Market Monitor News July 02 BMO (IHS Holding UP - Tesla, Progress Software DOWN)

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Jul 2, 2025

After a euphoric run-up, Wall Street decided it was time to pause and, let’s be honest, catch its breath. But don’t mistake Tuesday's split close for a quiet day. Under the surface, there was plenty going on: political drama, tech tantrums, economic data surprises, and a Federal Reserve chair who’s clearly not in a rush to do anything.

Dow Defies the Odds, Nasdaq Trips Over Itself

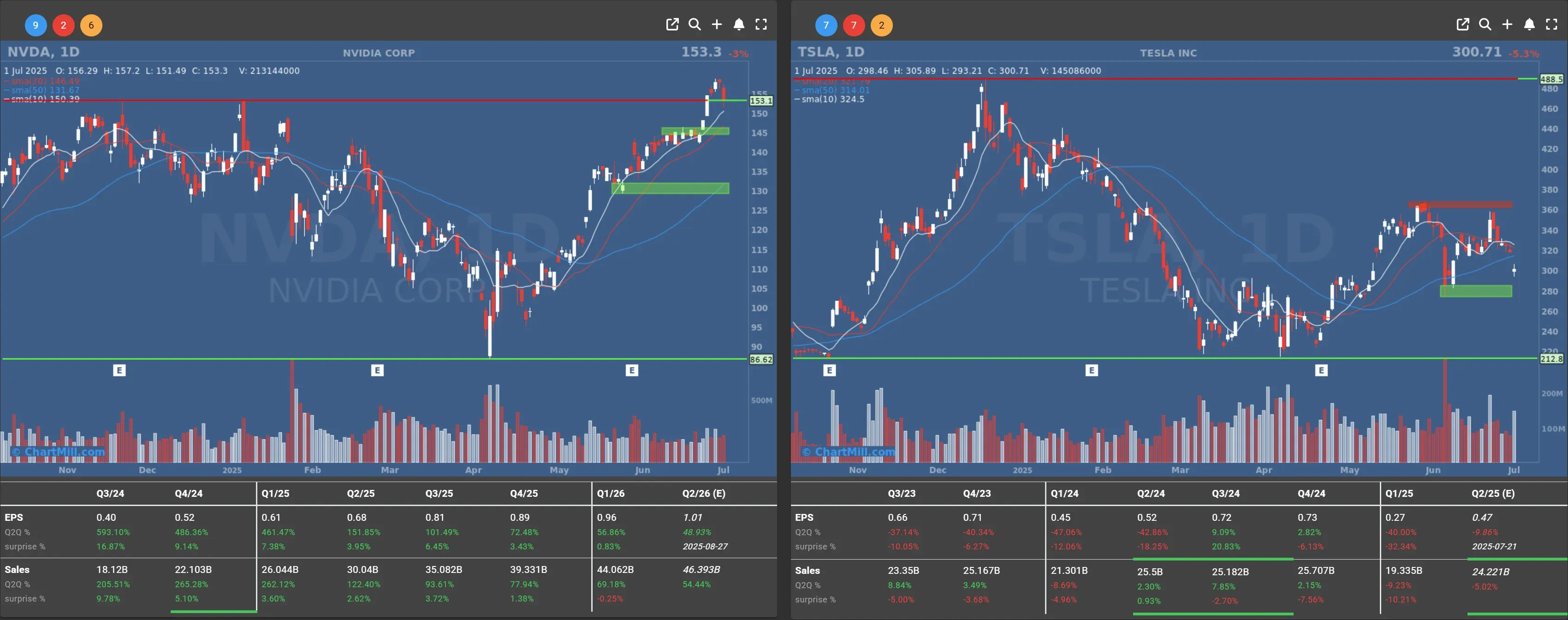

The Dow Jones Industrial Average posted a respectable gain of +0.9%, powered primarily by price-heavyweights in the index, a reminder that in the quirky world of a price-weighted index, not all stocks are created equal. Meanwhile, the Nasdaq stumbled, losing -0.8%, dragged down by heavyweights Tesla (TSLA | -5.34%) and Nvidia (NVDA | -2.97%), both of which gave back some of their recent gains.

The broader S&P 500 slipped -0.1%, marking a modest pullback after a string of record highs.

Jobs Market Heats Up - But That’s Not Necessarily Good News

Surprise! The JOLTS report showed job openings jumping to 7.76 million in May, the highest since November 2024. That’s up sharply from April’s 7.39 million and not what rate-cut hopefuls wanted to hear.

Why? A stronger labor market gives the Fed one more reason to stay on the sidelines. And Jerome Powell, speaking at the ECB forum in Portugal, was clear: "We’re taking our time. The economy’s solid. Let’s see how those tariffs play out first.”

"We’re taking our time. The economy’s solid. Let’s see how those tariffs play out first.” - Jerome Powell at the ECB forum in Portugal

Translation: Don't expect a rate cut tomorrow. However, Goldman Sachs is still betting on three cuts in the second half of 2025, with the first coming in September, a bump-up from their earlier call for December.

Short-term Treasury yields responded in kind, rising slightly, while the U.S. dollar remained weak, hovering near its lowest point in three years (EUR/USD: 1.1793). The greenback’s slide could continue if inflation numbers soften further, which would increase the pressure on the Fed to pivot.

Trump’s “Big Beautiful Bill” Inches Forward… Barely

The budget saga in D.C. took a dramatic turn Tuesday as the Senate passed Trump’s sweeping fiscal package, the so-called “One Big Beautiful Bill”, by the slimmest possible margin: 51-50, with VP J.D. Vance casting the deciding vote.

The bill, which now returns to the House of Representatives, extends Trump-era tax cuts, dramatically boosts defense and border spending, and slashes funding for healthcare and green energy incentives.

Ironically, the Congressional Budget Office estimates the revised bill would add $3.3 trillion to the federal debt over the next decade.

Naturally, not everyone’s thrilled, especially Elon Musk, who openly attacked the bill as "completely insane and destructive."

That drew a swift counterpunch from Trump, who suggested that Musk’s former agency, DOGE (Department of Government Efficiency), should re-examine subsidies given to Tesla.

The result? TSLA tanked. Add in the resignation of top exec Omead Afshar, plus more weak sales in Sweden and Denmark, and investor sentiment is clearly rattled, even if Norwegian Tesla sales jumped 54% in June, thanks to the ever-popular Model Y.

Company Movers: Crypto, AI, and… Spanish Search?

Some notable single-stock action worth mentioning:

Robinhood (HOOD | -1.39%) continued its crypto-fueled rebound, building on Monday’s 13% surge after launching new crypto services in the U.S. and Europe.

Coinbase (COIN | -4.33%), despite being the top S&P 500 performer in Q2 (+106%), finally hit a wall. Time for a breather?

Meta Platforms (META | -2.56%) slipped after Mark Zuckerberg announced the formation of a new AI division called "Superintelligence". Sounds like a Marvel villain, but it’s Meta’s bet on winning the AI arms race.

Progress Software (PRGS | -13,03%) got punished despite decent earnings. The drop likely reflects investor skepticism around its acquisition of a small Spanish search engine startup. Bold, maybe. Convincing? Not yet.

A notable riser was IHS Holding, which rose more than 14% to a new annual high without any significant news.

What I’m Watching Next

With the U.S. markets heading into a short trading week capped by Independence Day, I’m expecting lighter volumes, thinner news flow and maybe some window dressing from funds that want to tidy up their quarter-end books.

But keep an eye on:

-

Any pushback from the House on Trump’s budget bill

-

Fresh trade headlines, especially with EU and Canada inching toward deals that could ease tariff tension

-

More signs of inflation cooling (or not) as the Fed's next move continues to hang in the balance

Final Take

Tuesday reminded us that politics, policy, and personality (hello again, Elon) can weigh just as much on markets as earnings and economic data.

With Powell on pause and Washington on edge, I wouldn't expect smooth sailing into July. Volatility may have taken a vacation, but it hasn’t gone away.

I’ll be watching. So should you.

Kristoff - Co-Founder ChartMill

Next to read: Market Monitor Trends & Breadth Analysis, July 02

54.45

+0.55 (+1.02%)

6.03

+0.23 (+3.97%)

159.34

+2.09 (+1.33%)

315.35

-0.3 (-0.1%)

719.01

+5.44 (+0.76%)

355.8

+1.35 (+0.38%)

94.4

-3.58 (-3.65%)

Find more stocks in the Stock Screener

PRGS Latest News and Analysis

3 days ago - ChartmillMarket Monitor News July 02 BMO (IHS Holding UP - Tesla, Progress Software DOWN)

3 days ago - ChartmillMarket Monitor News July 02 BMO (IHS Holding UP - Tesla, Progress Software DOWN)Markets Take a Breather as Tesla Melts Down and Powell Plays the Waiting Game