The search for growth stocks at reasonable prices represents a cornerstone of disciplined investing, aiming to capture the upside potential of expanding companies without paying excessive premiums. This "Affordable Growth" strategy specifically targets companies demonstrating strong growth trajectories, solid underlying profitability, and healthy financials, all while trading at valuations that do not appear stretched. By focusing on these combined attributes, investors seek to mitigate the risk typically associated with high-growth, high-multiple stocks while still participating in their expansion. Neurocrine Biosciences Inc (NASDAQ:NBIX) emerges as a candidate fitting this methodology, as indicated by its fundamental analysis.

Growth Trajectory

A primary pillar of the affordable growth strategy is identifying companies with a demonstrated and expected strong growth profile. Neurocrine Biosciences exhibits precisely this characteristic, earning a high Growth Rating of 8 out of 10. The company's historical performance and future prospects paint a picture of solid expansion.

- Revenue Growth: The company has shown a notable increase in revenue, growing by 19.61% over the past year. This strength is part of a longer-term trend, with revenue growing at an average annual rate of 24.48% over recent years.

- Earnings Expansion: Growth is also translating to the bottom line. Earnings Per Share (EPS) grew by 12.06% in the last year and has been growing at a high average annual rate of 58.39% over a multi-year period.

- Future Expectations: Analyst expectations suggest this momentum will continue. EPS is forecast to grow by 35.05% annually in the coming years, while revenue is expected to increase by 12.49% per year.

This consistent and strong growth across key financial metrics is essential for the strategy, as it provides the fundamental "growth" engine that investors are seeking to capture.

Valuation Assessment

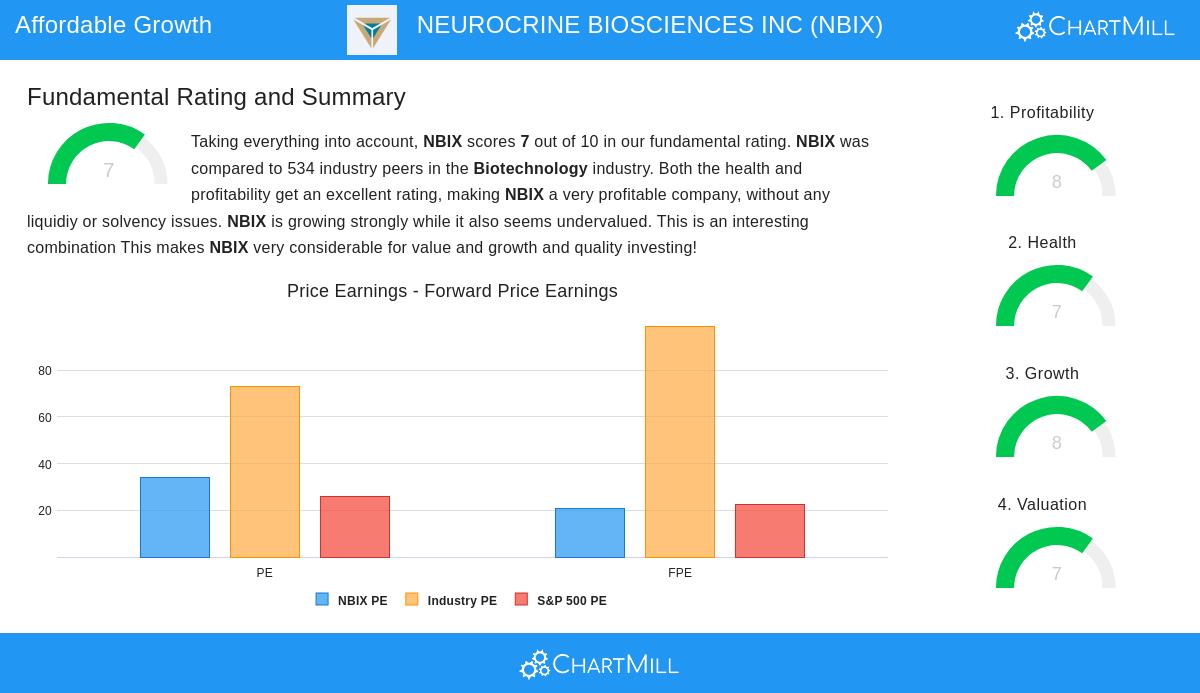

The "affordable" component of the strategy is critically assessed through valuation metrics. While a high-growth company often commands a premium, Neurocrine's Valuation Rating of 7 suggests it may offer relative value within its context.

- Relative Value: Despite a Price/Earnings (P/E) ratio of 34.26, which appears elevated in absolute terms, the company is valued cheaply compared to 92.70% of its Biotechnology industry peers. The industry average P/E is significantly higher at 72.82.

- Cash Flow and EBITDA: The valuation picture improves when looking at other metrics. Based on its Price/Free Cash Flow and Enterprise Value/EBITDA ratios, NBIX is cheaper than approximately 94% of its industry competitors.

- Growth Compensation: The PEG Ratio, which adjusts the P/E ratio for expected earnings growth, indicates a rather cheap valuation. This suggests the current share price may not fully reflect the company's strong projected earnings growth of over 35%.

This combination of strong growth and reasonable relative valuation is the core of the affordable growth approach, seeking to avoid the pitfalls of overpaying for future potential.

Profitability and Financial Health

Beyond growth and value, a company's operational efficiency and financial stability are crucial for sustainable expansion. Neurocrine scores highly in these areas, with a Profitability Rating of 8 and a Health Rating of 7.

The company's profitability is a standout feature, with margins that rank among the best in the biotechnology sector. Its Profit Margin of 15.95% and Operating Margin of 20.64% outperform over 93% of industry peers. Furthermore, returns on capital are strong, with a Return on Invested Capital (ROIC) of 11.10% that also places it in the top tier of its industry. Financially, the company is in a solid position with no outstanding debt, providing significant flexibility and reducing risk. Its Altman-Z score of 8.33 indicates a very low near-term risk of financial distress. These strong health and profitability metrics provide a solid foundation for the company's growth, reducing the operational and financial risks for investors.

Conclusion

Neurocrine Biosciences presents a strong profile for investors employing an affordable growth strategy. The company couples a notable growth engine, evidenced by solid historical and projected revenue and earnings increases, with a valuation that appears reasonable, if not attractive, relative to its high-growth industry peers. This is further supported by outstanding profitability and a healthy, debt-free balance sheet, which support the sustainability of its growth trajectory. The company's fundamentals suggest it has successfully positioned itself at the intersection of growth, value, and quality.

For investors interested in finding other companies that fit this Affordable Growth profile, more results can be discovered using the predefined screen on ChartMill.com.

This article is based on a fundamental analysis report and is for informational purposes only. It is not intended as investment advice, and investors should conduct their own research and consider their individual financial circumstances before making any investment decisions.