When screening for dividend stocks, investors often look beyond just high yields to identify companies with sustainable payout capabilities. The "Best Dividend" screen applies a multi-faceted approach by filtering for stocks with strong ChartMill Dividend Ratings (7 or higher) while maintaining minimum thresholds for profitability and financial health. This methodology helps identify companies that not only pay attractive dividends today but possess the underlying financial strength to maintain and potentially grow those distributions over time.

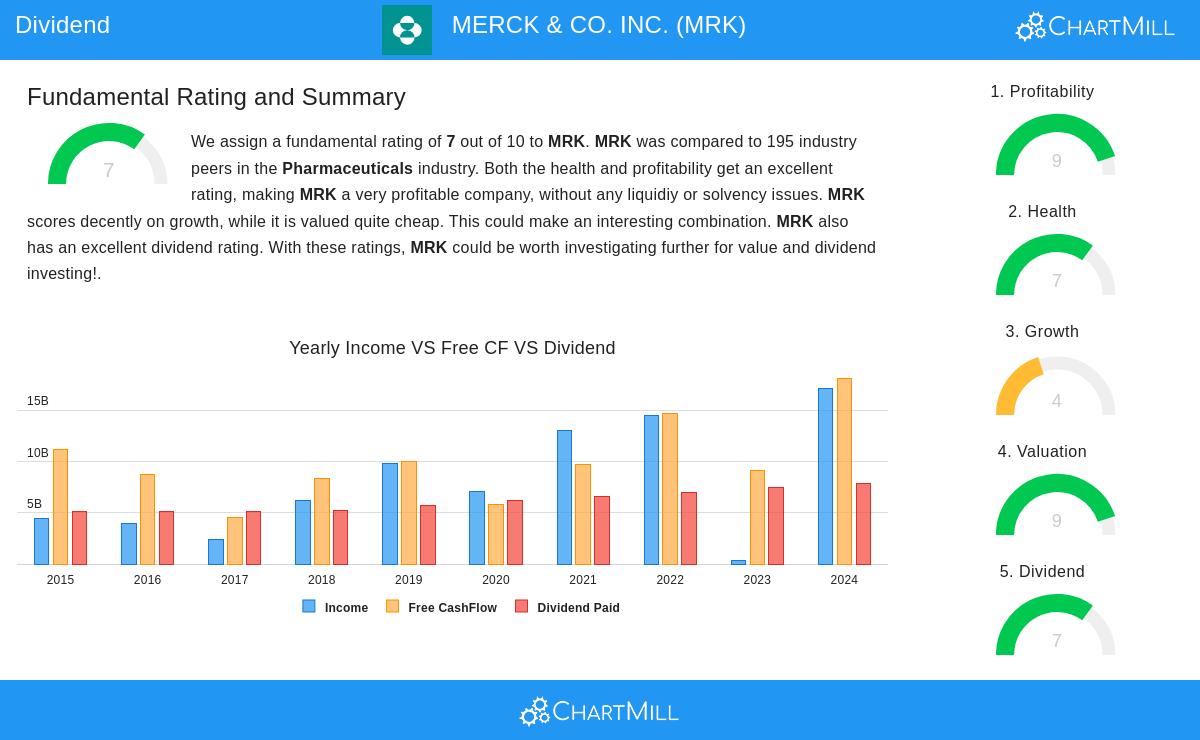

MERCK & CO. INC. (NYSE:MRK) appears as a noteworthy candidate through this screening process, demonstrating the balanced characteristics dividend investors typically seek. The pharmaceutical company's fundamental profile reveals a company with solid operational performance and shareholder-friendly policies that support its dividend appeal.

Dividend Strength and Sustainability

Merck's dividend profile shows several positive attributes that align with long-term income investing strategies. The company maintains a 3.70% dividend yield that, while not exceptionally high, provides reasonable income generation while balancing growth potential. More importantly, Merck demonstrates commitment to consistent shareholder returns through its dividend history and growth path.

- Reliable dividend growth of 6.90% annually over recent years

- Uninterrupted dividend payments for at least a decade

- No dividend reductions throughout that period

- Current payout ratio of 48.95% of earnings

The payout ratio deserves particular attention as it sits at a sustainable level that allows the company to reinvest in business operations while rewarding shareholders. This balanced approach is important for dividend sustainability, as very high payout ratios can signal potential future cuts if earnings face pressure.

Profitability Supporting Dividend Payments

Merck's strong profitability metrics provide the foundation for its dividend reliability. With a ChartMill Profitability Rating of 9/10, the company generates substantial returns that support ongoing dividend payments while funding future growth projects.

- Return on Equity of 33.49%, outperforming 96% of pharmaceutical peers

- Operating Margin of 37.52%, among industry leaders

- Consistent positive earnings and cash flow over multiple years

- Gross Margin of 78.32% indicating strong pricing power

These profitability measures are essential for dividend investors because they indicate the company's ability to generate excess cash that can be distributed to shareholders without compromising operational needs or strategic investments.

Financial Health Supporting Long-Term Payouts

Merck's financial health, rated 7/10 by ChartMill, demonstrates sufficient stability to maintain dividends through economic cycles. The company's solvency metrics show manageable debt levels and adequate liquidity, though some ratios appear modest compared to industry averages.

- Altman-Z score of 3.98 indicates low bankruptcy risk

- Debt-to-Free Cash Flow ratio of 2.40 years provides comfortable coverage

- Current and quick ratios suggest adequate short-term liquidity

- Declining share count over five years reflects shareholder-friendly capital allocation

While the debt-to-equity ratio of 0.69 shows moderate leverage, the company's strong cash flow generation and profitability lessen concerns about debt servicing capacity. For dividend investors, this financial health provides confidence that payouts can withstand potential market downturns or industry challenges.

Valuation and Growth Considerations

From a valuation perspective, Merck appears reasonably priced with a P/E ratio of 10.92, significantly below both the S&P 500 average and many pharmaceutical peers. This valuation cushion provides some protection for dividend investors against multiple compression. The company's growth profile shows solid historical performance with some moderation in forward expectations, which is typical for mature pharmaceutical companies but warrants monitoring for dividend sustainability.

The detailed fundamental analysis report provides deeper insights into Merck's financial metrics and competitive positioning within the pharmaceuticals industry.

For investors seeking additional dividend stock ideas using similar criteria, the Best Dividend Stocks screen offers a starting point for further research, allowing customization based on specific investment preferences and risk tolerance.

Disclaimer: This analysis is based on fundamental data and screening methodologies described, but does not constitute investment advice. Investors should conduct their own research and consider their individual financial circumstances before making investment decisions. Past performance does not guarantee future results, and dividend payments are subject to company discretion and market conditions.