Quality investing looks for companies with lasting competitive edges, solid financials, and steady growth—qualities that help them perform well over time. The Caviar Cruise screening approach, based on Luc Kroeze’s The Caviar Formula, selects businesses with high returns on invested capital (ROIC), stable revenue and profit growth, efficient cash flow, and low debt. These factors help investors find firms that can maintain profitability and grow value over the long term.

One company that fits this model is NAPCO SECURITY TECHNOLOGIES (NASDAQ:NSSC), a maker of security products like access control systems, fire alarms, and video surveillance solutions.

Key Quality Metrics Where NSSC Performs Well

1. High Return on Invested Capital (ROIC)

- NSSC’s ROICexgc (excluding cash, goodwill, and intangibles) is 55.79%, well above the Caviar Cruise target of 15%.

- Why it matters: A high ROIC shows efficient use of capital, a sign of a strong business. NSSC’s ability to generate high returns from its operations suggests it has pricing power and runs well.

2. Solid and Growing Profitability

- EBIT growth (5Y CAGR) of 31.28% is higher than its revenue growth (14.49% CAGR), showing margin improvement.

- Operating margins (26.56%) and profit margins (25.00%) are among the best in its industry, reflecting cost control and pricing strength.

- Why it matters: When profit grows faster than revenue, it often means the business benefits from scale or competitive advantages—key for long-term growth.

3. Strong Cash Flow Conversion

- 5-year average Profit Quality (FCF/Net Income) of 91.44% means nearly all profits turn into free cash flow.

- The company has no debt, with a Debt/FCF ratio of 0, removing solvency concerns.

- Why it matters: High cash conversion gives flexibility for reinvestment, dividends, or buybacks without needing outside funding.

4. Steady Historical Growth with Positive Future

- Despite a small revenue drop (-1.05%) last year, 5-year revenue CAGR of 14.49% and analyst-estimated future growth of 14.49% (3Y) show resilience.

- Why it matters: Quality investors favor businesses in growing sectors—NSSC’s focus on security technology fits this.

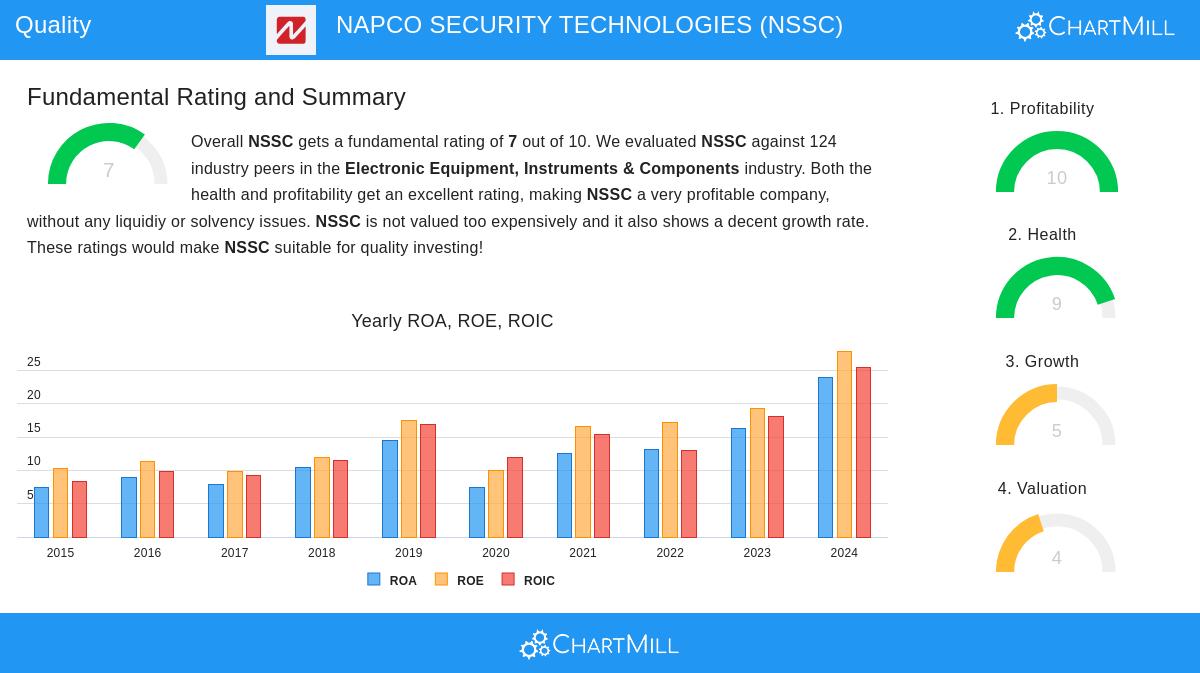

Fundamental Health Check

NAPCO’s fundamental analysis report highlights its strengths:

- Profitability score: 10/10—Top margins and ROIC.

- Financial Health: 9/10—No debt, strong liquidity (Current Ratio: 6.74), and a high Altman-Z score (26.66).

- Valuation: Neutral—While P/E (25.43) is above the industry average, it’s supported by high profitability and growth potential.

Points to Consider

- Higher Valuation: NSSC trades at a premium to peers, which could limit short-term gains.

- Slower Growth: Recent EPS decline (-3.17% YoY) needs watching, though long-term trends are still positive.

Find More Quality Stocks

For investors looking for similar high-quality companies, the full Caviar Cruise screen is available here.

Disclaimer: This analysis is not investment advice. Do your own research or consult a financial advisor before investing.