Natural Grocers by Vitamin Cottage (NYSE:NGVC) has appeared as a candidate from a stock screen based on the investment philosophy of Peter Lynch, the legendary manager of Fidelity's Magellan Fund. Lynch's strategy centers on finding companies with lasting growth paths that are trading at sensible prices, often called a Growth at a Reasonable Price (GARP) method. He supported putting money into businesses that are easy to grasp, have sound finances, and show steady earnings, letting investors create a varied, long-term portfolio without trying to predict market changes.

Following Lynch's Main Ideas

The screening criteria taken from Lynch's system point out several important financial measurements where Natural Grocers shows agreement. The strategy focuses on lasting growth, financial soundness, and appealing price relative to that growth.

- Lasting Earnings Growth: Lynch liked companies increasing earnings between 15% and 30% each year, as growth above that is often not maintainable. Natural Grocers shows good momentum here, with a 5-year average EPS growth rate of 28.65%, putting it directly within Lynch's preferred area and pointing to a solid, yet controlled, increase in earnings.

- Sensible Price via PEG Ratio: A key part of the Lynch method is the Price/Earnings to Growth (PEG) ratio, which tries to find companies whose price is supported by their growth rate. A PEG ratio at or under 1.0 is seen as good. Natural Grocers has a PEG ratio of 0.74, indicating the stock could be priced low compared to its past earnings growth.

- Good Profitability: Return on Equity (ROE) shows how well a company produces earnings from shareholder equity. Lynch searched for an ROE above 15%. Natural Grocers passes this mark noticeably with an ROE of 21.56%, showing high effectiveness and good earnings.

- Cautious Financial Soundness: Lynch was cautious about high debt. The screen looks for a Debt-to-Equity ratio below 0.6, with Lynch himself liking a number under 0.25. Natural Grocers displays a careful financial setup with a Debt-to-Equity ratio of 0.21, showing little dependence on loans and a solid equity position.

- Sufficient Short-Term Cash Flow: The screen looks for a Current Ratio of at least 1.0 to make sure a company can pay its short-term bills. Natural Grocers meets this basic need with a Current Ratio of 1.02.

Fundamental Analysis Summary

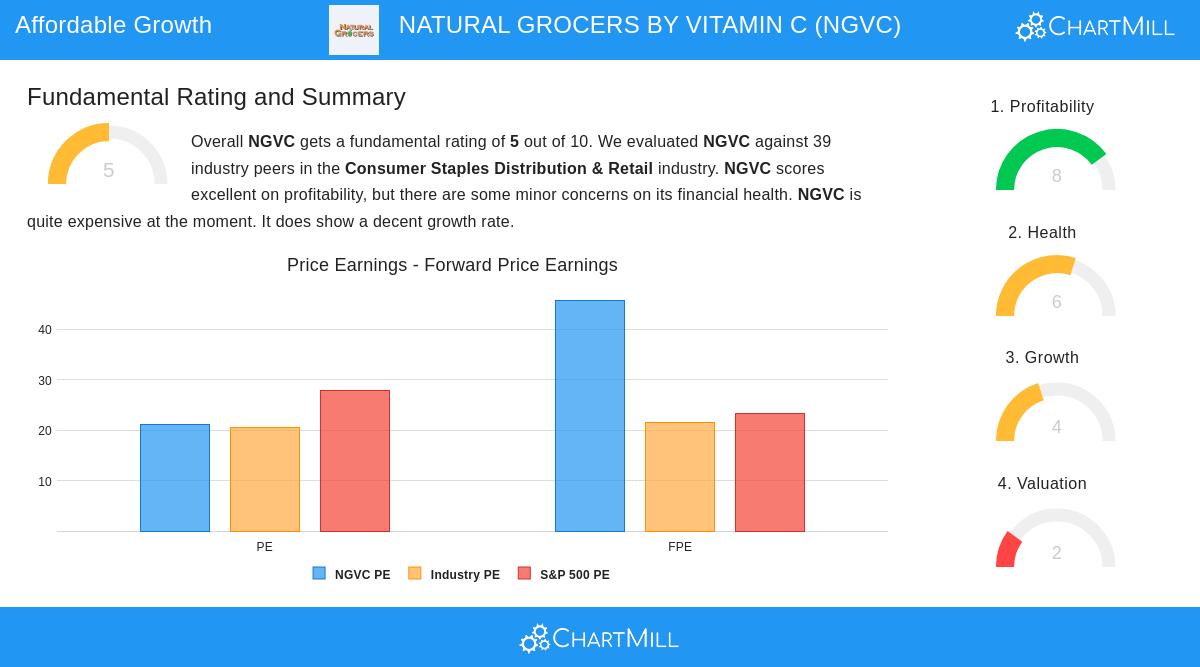

A detailed fundamental analysis of Natural Grocers gives the company a total rating of 5 out of 10. The analysis shows a company with clear positive points and some areas to note. Its most interesting characteristic is its earnings, where it gets an 8 out of 10, doing better than most of its competitors in the Consumer Staples Distribution & Retail industry on measurements like Profit Margin, Operating Margin, and Return on Equity. Financially, the company is seen as stable with a sound 6 out of 10 health score, helped by a small debt amount and a good Altman-Z score, although its cash flow ratios (Current and Quick Ratio) are mentioned as being lower than industry norms. The main challenge seems to be its price, which scores a 2 out of 10, as the stock is now seen as high-priced on several measurements, including its forward P/E ratio. Growth is rated at 4 out of 10, showing very good past EPS growth but a shortage of available analyst predictions for future results.

Investment Points for the Long Term

For investors who follow the Peter Lynch philosophy, Natural Grocers offers an interesting example. It works in the understandable, though competitive, grocery industry, concentrating on the increasing customer interest for natural and organic products, a pattern many investors can see in their own towns. The company's high earnings, cautious debt amount, and good past earnings growth match well with Lynch's requirements for a long-term investment. The main area of debate is its present price, which might make some value-focused investors hesitant. However, the low PEG ratio indicates that its growth rate could help explain its cost. As Lynch suggested, this first screen is a beginning step, requiring more investigation into the company's market position, leadership, and long-term growth plan.

For investors wanting to look into other companies that pass this strict screening method, you can find the full and current list of results here: Peter Lynch Strategy Stock Screen.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. The opinions expressed are based on analysis of publicly available data. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.