Profitability (ROE: 22.50%)

Return on Equity (ROE) shows how well a company turns equity into profits. NTES’s 22.50% ROE surpasses Lynch’s 15% benchmark, putting it among the best in its sector. This strong performance points to skilled management and a competitive advantage. -

Solid Financial Position (Debt/Equity: 0.07, Current Ratio: 3.21)

Lynch avoided companies with heavy debt, favoring those with a Debt/Equity ratio below 0.6—ideally under 0.25. NTES’s 0.07 D/E ratio shows little dependence on borrowing. Its Current Ratio of 3.21 also indicates plenty of liquidity to cover short-term needs, lowering financial risk.

Additional Strengths

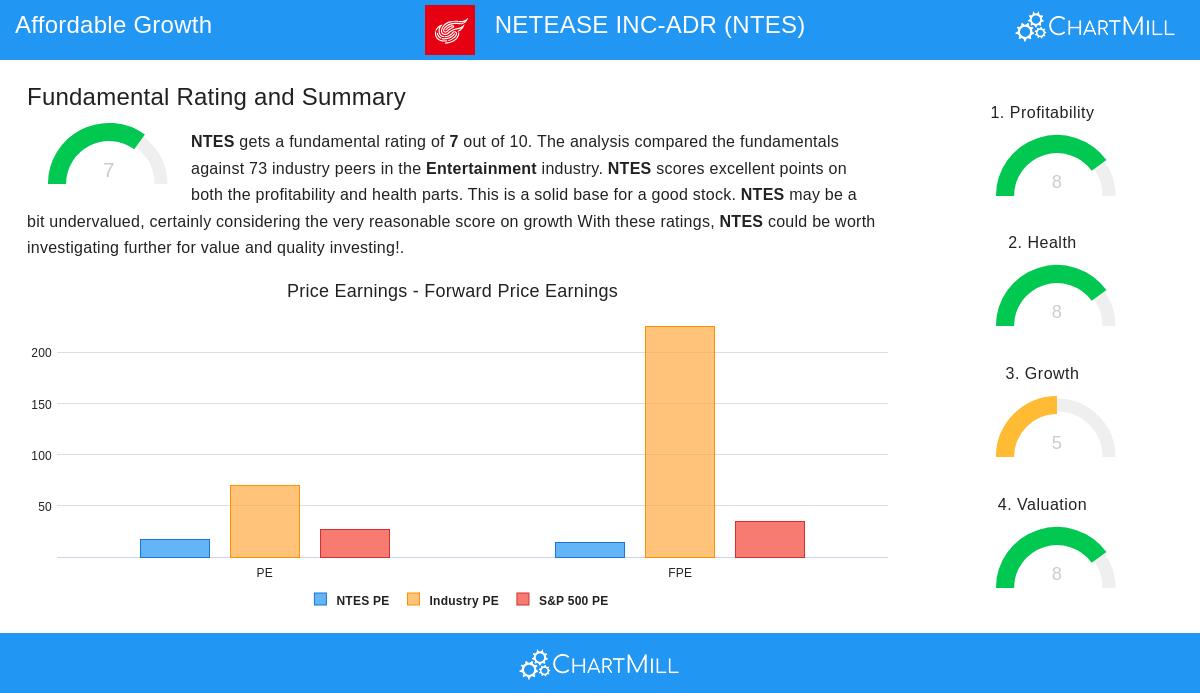

Our fundamental analysis report scores NTES 7 out of 10, noting:

- Strong Profitability: High margins (30%+ operating margin) and top-tier ROIC (17.14%).

- Financial Stability: Solid liquidity and a cautious approach to debt.

- Fair Pricing: P/E and EV/EBITDA ratios below industry norms.

Though earnings growth may slow in the short term, the company’s diverse operations and reliable cash flow help mitigate uncertainty.

Final Thoughts

NetEase (NTES) embodies the kind of firm Peter Lynch favored—profitable, financially secure, and priced fairly relative to its growth outlook. For investors looking for long-term GARP opportunities, NTES is a strong candidate.

To discover more stocks that fit the Peter Lynch strategy, visit our pre-built stock screener.

Disclaimer: This article is not investment advice. Always conduct your own research or consult a financial advisor before making investment decisions.